In today’s dynamic business environment, it’s essential to approach financial plans with flexibility. Credit growth, for instance, is a key metric that requires adaptability, and experts predict that achieving the State Bank of Vietnam’s (SBV) target of 14-15% in 2024 may be challenging, with a more realistic range of 11-12%.

Mr. Trinh Bang Vu, Head of Retail Banking, Shinhan Bank Vietnam

|

Maintaining low-interest rates

Mr. Trinh Bang Vu, Head of Retail Banking at Shinhan Bank Vietnam, shared that in the first half of 2024, average lending rates were significantly lower than in previous periods, but the system-wide growth only reached nearly 5%. To achieve the remaining 10% growth target set by the SBV for the full year, banks will face challenges in the second half.

The government’s macro-management goals, a strong exchange rate, and unfavorable inflation rates create a complex dynamic. Theoretically, increasing interest rates to attract VND is necessary, but this conflicts with the need to maintain low-interest rates to support economic growth and production sectors.

Banks are facing internal pressures, and most have already increased deposit rates. This decision’s impact on lending rates may start to be felt in Q4 of 2024, forcing banks to further narrow profit margins, cut costs, or reduce annual profit targets to maintain current low-interest rates.

Considering these factors, Mr. Vu believes that banks are more likely to maintain low-interest rates or, at most, implement minor increases rather than significant hikes in the near future.

In the first half of 2024, particularly after the Lunar New Year, Shinhan Bank also boosted its personal lending business, accepting lower profits to support customers. They repeatedly reduced interest rates for home, auto, and consumer loans, with new rates nearly 1.5% lower than in December 2023. As a result, retail credit grew by over 8% in the first half, outpacing the industry average, and the bank’s total credit growth exceeded 12%.

Positive borrowing demand, with a slight increase in lending rates expected in Q4

Mr. Vu anticipates higher borrowing demand in the second half, especially from Q3 to Q4. This optimism stems from expectations of positive developments in the macroeconomic landscape and improved borrowing capacity among the population.

However, critical macroeconomic factors influencing the banking sector, such as inflation rates, exchange rates, and GDP growth, remain unpredictable. Consequently, maintaining the current low-interest-rate environment or further reductions in the coming period will be challenging.

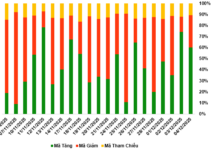

In this context, banks with lower credit growth in the first half will aim to accelerate in the remaining months, while those with higher growth may adopt a more conservative approach. As a result, the growth disparity among credit institutions in the first half may narrow in the coming months.

Currently, most banks are increasing deposit rates, and this move will impact lending rates starting in the next six months, specifically in Q4 of 2024 and early 2025.

However, lending rates do not necessarily move in lockstep with deposit rates and are influenced by various factors, depending on each bank’s objectives and capabilities, as well as government and SBV policies. Banks should strive to maintain low-interest rates to continue providing efficient credit support to businesses and individuals.

Mr. Vu predicts that lending rates will remain relatively stable at current low levels and may experience a slight increase in Q4 of 2024.

Banking: Huge Profits Yet Worried

Several banks have announced their 2023 financial results, showing outstanding growth. However, they are also facing increased pressure in setting aside provisions for credit risk.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

HDBank Investor Conference: Sustaining High and Stable Growth

On the morning of February 1, 2024, HDBank (HoSE: HDB), a leading commercial bank in Ho Chi Minh City, organized an Investor Conference to provide updates on its business performance in 2023 and share insights on future directions and prospects for 2024.