Finding Gold in the Real Estate Sector Amidst a Dull Market

The Vietnamese stock market has been rather dull for investors in the latter part of June and early July. After failing to conquer the 1,300-point mark, the VN-Index headed south, hovering around 1,250 points.

While sectors like technology, steel, seaports, retail, and industrial parks are attracting investors’ interest, the real estate sector seems to be left out in the cold.

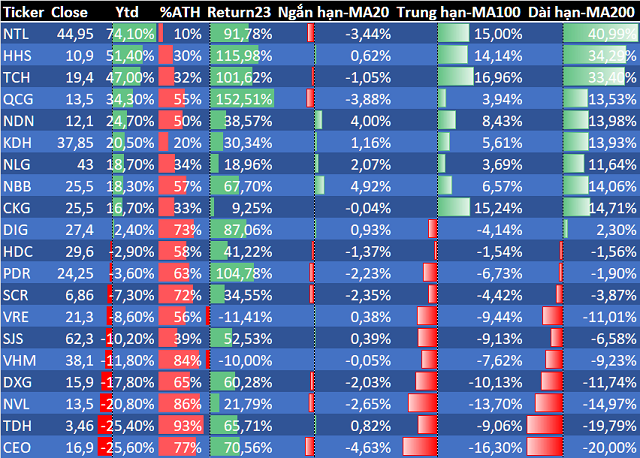

This sentiment is reflected in the performance and trends of real estate stocks. As of July 3, out of 20 real estate stocks, 10 have witnessed a decline since the beginning of the year, and all have lost their long-term upward momentum.

The presence of large caps among the decliners further indicates the absence of a real estate wave in the market. Specifically, VHM (-11.8%), NVL (-20.8%), DXG (-17.8%), and VRE (-8.6%) have resulted in losses for investors, with VRE struggling to recover from a four-year low and unable to fully offset the first-half damage.

|

Measuring the performance and strength of 20 real estate stocks

|

However, the real estate stock landscape isn’t entirely bleak, with half of the stocks recording price increases. Some have even generated exceptional profits compared to the overall market, such as NTL, TCH, and HHS.

The most notable performer, NTL, has surged 74% after a 92% growth in 2023. The driving force behind NTL’s outstanding performance is the completed Bãi Muối Urban Area project, which delivered impressive business results (the highest profit in 12 years).

Moreover, the Bãi Muối Urban Area is just one subdivision of the Lideco Bãi Muối Complex, which spans approximately 43.7 hectares, with the urban area occupying 23 hectares. The company will continue to develop sections of the Lideco Bãi Muối Complex to ensure a stable income stream in the future.

Meanwhile, the duo of TCH (+47%) and HHS (+52%) has also offered impressive investment returns thanks to the upcoming delivery of the Hoàng Huy Commerce project (4,010 apartments) in 2024.

Will Real Estate Stocks Surge in the Latter Part of the Year?

According to Mr. Nguyễn Thế Minh, Director of Analysis for Individual Customers at Yuanta Vietnam Securities, the real estate stocks that have performed well since the beginning of the year owe their success to unique narratives within the industry. These companies haven’t faced legal hurdles, and their projects are easily accounted for as revenue after sales.

In reality, Mr. Minh acknowledges that the market has not entered a real estate wave in the past period. However, the most challenging phase is now behind us. With the Land Law, Housing Law, and Business Law coming into effect on August 1, 2024, real estate stocks may gain momentum towards the end of 2024 and experience a more evident sector wave in 2025.

One reason for the lingering “boycott” sentiment stems from concerns that real estate enterprises will enter a cycle of capital increases to reduce leverage and develop liquid projects.

However, this psychological knot could soon be untied thanks to policy changes and the positive stories of the rising stocks. As Mr. Minh points out, “The economy and the stock market cannot recover without the real estate sector, which currently accounts for 40-45% of credit balances.”

Meanwhile, MBS’s report on real estate at the beginning of June also noted the improving prospects of the industry due to factors such as attractive interest rates stimulating market development and a refined legal framework ensuring sustainable market growth. Additionally, the significant growth in land tax revenue indicates a recovery in supply, and the market gains further momentum from the recovery capital of overseas remittances.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.