VN-Index has been teetering after crossing the 1,300-point mark, and its direction remains uncertain. At the “Pulse of Money Flow” seminar, Ms. Do Hong Van, Head of Analysis at FiinGroup, shared her insights on the market’s performance. She noted that macroeconomic growth and corporate profits are progressing slower than expected.

Overall growth relies more on external factors than internal strength. This is evident in the average levels of private investment and budget capital, while the bright spots lie in exports and FDI.

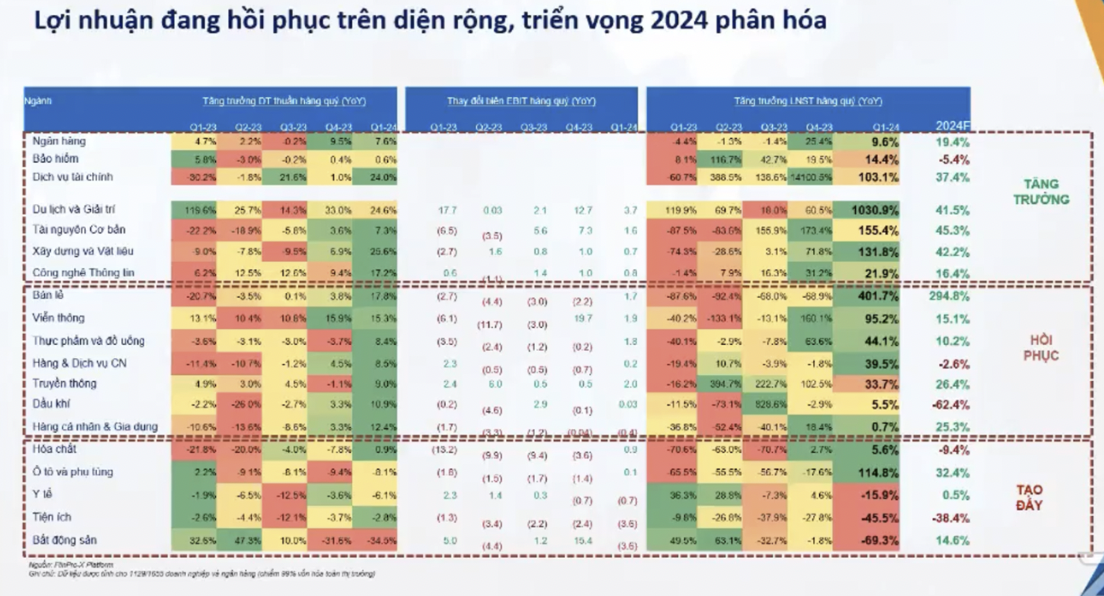

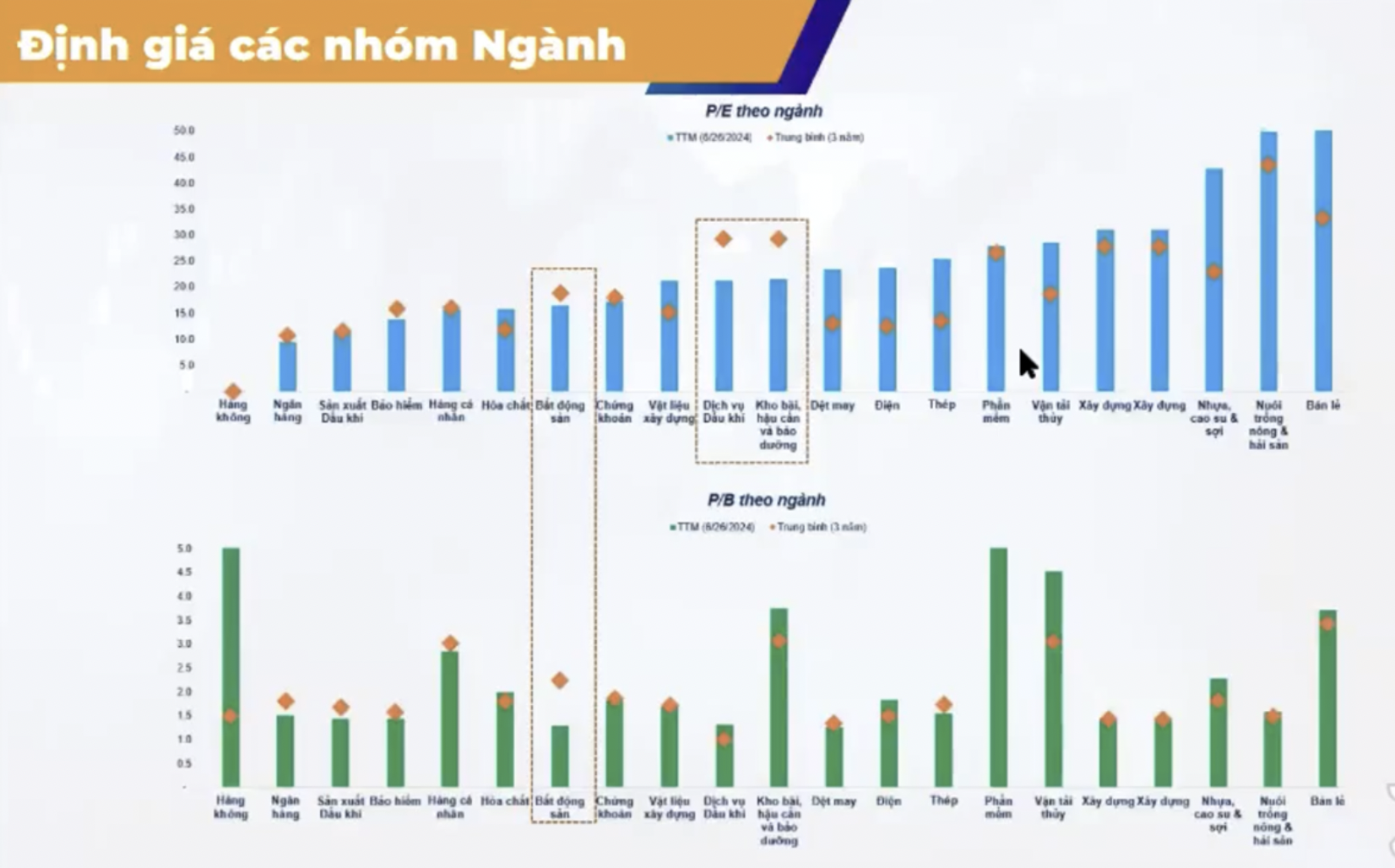

In terms of valuation, the market’s P/E ratio is relatively high, with many sectors having above-average valuations compared to the past three years. The expectation of high profit growth in the second quarter, based on low comparisons from the previous year, is no longer as appealing when considering the correlation between profit growth and valuation.

“Valuation barriers have prevented significant inflows of large money flows in the past, and money continues to struggle to find opportunities in groups that have already risen sharply, resulting in poor liquidity,” said the FiinGroup expert.

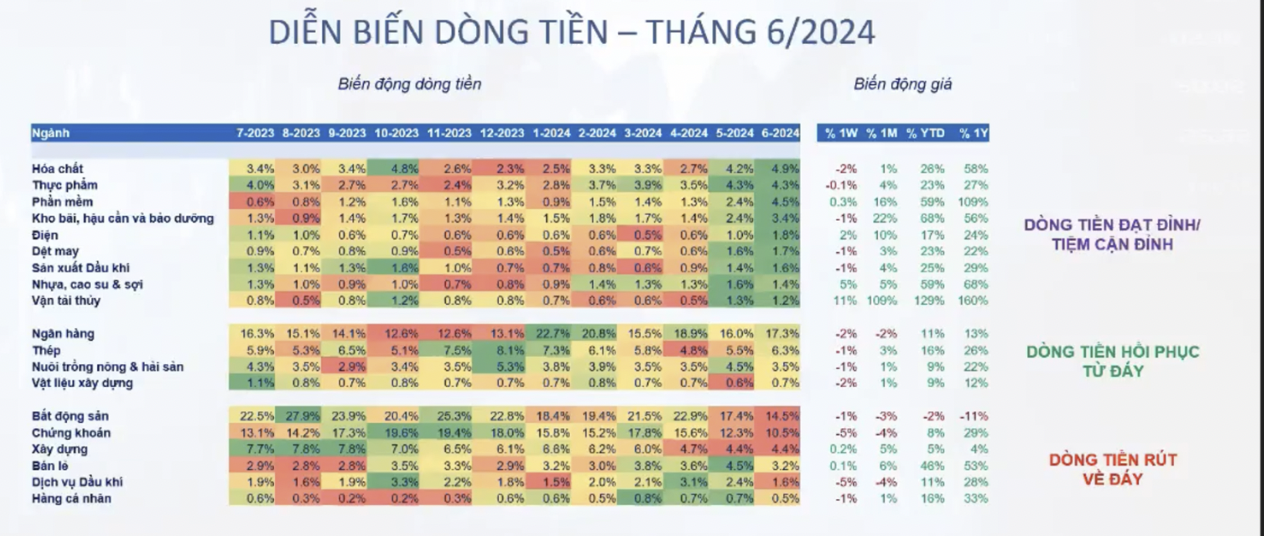

Updating on money flow dynamics, Ms. Van noted that sectors with money flows reaching or approaching peaks include chemicals, food, electricity, textiles, and oil production. Money flows are recovering from lows in banking and steel, while flows are retreating to lows or showing signs of weakening in real estate, securities, construction, and retail.

Therefore, the FiinGroup expert believes that expecting a “sector wave” in the coming time is challenging. In July, investors should focus on stocks with unique stories rather than specific sectors. Enterprises in industries with strong supporting narratives and money flows at multi-month lows may attract money flows in the future.

First, the real estate sector is expected to perform well as the money flow ratio in this group continues to hit new lows, falling below the previous month’s level. Investors should focus on enterprises with legal hurdles cleared and sales achievements in residential real estate, as well as those benefiting from FDI in industrial park real estate.

Second, the steel group, with increasing money flows (recovering from October lows) and expected profit recovery in the second quarter from low levels, will support this sector. Pay attention to enterprises with stable consumption volume growth in April-May and the potential to improve profit margins by increasing inventory at low prices.

Third, the retail group, with money flows trending downward towards lows, investors should consider enterprises with sustained revenue growth in April-May 2024 and improved profit margins. A representative example is MWG, which has significantly enhanced its business performance through the Bach Hoa Xanh chain, while its appliance and phone chains show signs of saturation.

Fourth, infrastructure construction, with money flow ratios continuing to hit new lows, focuses on infrastructure construction groups with growth momentum.

Fifth, the export sector, with money flow ratios at 10-month highs, is expected to improve business performance through garment exports and imports of textile raw materials, which are on the rise again. Pay attention to garment enterprises with large customer portfolios that are not financially strained.

Mr. Doan Minh Tuan, Head of Analysis at FIDT, believes that the market’s recent adjustments are purely technical. In the second half of 2024, the groups driving economic growth will be production, exports, imports, FDI, international visitors, and retail services. The sectors benefiting from the recovery of economic growth are retail consumption, real estate and resort real estate, investment, and private economic business.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.