Mr. Luu Quang Tien, Deputy Director of the Institute for Economic, Financial and Real Estate Research at Dat Xanh Services (Dat Xanh Services-FERI), assessed that the real estate market in the first half of 2024 performed better than expected.

Specifically, new supply increased by 40% compared to the same period last year, far exceeding the predicted 20-30% in the expected scenario. Selling prices rose by 3-5%, in line with forecasts. Floating interest rates stood at 10-12%, also within the expected range (some banks offered promotional rates for the first 6-12 months, ranging from 6-8%/year). The absorption rate reached approximately 34%, equivalent to the estimated 30-35% in the expected scenario put forward by FERI at the beginning of 2024.

These developments indicate that the real estate market is showing positive signs of recovery, overcoming the challenges of 2023. However, there are still some difficulties, such as economic recession due to global geopolitical instability, low credit growth despite reduced lending rates, unresolved real estate legal issues, and market confidence not yet fully restored.

Mr. Tien highlighted five notable events in the real estate market in the first half of the year:

Firstly, the State officially adopted and expedited the implementation of important laws: the Land Law, the Real Estate Business Law, and the Law on Credit Institutions 2024, which will come into force earlier on August 1, 2024.

Secondly, capital inflows into the real estate market continued to grow, especially FDI in real estate, which increased by nearly 62% compared to 2023 and ranked second among sectors attracting foreign investment. Real estate credit accounted for nearly 22% of the total outstanding credit of the economy. The market recovery, particularly the demand for home loans, had a significant impact on the credit growth of banks.

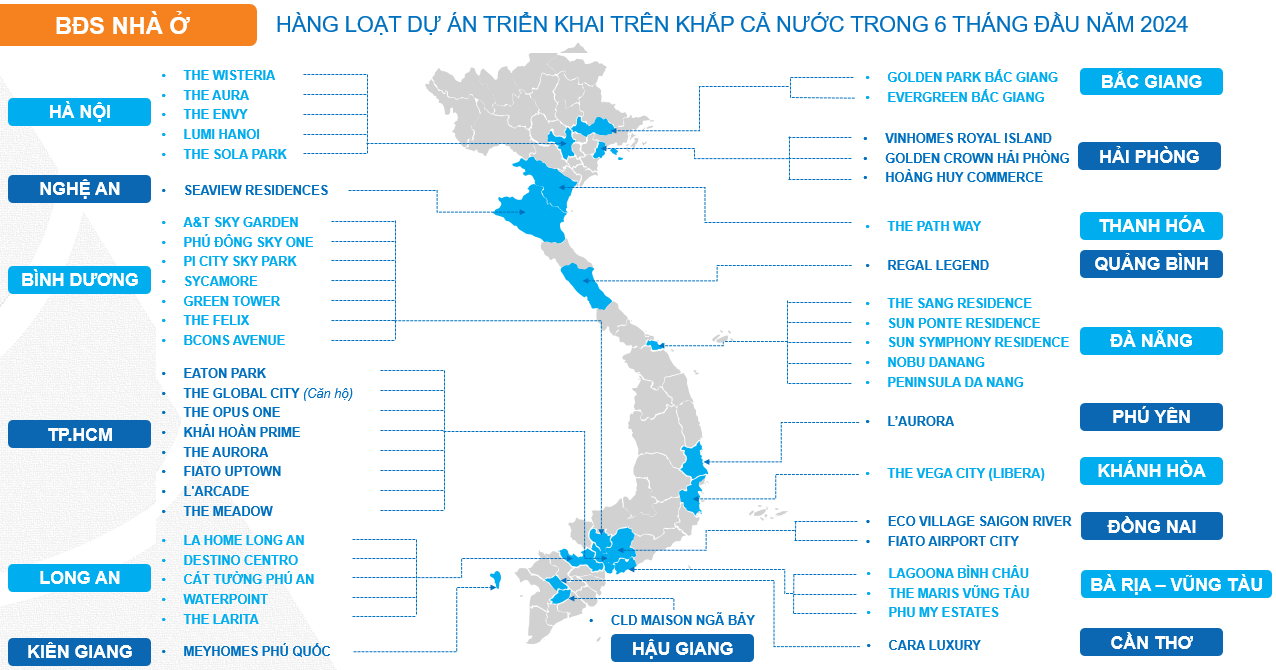

Thirdly, numerous new projects were launched across the country. As of the end of June, more than 20 projects were introduced and sold in the market, covering diverse segments, types, sales methods, and policies. Some projects achieved promising sales results, reflecting customers’ strong interest and contributing to the market’s gradual improvement in the first half.

Fourthly, there was a focus on accelerating the implementation of social housing development programs.

Fifthly, real estate absorption across the country improved, increasing about fourfold compared to the same period in 2023.

Stable Rental Market

The two segments with positive developments in the first half were office and retail spaces.

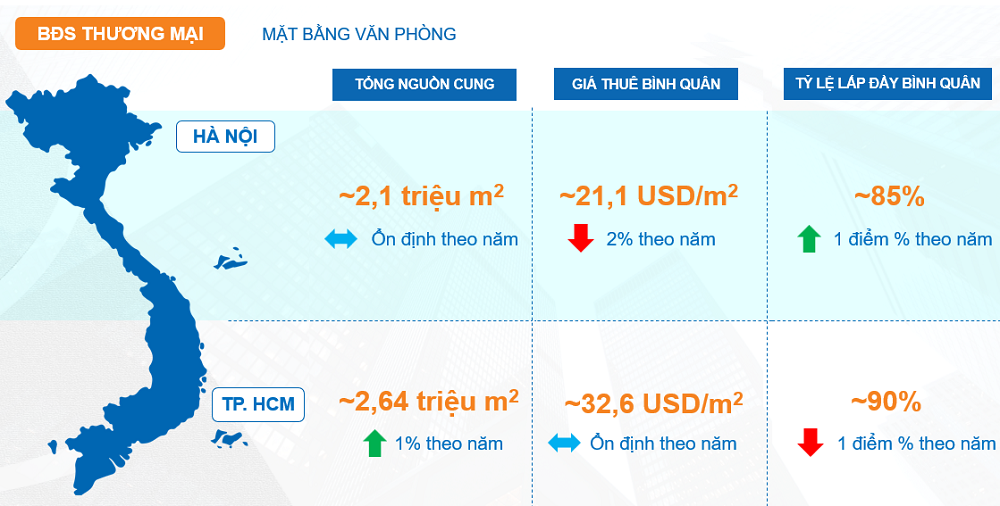

Regarding office spaces, there was a stable supply, increasing by about 1% compared to the end of 2023. The total supply of office space for lease in Hanoi remained at approximately 2.1 million m2, with the average rental price decreasing by 2% compared to the same period, reaching 21.1 USD/m2. The average occupancy rate increased by 1 percentage point to 85%. In Ho Chi Minh City, the total supply increased by 1% to 2.64 million m2. Prices remained stable compared to the previous quarter, reaching 32.6 USD/m2. The average occupancy rate decreased by 1 percentage point compared to the previous year, reaching 90%.

In terms of demand, it remained stable for Grade A offices in central locations, mainly from new FDI enterprises entering the market. Rental prices were stable, with a slight decrease in some areas of Hanoi. Buildings were upgraded to meet ESG standards.

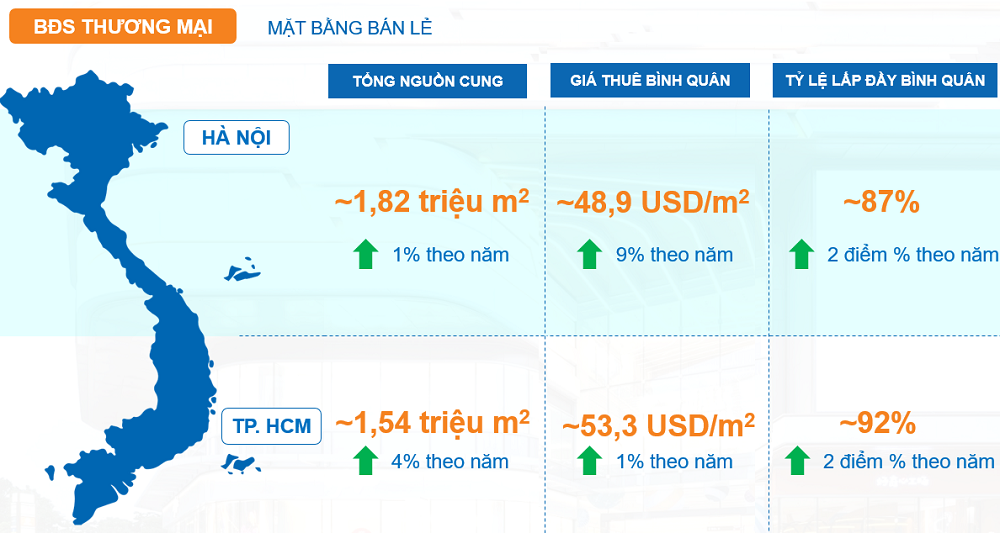

For retail spaces, in addition to the projects under construction, the supply of retail spaces improved due to the opening of new shopping centers such as The Linc ParkCity and Vincom Mega Mall Grand Park, and the reopening of Vincom 3/2 after renovation.

On the demand side, the demand for street-front retail spaces decreased due to the growth of e-commerce. Instead, there was a rising demand for spaces in shopping centers located in areas with convenient transportation and ample parking spaces, aligning with the Shoppertainment trend. Rental prices for retail spaces in shopping centers increased due to high demand but insufficient new supply.

Foreign investors are increasingly entering the Vietnamese market, led by AEON, with a strategy to develop a series of large-scale shopping centers in provinces and cities nationwide, rather than just focusing on the two major cities as before.

|

Source: FERI

|

Improved Absorption Rate in the Residential Real Estate Market

According to Mr. Tien, the residential real estate market in the first half showed positive signs, with a significant increase in supply and improved absorption rates.

In the first six months of 2024, nearly 20,700 products were launched in the market, with a total primary supply of 69,200 products, an increase of 82% compared to the same period and a 46% increase compared to the end of 2023. The Northern region accounted for more than half of the supply, with nearly 10,800 new products. The Southern region had approximately 5,900 new products, but the total accumulated supply accounted for 46%, equivalent to more than 32,100 products, leading the country. The absorption rate improved significantly, with all regions experiencing increases. The region with the highest growth was the Central region, with a 600% increase compared to the same period last year. Overall, the absorption rate across all regions increased by 30-35% compared to the previous year.

The overall absorption rate of the market nearly tripled compared to the same period in 2023. The absorption rate gradually increased over the quarters, especially in the months after the Lunar New Year. The Northern region continued to lead with outstanding sales performance compared to other markets. Hanoi had a new supply of 7,525 products, with an absorption rate of 65-70% for new products, a 4.5-fold increase compared to the previous year. Ho Chi Minh City had a 1.3-fold increase in new supply, reaching 2,356 products, with an absorption rate of 45-50%, a 2.5-fold increase.

Primary selling prices increased by 5-10%, with apartments recording the highest average increase of up to 20% in the Northern region. There were no longer many cases of secondary selling at a loss, with a slight increase in prices across most types, especially detached houses. In Hanoi, Grade C apartments had the highest price increase of 20-30% compared to the previous year, while in Ho Chi Minh City, Grade A apartments experienced the strongest price growth of 20-30%.

The demand for apartment rentals in central areas and satellite towns continued to rise. Rental prices also increased by 5-10%.

Projects launched nationwide in the first half of 2024. Source: FERI

|

Restored Market Confidence

Mr. Tien assessed that market confidence is showing positive signs, especially in the North. The number of customers registering for project visits and model house viewings increased by 5-10 times compared to the same period in 2023.

Developers accelerated the launch of new projects, offering a diverse range of segments and locations to meet the growing market demand. Real estate brokers strengthened alliances and collaborations to boost sales activities. The number of businesses returning to the market in the first six months increased by over 11% year-on-year to 1,416 enterprises. The number of newly established enterprises increased by 1.4% to 2,179, and the average capital scale of each newly established enterprise increased by nearly 30% to nearly VND 72.2 billion/enterprise. The number of employees in the real estate sector rose by 19% to nearly 14,200, indicating the restoration of investors’ and enterprises’ confidence in the real estate market, laying a foundation for future development.

Developers’ Strategies for Capital Raising and Sales

As of mid-June 2024, there were 92 issuances of corporate bonds in the real estate sector, with a total value of approximately VND 28,000 billion. Mr. Tien assessed that the value of bonds issued in the first half was not significant compared to the pressure of debt repayment, leading developers to diversify channels to restructure their capital. Real estate enterprises still face considerable pressure from bond maturities at the end of this year, with more than VND 67,000 billion, accounting for nearly 43% of the total value of soon-to-mature corporate bonds.

Consequently, capital mobilization from the stock market has become a popular strategy for listed companies. Particularly after the General Meeting of Shareholders, many enterprises announced plans to issue shares, increase revenue and profits, and initiate numerous new projects. Additionally, enterprises restructured their investment portfolios by divesting assets, land funds, and equity stakes in projects or enterprises through M&A activities.

In the first half of 2024, there were 19 projects started, 23 projects kicked off, and 27 sales events nationwide. Legal aspects have been given more attention than ever by developers, becoming a critical competitive factor to ensure legality and promote market trust.

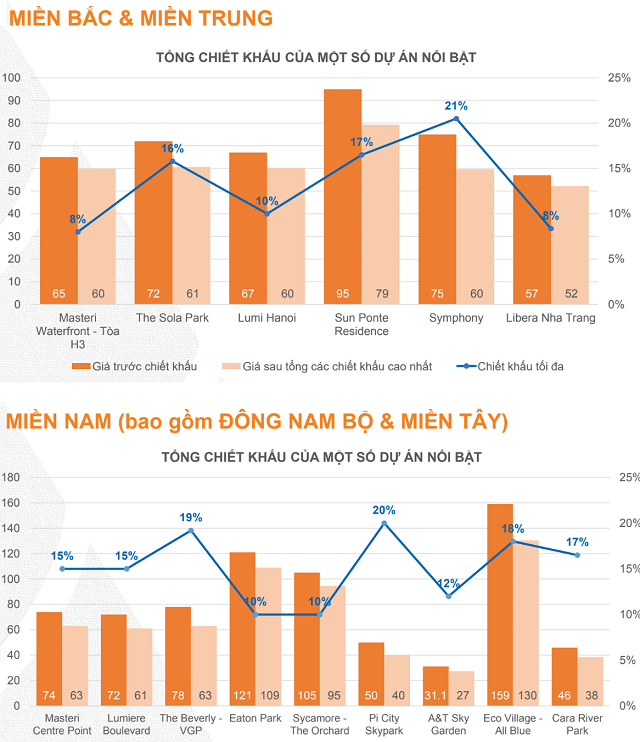

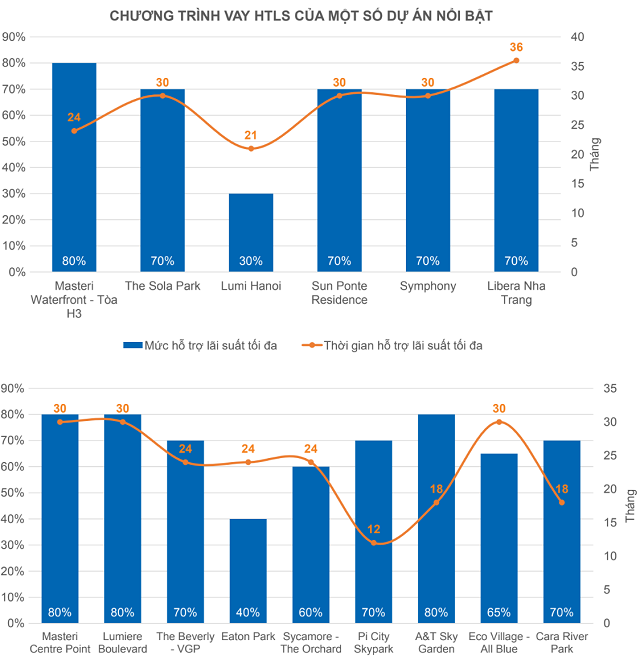

Regarding sales and payment methods, while the previous focus was on price discounts, the current prices are now closer to reasonable levels, leading to a reduction in deep discount policies. The highest discount rate currently offered is 20%. Instead, other policies such as extended payment schedules, grace periods for principal repayment, loan support (averaging 70-80%), interest rate support, principal grace periods, management fee waivers, leaseback guarantees, and early delivery offers are widely applied to reduce financial pressure on customers and improve sales performance.

Source: FERI

|

Removing Land Policy Bottlenecks, Creating New Resources for Development

The passing of the Land Law by the National Assembly has been well-received by society, with expectations that policy barriers and bottlenecks will be quickly dismantled and eliminated. This will effectively utilize land resources, contributing to the creation of new resources that will promote socio-economic development…

‘Unusual surge in prices of old apartments’

After years of hard work and saving, many families have accumulated huge sums of money. However, with soaring prices and record low interest rates, buying a home has become a challenging task for many.