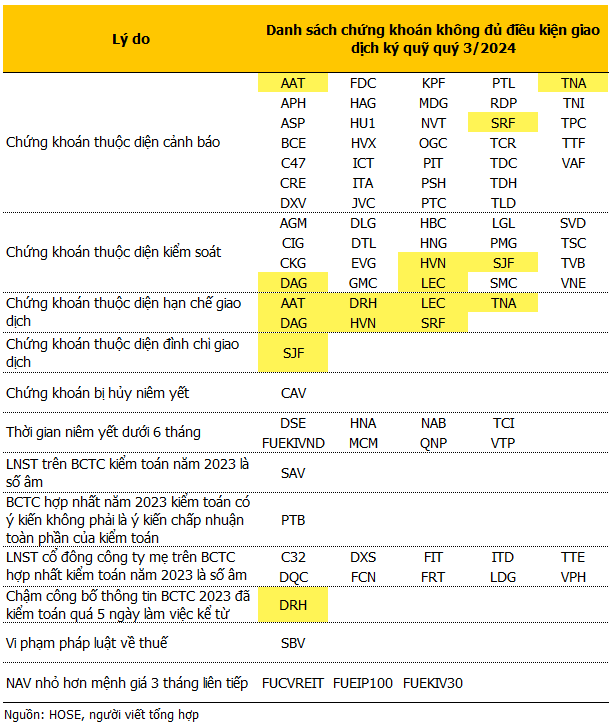

On July 2nd, the Ho Chi Minh City Stock Exchange (HOSE) published a list of 79 securities codes that are ineligible for margin trading in the third quarter of 2024. The list includes familiar names that are either under warning or supervision, such as AAT, DAG, DRH, HAG, HBC, HNG, HVN, ITA, OGC, PSH, SMC, TTF, and SRF.

According to the list, stocks such as FRT, DQC, DXS, and FCN have been cut from margin trading in the third quarter due to negative post-tax profits of the parent company’s consolidated audited financial statements for 2023.

Some special cases include CAV, which is ineligible for margin due to its delisting status, and PTB, which had its consolidated financial statements for 2023 audited with a disclaimer of opinion by the auditing organization. SBV is also ineligible due to tax law violations.

DRH is not qualified for margin trading due to trading restrictions and the company’s delay in disclosing audited financial statements for 2023, exceeding the 5-day deadline.

Additionally, three listed funds, FUCVREIT, FUEIP100, and FUEKIV30, are ineligible due to their net asset value (NAV) per fund certificate being lower than the par value, based on the monthly net asset value change report for three consecutive months. Moreover, the FUEKIVND fund certificate is ineligible for margin trading as it has been listed for less than six months.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.