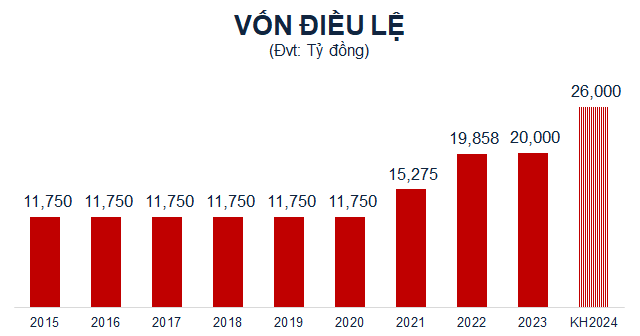

Specifically, MSB plans to raise capital by issuing shares to pay dividends from retained earnings as of the audited financial statements on December 31, 2023, after allocating funds according to regulations. The issuance ratio is 30% of the total outstanding shares, equivalent to issuing 600 million new shares. After the capital increase, the total number of outstanding shares is expected to be 2.6 billion, corresponding to a new charter capital of VND 26,000 billion.

Source: VietstockFinance

|

The increase in charter capital in 2024 boosts the bank’s competitive position in terms of scale, supports its capital buffer, maintains its CAR at a high level, and contributes to credit flow.

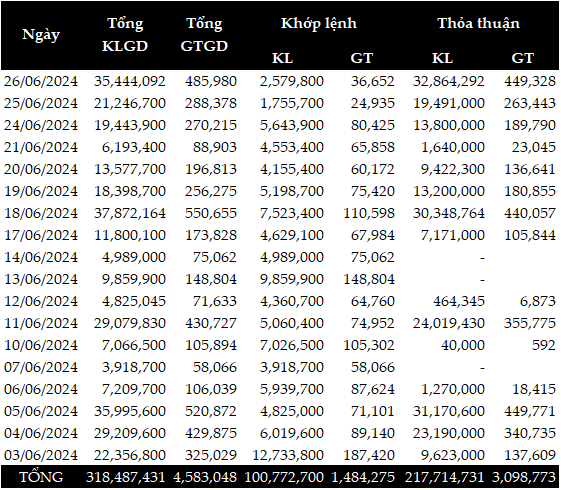

Nearly 33 million shares were traded in the session on June 26

On the HOSE, MSB shares frequently record large matching transactions. From the beginning of June until now, nearly 218 million MSB shares have been traded with a total value of VND 3,099 billion, equivalent to VND 14,233 per share.

In particular, the session on June 26 recorded nearly 33 million MSB shares traded via matching transactions, with a value of more than VND 449 billion, equivalent to VND 13,672 per share, 4% lower than the market price.

|

MSB Share Trading in June

Source: VietstockFiance. Unit: Value (Millions VND)

|

Since the beginning of the year, MSB share price has increased by nearly 10%, closing the session on June 26 at VND 14,250 per share. Average liquidity reached 7 million shares/day.

| MSB Share Price Movement since the Beginning of the Year |