State Bank of Vietnam’s (SBV) Decision 2345 mandates that transactions over 10 million VND per transfer, or with a total transaction value exceeding 20 million VND per day, must be authenticated using biometric identification that matches the data stored in the customer’s microchip-enabled Citizen Identity Card issued by the police, effective July 1, 2024.

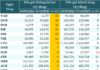

According to SBV statistics, the proportion of transactions over 10 million VND in the past three days has fluctuated around 6-8%. On the first day of implementation, July 1, the proportion of transactions over 10 million VND was 8.35%.

During the initial implementation phase, various issues arose, including customers without microchipped identity cards, phones lacking NFC functionality, network congestion, and system failures in recognizing customers.

Moreover, during the first few days, many banking apps encountered errors, failing to authenticate biometrics or process transfers even for amounts below 10 million VND per transaction.

Mr. Nguyen Duc Lenh, Deputy Director of the SBV’s Ho Chi Minh City Branch, stated that to facilitate a smooth transition for customers to adopt biometric authentication for online payments, financial institutions are not only committed to continuously improving and enhancing their services but also determined to strengthen their communication and guidance for customers, especially in addressing their concerns and promptly resolving any issues that may arise.

Financial institutions have established dedicated customer support and information centers operating 24/7. They are closely monitoring the implementation process and are prepared to address any difficulties or technical glitches, providing timely assistance to customers. They are also gathering feedback and scenarios to proactively handle potential challenges and organize an efficient response.

Customers updating their biometric data at a bank. Photo: Han Dong

|

Fraudsters have taken advantage of the situation, with some customers facing challenges in updating their biometric information. These scammers impersonate bank employees and contact customers, offering to “assist” with biometric setup to gain access to their assets and personal information.

The scammers typically reach out to customers through phone calls, text messages, or social media platforms (such as Zalo or Facebook), creating fake profiles with names like “Bank Employee” or “Customer Support” to interact with customers in the comment sections of official bank social media posts, requesting private communication to deceive and steal their banking information.

These scammers ask for personal details, bank account information, Citizen Identity Card images, and even facial images. They may also request video calls to collect voice and gesture data. Subsequently, they instruct customers to access suspicious links and download applications to purportedly facilitate biometric data collection on their phones.

Once they obtain the customer’s information, they proceed to steal funds from their bank accounts.

Agribank has advised customers on measures to safeguard their personal and bank account information. They emphasize that customers should never provide OTP codes, online banking passwords, or any other sensitive information to anyone, including individuals claiming to be bank employees. Agribank asserts that they do not directly contact customers for biometric data collection. Customers are urged to be vigilant and refrain from accessing unfamiliar links sent via chat, SMS, or email to prevent fraud and protect their information.

Vietcombank echoes similar warnings, advising customers against accessing unfamiliar links to download and install applications for biometric data collection. They assure customers that the bank does not request personal information through phone calls, SMS, email, or chat applications like Zalo, Viber, or Facebook Messenger.

Therefore, customers should refrain from clicking on links, providing account security information, online banking credentials (usernames and passwords), card information (card numbers and OTP codes), or any other sensitive banking or personal information.

Sacombank emphasizes the importance of customers refraining from updating biometric data through any websites or applications to prevent fraud. Sacombank assures customers that they will never ask for OTP codes, passwords, card numbers, or security codes through phone calls or links.

Additionally, customers are advised against sharing personal or banking information on social media to prevent scammers from impersonating bank employees or officials and requesting sensitive information under the pretext of providing assistance or support, ultimately leading to fraudulent activities and the theft of funds from customer accounts.

The SBV has also issued warnings to the public regarding the use of online banking services, highlighting the importance of remaining vigilant to avoid financial losses.

Given the evolving nature of cybercrime, the SBV encourages individuals to enhance their awareness of online security, adhere to guidelines for safe electronic banking practices, and follow the instructions provided by their financial institutions for online transactions.

It is crucial for individuals to set strong and unique passwords for their online banking accounts, regularly change them, and avoid using password auto-fill features. They should never disclose their online banking login credentials or OTP codes to anyone, including bank staff, and promptly report any suspected or confirmed breaches to their financial institution.

In the event of a lost card, it is essential to block the card through the electronic banking application or by contacting the bank as soon as possible to mitigate the risk of financial loss. Individuals are also advised to avoid using public computers or Wi-Fi networks when accessing electronic banking systems and to type the bank’s website address directly into the browser instead of relying on saved links.

Biometric Authentication for Transfers Over 10 Million VND: Balancing Convenience and Security

Vietnamese woman scammed out of 18 billion VND after befriending and entrusting her assets to a ‘foreigner’: Police quickly intervene and dismantle cross-country fraud ring

According to Gia Lai Provincial Police, a group of individuals has conducted cross-country fraud, embezzling nearly 100 billion VND from multiple victims nationwide.

Combating Criminal Activity: The Dangers of Facilitating Bank Account Transactions

In recent days, Hanoi City Police have released information that there have been cases of subjects renting and purchasing bank accounts on forums and groups for the price of 500 thousand to 1 million VND. These accounts are then used for fraudulent purposes such as asset appropriation, and money laundering through a variety of different methods.

VMG eID-VMG Bio-2345: The Next-Gen Solution for Bank Account Protection

Despite constant warnings from banks, regulators, and the media, many people still fall prey to sophisticated online scams and lose their hard-earned money. This problem is becoming increasingly prevalent, and it is crucial to find effective solutions to protect citizens in the digital age.