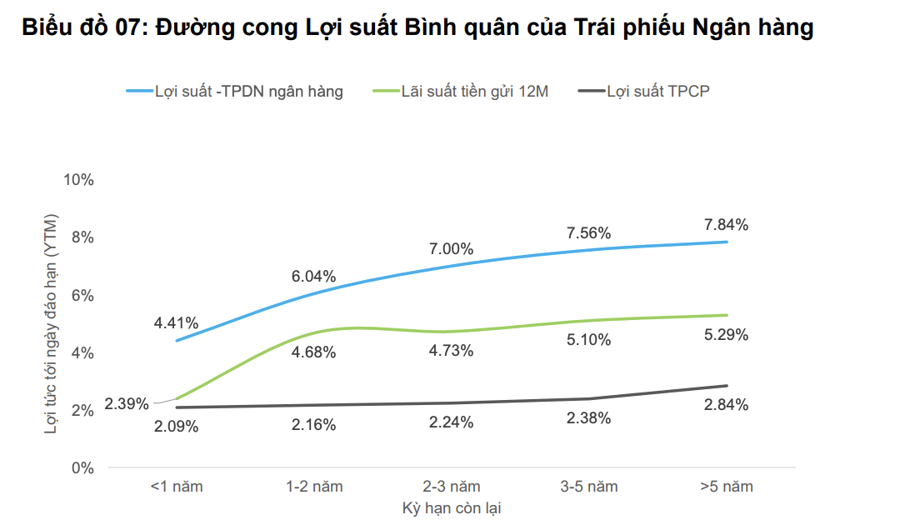

FiinRatings has just released its Yield Curve report, which contains notable observations. The report reveals that the current yield differential between non-bank corporate bonds and bank bonds is widening in the short term, averaging around 5-6% for maturities of less than 24 months. Non-bank corporate bond yields to maturity are typically significantly higher than those of bank bonds, due to their lower liquidity and credit ratings.

According to FiinRatings, the most liquid bank bonds are usually those with remaining maturities of around 2-3 years and original maturities of about 5-7 years. The early redemption of bonds helps banks avoid having to deduct Tier 2 capital, while also providing room for the issuance of new bonds with maturities of over 5 years to supplement the necessary capital to meet regulatory capital adequacy requirements.

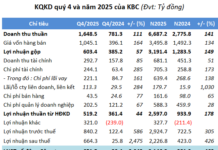

The yield differential trend between bank bonds and the 12-month term deposit interest rate currently fluctuates between 1.5% and 2%, depending on the maturity.

With interest rates on bank deposits currently low, similar to the Covid-19 era, investing in bank bonds can offer investors, especially institutional investors, potentially higher yields than deposits, along with good liquidity and a diverse range of maturity and yield options.

Bank bond transactions on HNX currently include repo-type deals, where the seller (usually a bank) sells the bond and agrees to buy it back at a future date at a predetermined price. While the yield to maturity (YTM) calculated based on market transaction prices may not accurately reflect the true nature of these bonds due to their repo nature, there is still some differentiation in yields among bank bonds based on their credit ratings.

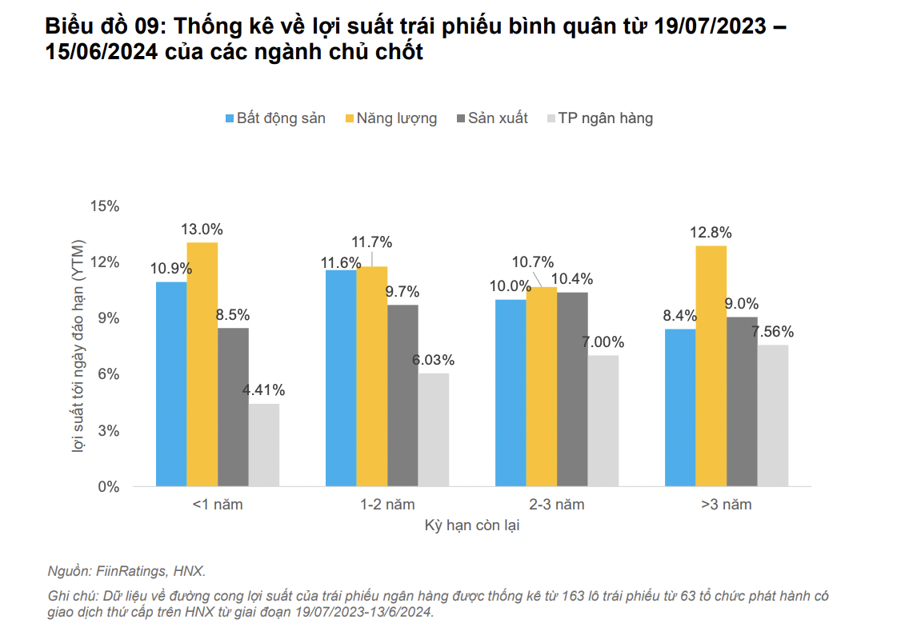

In the non-financial sector, the most liquid corporate bonds are typically those with remaining maturities of less than 2 years in the real estate industry. This industry has been the most active in bond issuance over the past 3 years but is also facing numerous challenges and headwinds due to the unfavorable market conditions.

The commonly traded yield to maturity for real estate companies is around 10-11%, while energy companies are trading at 11-13%. This translates to a yield differential of approximately 4-6% compared to bank bonds. The manufacturing sector has a lower YTM than the other two sectors, ranging from 8.5-10%.

Following a period of significant volatility in the corporate bond market in late 2022, there were bond transactions from financially distressed companies that offered very high yields to maturity, ranging from 20-30%, and in some exceptional cases, surpassing 50%.

These transactions primarily occurred in the real estate sector, involving small-volume bonds (<100 billion VND) during the late 2023 to early 2024 period. The companies involved did not have the financial means to repay or repurchase the bonds, and some investors were forced to cut their losses.

In the second half of 2023, many real estate businesses faced liquidity issues due to the unfavorable market conditions. As a result, some corporate bonds were traded with yields as high as 20-25%.

This also reflects the commensurate risk appetite of investors who purchased these bonds, as these transactions typically involved companies with very low credit ratings. These companies often faced challenges in project implementation and significant financial pressures, with the next 12-18 months being critical for their ability to refinance or raise new capital.

FiinRatings also notes that renewable energy companies issuing corporate bonds have a high average financial leverage ratio (Debt/Equity) of 2.3 times, significantly higher than other industries due to the capital-intensive nature and high initial investment requirements of the sector.

With specific guidelines on implementing the 8th Power Plan for upcoming projects still unclear and long-term capital sources in the system limited, there remain significant challenges and obstacles for businesses in this industry.