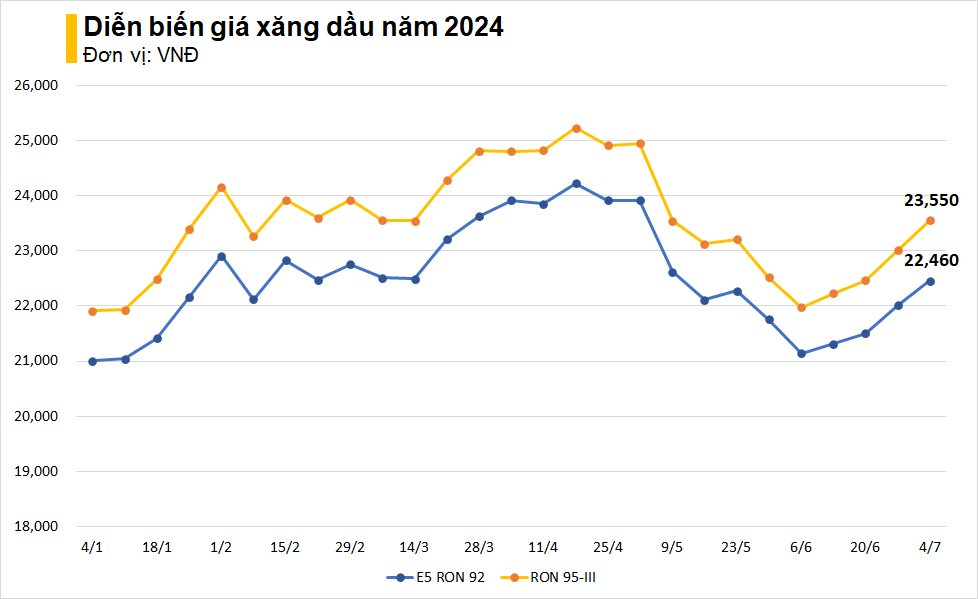

On July 4th, the Ministry of Finance and the Ministry of Industry and Trade announced a decision to increase the price of gasoline. The price of E5 RON 92 gasoline was raised by 450 VND per liter to 22,460 VND per liter, while the price of RON 95 gasoline increased by 540 VND per liter to 23,550 VND. Similarly, the price of diesel oil was adjusted upwards by 490 VND per liter, with the new selling price set at 21,170 VND per liter. This marks the fourth consecutive price hike for this essential commodity.

On the same day, the shares of the two largest gasoline retailers in the country, Petrolimex (PLX) and PV Oil (OIL), also witnessed a significant surge. PLX’s market price rose by 4.9% on July 4th to 43,900 VND per share, while OIL’s share price climbed by 13.6% to 14,200 VND per share. These levels represent the highest prices for both stocks in over two years.

Since the beginning of 2024, PLX shares have climbed by 32%, pushing Petrolimex’s market capitalization to nearly VND 56 trillion (over USD 2 billion). Similarly, OIL shares have gained 42% in the past six months, driving its market capitalization to VND 14.6 trillion (over USD 500 million). However, these figures still fall short of the record highs previously achieved by the two companies.

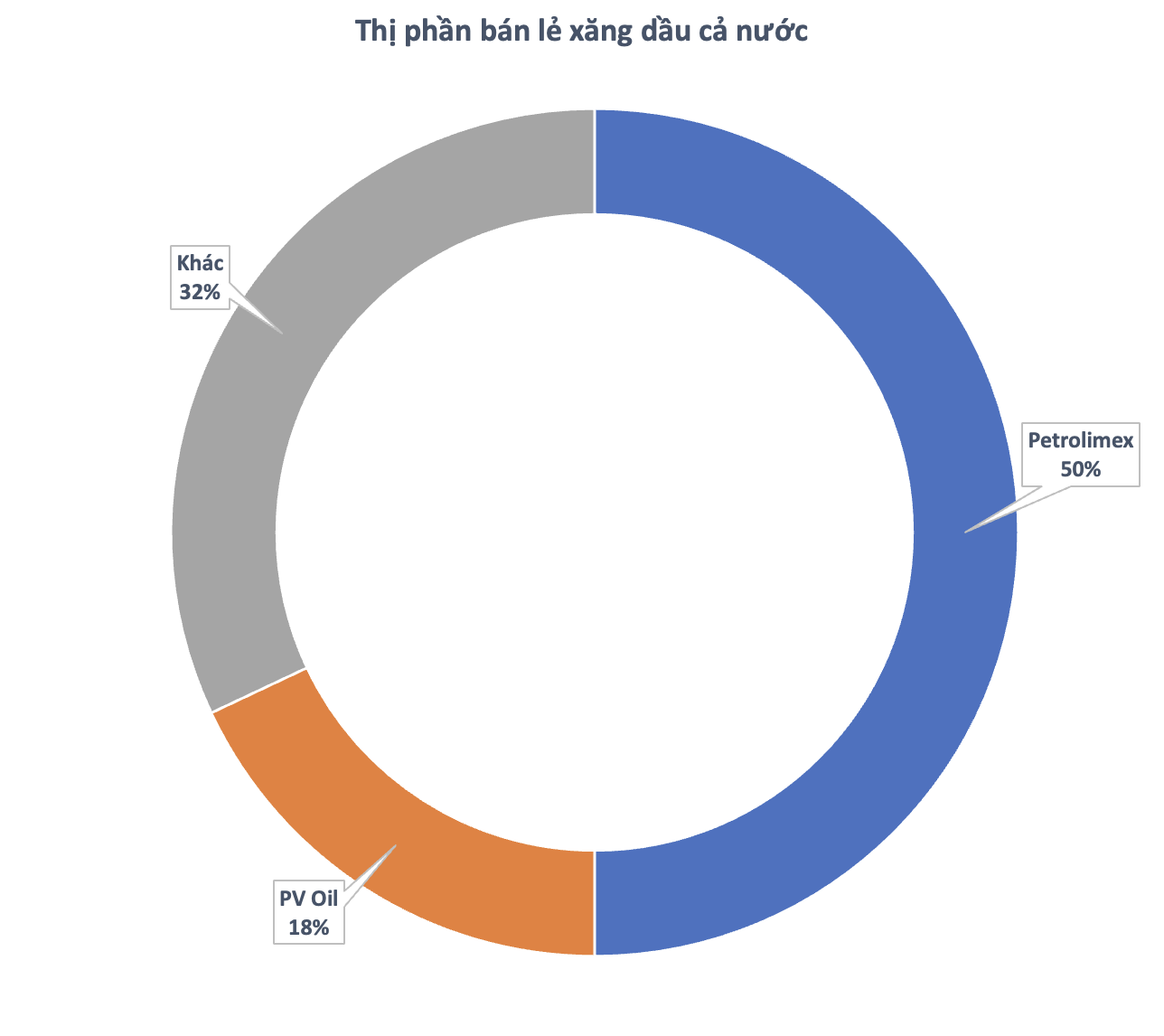

According to estimates, Vietnam currently has more than 17,000 retail gasoline stations, supplying tens of millions of tons of products to consumers annually. Approximately 70% of the domestic gasoline market share, in revenue terms, is held by the duo of Petrolimex and PV Oil. Petrolimex leads the market with a 50% share and 5,500 stores nationwide, while PV Oil ranks second with an 18% share and 700 directly-owned stores.

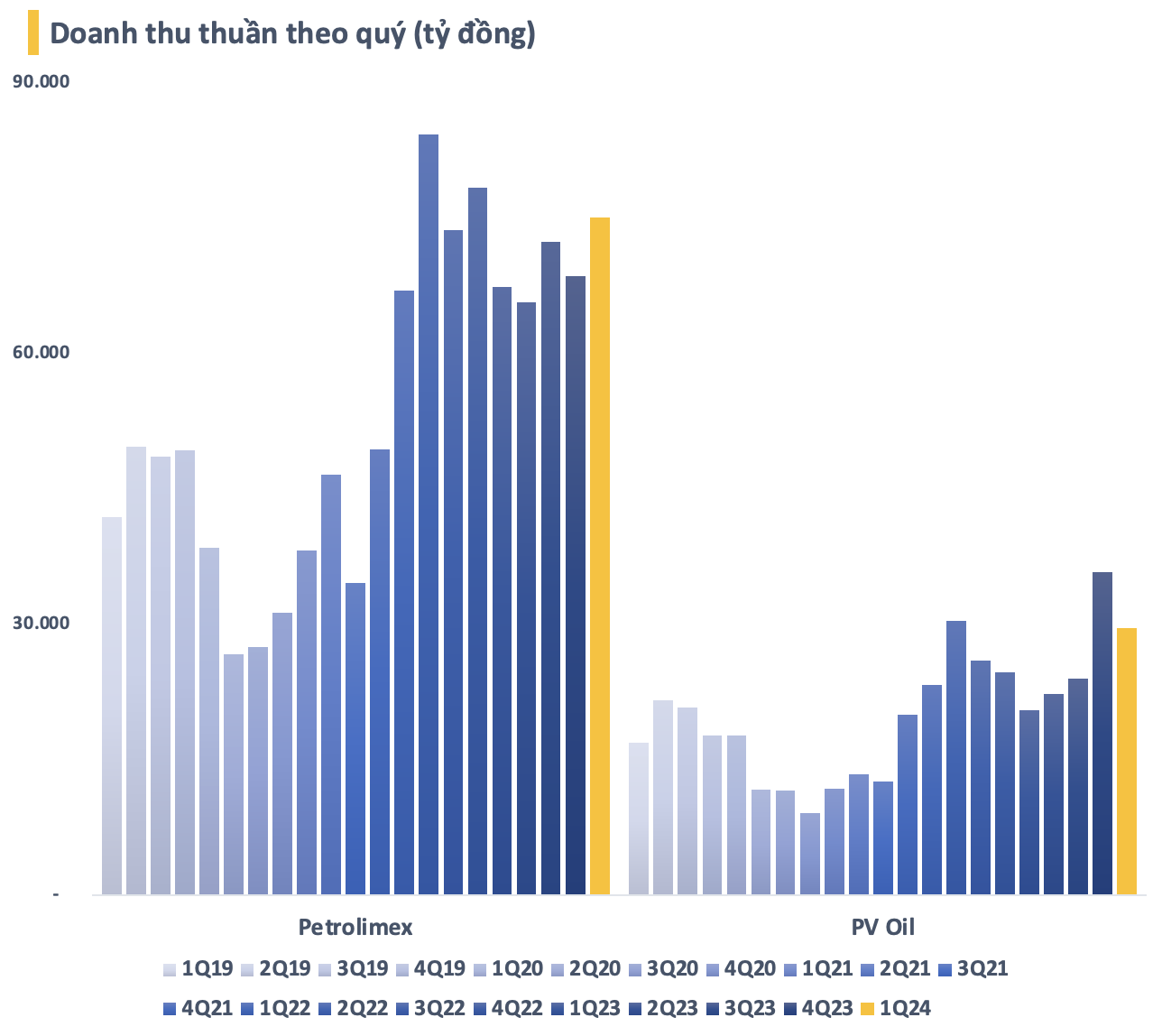

In the first quarter of 2024, the combined revenue of Petrolimex and PV Oil reached nearly VND 105 trillion, the highest since the second quarter of 2022. On average, these two gasoline retailers bring in VND 1,150 billion per day. Petrolimex recorded first-quarter revenue of over VND 75 trillion, an 11% increase compared to the same period in 2023, while PV Oil’s revenue surged by over 44% to VND 29.6 trillion.

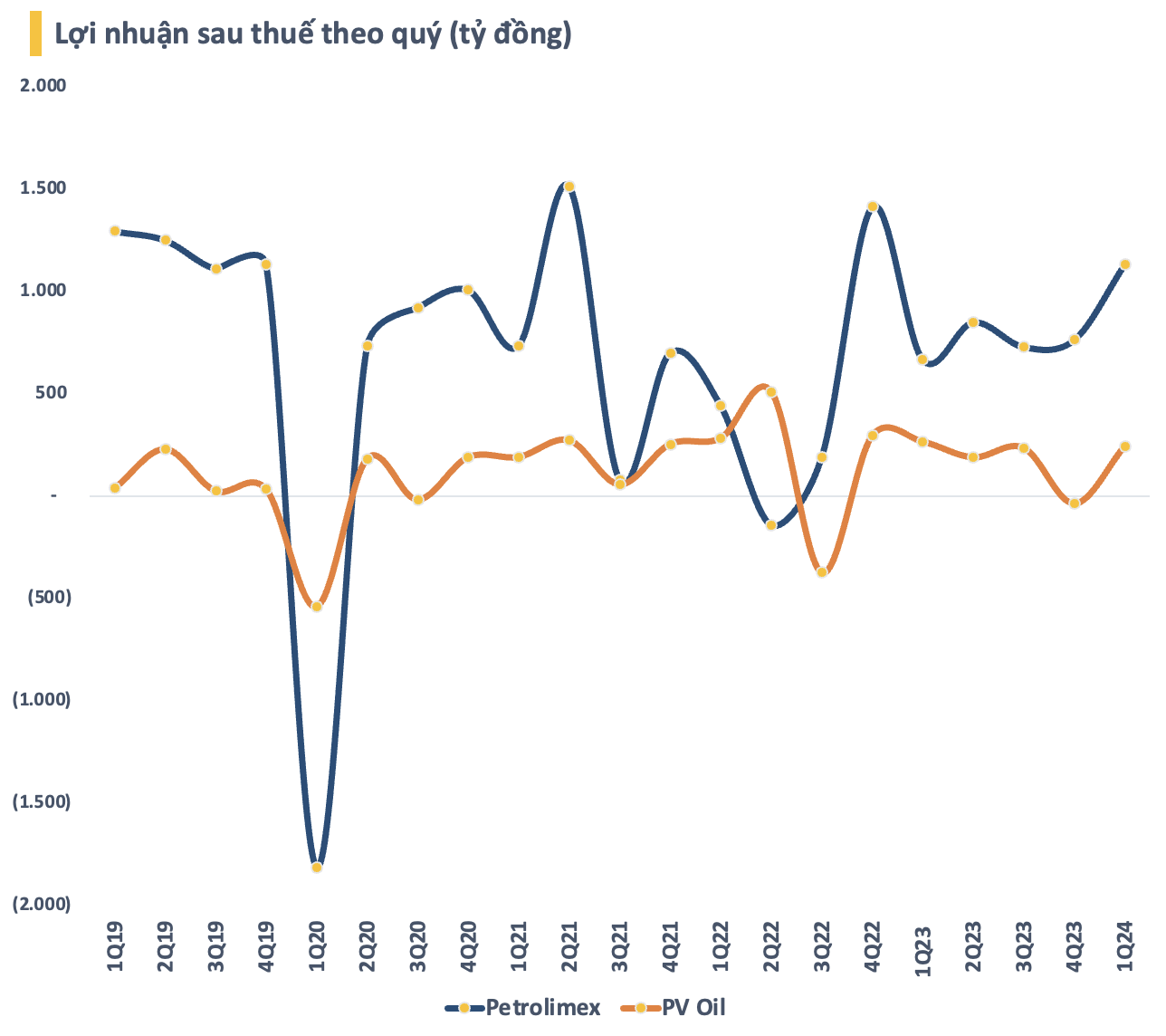

Despite their joint windfall in the first quarter, the two gasoline retailers experienced contrasting profit trajectories compared to the previous year. Petrolimex’s first-quarter after-tax profit surged by nearly 70% to over VND 1,300 billion, while PV Oil reported an 8% decline in profit compared to the first quarter of 2023, falling to VND 244 billion.

Looking ahead to the second quarter, a recent ACBS report suggests that Petrolimex’s performance may be less favorable than in the first quarter. In May 2024, gasoline prices were lower compared to March and April due to a decline in oil prices. This price drop could negatively impact Petrolimex’s inventory valuation. Additionally, the reduction of import taxes on gasoline to 0% under FTAs may decrease the company’s tax advantage.

For the full year 2024, with a stable supply of gasoline, Petrolimex is expected to benefit from the application of new cost norms for the entire year, as opposed to starting from July 2023. Estimated consumption volume is projected to increase by 4% year-on-year, driven by a recovery in production activities.

Moreover, according to Decree 80/2023, transportation costs for importing gasoline to Vietnam, insurance costs, and premium in the selling price formula are now adjusted more frequently, every three months instead of every six months. This helps reduce the risk of closure for smaller gas stations, as experienced in 2022. Additionally, the draft amendment to Decree 80/2023 includes several provisions that support gasoline wholesalers like Petrolimex.

Regarding PV Oil, the corporation recently held a mid-year review, reporting an estimated gasoline sales volume of 2.8 million cubic meters/tons. Revenue and pre-tax profit are expected to reach nearly VND 64 trillion and VND 390 billion, respectively. Specifically, for the second quarter, PV Oil’s revenue is estimated at VND 34,376 billion, a 54% increase, but its pre-tax profit decreased by 64% compared to the same period in 2023, reaching VND 91 billion.

Minister of Industry and Trade inspects fuel and electricity supply for Tet holiday 2024

On February 6, 2024, the Minister of the Ministry of Industry and Trade conducted an inspection of the fuel and electricity supply for the 2024 Lunar New Year holiday and extended Tet greetings to some energy sector enterprises.