After more than two years of stagnation in the real estate market, businesses faced challenges and continuous losses. As a result, the stock prices of these companies were cautiously viewed by the market. Compared to other sectors such as banking, steel, securities, and construction, the real estate industry has not witnessed a significant recovery.

However, MBS Securities believes that the market will soon re-evaluate this sector at a more reasonable level.

This optimism is based on several positive signals for the real estate market. Interest rates have reached an attractive level to stimulate market development. Since the beginning of 2023, the State Bank has reduced the operating interest rate four times, and the refinancing interest rate is now at 4.5%, lower than during the Covid-19 pandemic in 2020. As a result, medium and long-term lending rates now fluctuate around 7.5%–7.9%, down from 9.3%–11.4% in mid-2023.

Even if interest rates rise in the future, it will not significantly impact the real estate market. A slight increase in lending rates may stimulate cash flow into real estate as investors anticipate that interest rates have bottomed out. They will seize the opportunity to take advantage of favorable rates for investment.

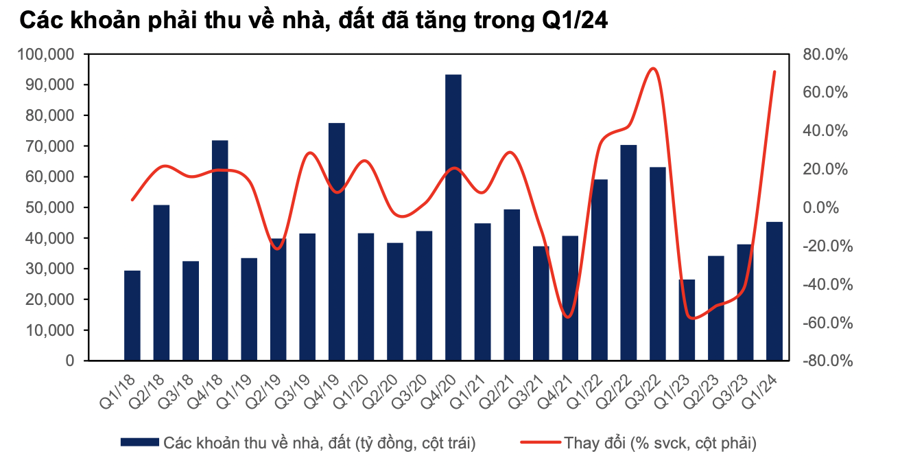

Another notable indicator is the recovery of tax revenues related to real estate. After plummeting to its lowest level in years in Q1/23, with only VND 26,515 billion, a 55.1% decrease compared to the same period last year, tax revenues from house and land taxes have consistently rebounded. In Q1/2024, it reached VND 45,277 billion, a 70.8% increase year-on-year. This indicates an improvement in fulfilling financial obligations to the state.

Over the years, tax revenues from land include land use fees (80-85%) and land and water surface rentals (10-15%). This is an early indicator of the real estate market’s recovery in the upcoming period.

Regarding real estate businesses, capital mobilization on the stock market will be a prominent activity in the coming time. This move aims to restructure their debt obligations, meet financial obligations related to land, and cover the increasing project development costs.

Additionally, M&A activities for real estate projects are expected to play a crucial role in 2024. Many real estate businesses still have weak financial health and limited access to capital. As interest rate fluctuations have eased, buyers will find it more manageable to arrange capital for future transactions.

The focus of these M&A deals will remain on projects with clear legal status, good quality, and high potential for development.

In terms of market trends in 2024, Hanoi is witnessing a noticeable shift away from the city center, with new hotspots emerging in the eastern and western parts of the city.

As the land fund in the central area decreases, the eastern and western regions are expected to contribute significantly to the apartment supply in 2024, thanks to the large smart city and ocean park projects. Projects like Canopy and The Lumi, launched in Q1/24, achieved over 60% absorption rates, and selling prices increased by nearly 15% compared to surrounding projects, indicating high demand in the context of the current low-interest-rate environment.

The average selling price is now VND 55 million/m2, a 9% increase compared to the same period last year. This recovery sign is evident, and the contribution of luxury products has gradually increased over the past four years.

In Ho Chi Minh City, the luxury segment will continue to dominate the supply, while the middle-class segment will be more common in neighboring provinces. According to CBRE statistics, the new supply in Ho Chi Minh City is expected to exceed 8,000 units, and with such a limited supply, the price level is expected to remain high, with primary selling prices potentially increasing by 3%.

New projects in Ho Chi Minh City will mainly focus on the luxury segment, including Eaton Park and The Global City. As land funds in the inner districts become scarce, new supply trends are shifting to the eastern, southern, and city fringe areas and neighboring provinces, in line with infrastructure development orientations. These areas will continue to dominate the market in the future.

In the stock market, MBS Securities believes that a re-evaluation of this stock group is possible. So far, the real estate index has underperformed compared to the VN-Index, with increases of 1.4% and 13.1%, respectively, since the beginning of the year.

The P/B ratio of the residential real estate group is 1.16 times, lower than the five-year median of 1.6 times. “The residential real estate group is trading at a relatively low valuation, and as the business outlook shows more positive signals, the market is likely to seek a leading sector with an attractive risk-reward ratio in the near future. We do not rule out the possibility of a re-rating for the residential real estate group to bring it back to a more appropriate valuation,” MBS emphasized.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.