Liquidity in the market increased compared to the previous trading session, with the VN-Index matching volume reaching over 664 million shares, equivalent to a value of more than 15.7 trillion VND. The HNX-Index reached over 60 million shares, equivalent to a value of more than 1.3 trillion VND.

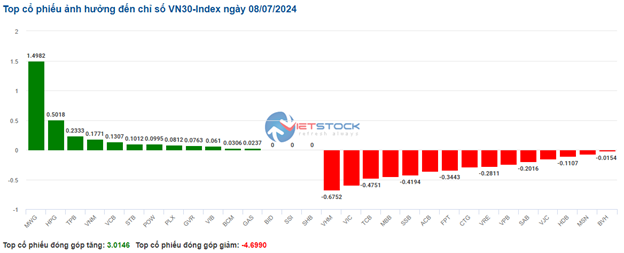

The VN-Index opened the afternoon session with a continued tug-of-war around the reference level, but buyers had a slight advantage, helping the index close in the green. In terms of impact, GVR, PLX, MWG, and DCM were the most positive influences on the VN-Index, contributing over 3.1 points. On the other hand, VCB, VIC, SAB, and VHM were the most negative influences, taking away more than 2.9 points from the overall index.

| Top 10 stocks with the most significant impact on the VN-Index on July 8, 2024 |

The HNX-Index followed a similar trajectory, positively influenced by MBS (+3.35%), IDC (+1.64%), LAS (+9.79%), and DTK (+2.96%)…

|

Source: VietstockFinance

|

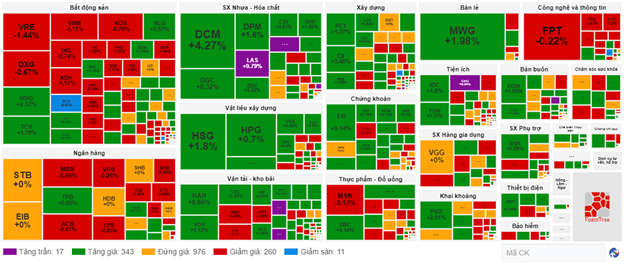

The wholesale industry group led the market with a strong gain of 3.53%, mainly driven by PLX (+5.8%), DGW (+0.93%), PET (+2.17%), SHN (+1.52%), VPG (+0.35%), and PSH (+4.52%). This was followed by the plastics and chemicals manufacturing industry and the retail industry, with increases of 3.37% and 1.69%, respectively. On the other hand, the consulting and support services industry witnessed the most significant decline in the market, falling by -4.54%, mainly due to TV2 (-6.92%) and VNC (-0.51%)

In terms of foreign trading activities, they continued to be net sellers on the HOSE exchange, focusing on HDB (498.02 billion VND), FPT (263.12 billion VND), STB (253.81 billion VND), and SAB (196.48 billion VND). On the HNX exchange, foreign investors were net buyers of nearly 0.15 trillion VND, mainly investing in PVS (6.83 billion VND), VGS (6.15 billion VND), and DTD (4 billion VND).

| Foreign Trading Activities – Net Buying and Selling |

Morning Session: Selling Pressure Intensifies, VN-Index Turns Negative

The market opened positively, gaining over 3 points at the open due to the momentum from the previous session. However, selling pressure emerged and intensified towards the end of the morning session, causing challenges for the market. At the end of the morning session, the VN-Index lost 1.38 points, temporarily settling at 1,281.66 points, while the HNX-Index gained 0.08 points to reach 242.39 points.

The trading volume of the VN-Index in the morning session exceeded 332 million units, with a value of more than 8 trillion VND. The HNX-Index recorded a trading volume of over 32 million units, with a trading value of over 700 billion VND.

The wholesale industry was leading the market with a solid gain of 2.17%. Notably, the stock PLX continued its impressive growth from recent sessions, achieving a gain of 3.53% in the morning session. Additionally, other stocks in this group also recorded positive performances, including DGW (+1.09%), PET (+1.45%), and HTL (+6.85%)…

Meanwhile, stocks in the retail group, such as MWG, PNJ, and FRT, also traded in the green during the morning session. In contrast, stocks like CTF, HAX, and CCI ended the morning session in the red, with decreases of 0.29%, 0.91%, and 4.76%, respectively.

The plastics and chemicals manufacturing group continued to attract strong cash flow, with notable performances from GVR (+1%), DCM (+4.53%), DPM (+1.74%), and NTP (+3.07%). It is worth mentioning that stocks like BFC, LAS, SFC, and TPP hit their daily limit-up prices during the morning session.

10:35 am: VN-Index Struggles to Break Free, Real Estate and Banking Sectors Diverge

Selling pressure persisted in the real estate and banking sectors, resulting in a tug-of-war around the reference level for the major indices. As of 10:30 am, the VN-Index slightly increased by 0.24 points, hovering around 1,283 points. The HNX-Index gained 0.59 points, trading around 242 points.

The breadth among the VN30 constituents was relatively balanced, with 12 gainers and 15 losers. Specifically, VHM, VIC, TCB, and MBB subtracted 0.68 points, 0.59 points, 0.48 points, and 0.45 points from the index, respectively. Conversely, MWG, HPG, TPB, and VNM provided the most significant support to the VN30-Index, contributing over 2.4 points.

Source: VietstockFinance

|

The real estate sector was the leader in terms of trading value, but it also experienced a degree of divergence, with a higher number of declining stocks. As of 10:30 am, this sector attracted a trading value of over 1,185 billion VND and a trading volume of over 58 million units. Within this sector, VHM fell by 1.04%, VIC declined by 1.09%, VRE dropped by 1.2%, and KDH rose by 0.78%, exerting considerable pressure on the sector. On the other hand, stocks that maintained their upward momentum and continued to support the group included BCM, which increased by 0.94%, NVL rose by 1.14%, PDR gained 0.21%, and NLG climbed by 0.8%…

The banking sector exhibited a similar pattern of divergence, with selling pressure slightly outweighing buying interest. As a result, stocks like BID fell by 0.11%, CTG declined by 0.76%, MBB dropped by 0.44%, and TCB decreased by 0.85%… Conversely, VCB rose by 0.23%, VIB climbed by 0.47%, and TPB gained 1.14%…

On the other hand, the plastics and chemicals manufacturing sector demonstrated the strongest recovery, with an increase of 1.41%. Within this sector, the bullish sentiment was evident in stocks like GVR, which rose by 1.42%, DGC gained 0.56%, DCM climbed by 3.33%, DPM increased by 1.47%, and LAS hit the daily limit-up price…

BFC stood out as a notable stock, exhibiting several interesting technical factors. It is evident that BFC has maintained a very positive long-term uptrend, consistently creating new higher highs and higher lows. In today’s morning session, BFC continued its upward momentum, trading above the Middle Bollinger Band with volume surpassing the 20-day average, indicating a continued optimistic outlook. Moreover, the stock has retested the Neck line (corresponding to the 34,500-37,500 range) of the Rounding Bottom pattern and is poised for further upside.

If the current upward trend persists and the stock surpasses the 100% Fibonacci Projection level, the potential price target could be in the range of 61,000-63,000 (which also coincides with the 161.8% Fibonacci Projection level) in the long term.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, the number of stocks trading around the reference level remained significant, with over 970 stocks. However, buyers slightly outnumbered sellers, with 343 stocks trading higher and 260 stocks trading lower.

Source: VietstockFinance

|

Market Open: Positive Sentiment Prevails

At the opening of the July 8 trading session, as of 9:30 am, the VN-Index gained over 3 points, reaching 1,286.66 points. The HNX-Index also edged slightly higher to 243.55 points.

On July 6, Prime Minister Pham Minh Chinh chaired the regular Government meeting for June 2024 and the Government’s online conference with localities. Overall, the economy has recovered to pre-COVID-19 levels and continues to show positive trends: each month and quarter is better than the previous one; the first half of the year has achieved significant results, with most sectors outperforming the same period last year, and the full year 2024 is expected to surpass 2023.

Concluding the Government meeting and the online conference with localities, Prime Minister Pham Minh Chinh instructed to strive for a GDP growth rate of 6.5 – 7% in the third quarter, aiming for the highest plan for 2024, and maintaining this momentum into 2025.

Large-cap stocks, such as VCB, MWG, and GAS, led the market higher, contributing nearly 1.5 points to the index. Conversely, stocks like VHM, LPB, and SSB weighed on the market, dragging the index down by nearly 0.5 points.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.