Market liquidity increased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 671 million shares, equivalent to a value of more than VND 16 trillion; the HNX-Index reached over 66 million shares, equivalent to a value of more than VND 1.2 trillion.

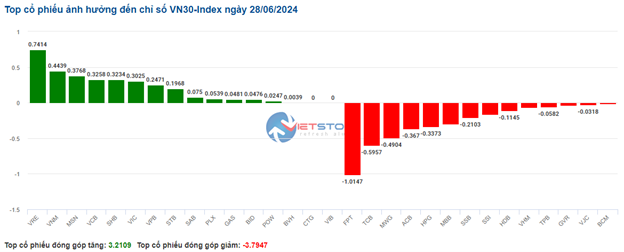

The VN-Index opened the afternoon session on a negative note, with strong selling pressure continuously appearing, causing the index to weaken and plummet until the end of the session. In terms of impact, GVR, BID, HPG, and FPT were the stocks with the most negative influence, taking away more than 4.5 points from the index.

On the other hand, EIB, VIC, VNM, and SHB were the stocks with the most positive impact on the VN-Index, contributing more than 0.62 points to the index.

| Top 10 stocks impacting the VN-Index on June 28th |

The HNX-Index also followed a similar trend, with negative influences from VIF (-9.66%), VCS (-5.16%), SHS (-2.89%), and CEO (-3.51%), among others.

|

Source: VietstockFinance

|

The rubber product industry witnessed the sharpest decline in the market, falling by -5.36%, mainly due to DRC (-6.97%) and CSM (-4.75%). This was followed by the agriculture, forestry, and fisheries sector, and the plastics and chemicals production industry, with decreases of 3.9% and 3.46%, respectively. On the contrary, the equipment and machinery manufacturing industry witnessed the strongest recovery, with a 0.16% increase, mainly driven by NAG (+0%), SBG (+0%), CTB (+0%), and QHD (+0%).

In terms of foreign trading, they continued to sell a net amount of more than VND 1,229 billion on the HOSE exchange, focusing on FPT (VND 254.93 billion), TCB (VND 181.74 billion), MWG (VND 112.72 billion), and VPB (VND 126.81 billion). On the HNX exchange, foreign investors net bought over VND 7 billion, focusing on MBS (VND 18.08 billion), PVS (VND 16.64 billion), IDC (VND 16.29 billion), and TNG (VND 7.75 billion).

| Foreign Trading Buy-Sell Dynamics |

Morning Session: Sellers Win, VN-Index Drops More Than 3 Points

After a tug-of-war around the reference level throughout the first half of the morning session, the VN-Index fell back into negative territory. Meanwhile, foreign investors continued their net selling streak, indicating a more negative situation. At the end of the morning session, the VN-Index lost 3.13 points, equivalent to a 0.25% decrease. The HNX dropped by 1.61 points, or 0.67%.

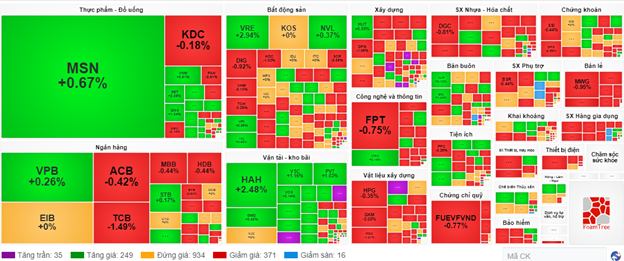

Despite the mixed performance of the food and beverage sector, the upward momentum of some stocks provided support and prevented the market from falling further. MSN, VNM, and SAB were the main contributors among the group that pushed the VN-Index higher. On the other hand, Large Cap stocks dragged the index down, including TCB, MWG, BCM, HPG, FPT, TPB, SSI, and others. This indicated that the food and beverage sector was still acting as a pillar for the market.

The trading volume of the VN-Index recorded in the morning session exceeded 201 million units, with a value of more than VND 5 trillion. The HNX-Index recorded a trading volume of nearly 24 million units, with a trading value of over VND 387 billion.

Almost all sectors were in the red by the end of the morning session, including the transportation and warehousing sector, despite its positive growth earlier. Some large-cap sectors, such as retail, construction materials, and rubber products, experienced more significant declines. Meanwhile, the utilities and insurance sectors maintained their positive growth from the beginning of the session but ended with a relatively low weight.

The utilities sector recorded a slight increase by the end of the morning session. Stocks like GAS (+0.39%), POW (+0.34%), IDC (+0.17%), and VSH (+0.2%) contributed to this growth. Notably, DTK stock witnessed an impressive rise of 6.47%.

In contrast, the accommodation, food and beverage, and entertainment services sector experienced the sharpest decline, with large-cap stocks dipping into the red. OCH fell by 1.56%, VNG decreased by 5.73%, and NVT dropped by 6.02%.

Performance of Sectors at the End of the Morning Session on June 28th. Source: VietstockFinance

|

Foreign investors’ net selling contributed to the VN-Index‘s decline during the morning session. On the HOSE and HNX exchanges, stocks like FPT, VPB, TCB, and MWG experienced the strongest net selling, accounting for a higher proportion compared to stocks like SHS, MSN, VHM, and TCH, which were net bought.

10:40 AM: Cautious Sentiment Persists, VN-Index and HNX-Index Diverge

Liquidity did not show significant improvement, and the main indices fluctuated around the reference level due to selling pressure after an initial upward surge, indicating investors’ cautious sentiment. As of 10:30 AM, the VN-Index gained 0.19 points, hovering around 1,259 points. Meanwhile, the HNX-Index lost 0.76 points, trading around 239 points.

Stocks in the VN30 basket exhibited mixed performance, but buying pressure slightly outweighed selling pressure. Specifically, VRE, VNM, MSN, and VCB contributed 0.74 points, 0.44 points, 0.38 points, and 0.33 points to the overall index, respectively. Conversely, FPT, TCB, MWG, and ACB faced strong selling pressure, deducting more than 2 points from the VN30-Index.

Source: VietstockFinance

|

The transportation and warehousing sector stood out with an early positive start and maintained its upward momentum. Within this sector, stocks like GMD (+0.48%), VTP (+0.82%), PVT (+1.2%), and SCS (+0.23%) continued to receive strong buying support.

Banking sector stocks displayed mixed performance, with a slight bias towards the green. Notably, VCB (+0.59%), BID (+0.45%), VPB (+0.26%), and STB (+0.34%) were among the gainers. Conversely, ACB, MBB, TCB, and LPB faced selling pressure but did not witness significant declines.

The real estate sector also maintained a positive trend, although the number of declining stocks outnumbered the advancing ones. Specifically, the gains were concentrated in some large-cap stocks, such as VIC (+0.73%), VRE (+3.68%), NVL (+0.74%), and KBC (+0.34%)… Meanwhile, stocks like BCM (-0.46%), KDH (-1.47%), DIG (-0.73%), and NLG (-1.07%) struggled to shake off selling pressure.

Compared to the opening, the tug-of-war continued, but sellers slightly gained the upper hand. There were 371 declining stocks and 249 advancing stocks.

Source: VietstockFinance

|

Opening: Cautious Sentiment Lingers

On June 28th, as of 9:40 AM, the VN-Index opened more than 2 points higher, hovering around 1,261 points, with 28 stocks hitting the ceiling price, 261 rising stocks, 1,095 stocks standing at the reference price, 209 declining stocks, and 13 stocks falling to the floor price.

The consulting and support services sector took the lead, starting the day on a positive note. Notably, CSM rose by 1.9%, and DRC increased by 0.68%. Meanwhile, the remaining stocks in the sector, SRC and BRC, maintained their reference prices.

The securities sector followed suit, with most stocks in this group recording positive performance. Specifically, VND (+0.61%), VCI (+0.54%), HCM (+0.19%), FTS (+0.72%), MBS (+0.32%), BSI (+0.3%), and CTS (+1.04%) were among the gainers.

In contrast, the accommodation, food and beverage, and entertainment services sector opened on a negative note, with most stocks in the sector witnessing declines. VNG fell by 5.83%, NVT decreased by 2.91%, OCH dropped by 1.56%, and DAH slipped by 0.76%.