The secret to financial success for Minh Hoa (Ho Chi Minh City) and many other women lies in adhering to modern spending principles and embracing the habit of using the VIB Family Link credit card to optimize their cash flow.

The Rule of Six Jars

With a comfortable combined income, Minh Hoa, a Ho Chi Minh City-based accountant, shared that budgeting for her family of four requires careful consideration, as she heavily invests in her children’s education. Every month, 10-15% of her family’s income is allocated to language and skill-building classes that her children have been attending for years. The remaining funds are used for living expenses, investments, and emergency savings.

To effectively manage her family’s finances, she implements the rule of six jars. This popular method helps her allocate her and her husband’s income across various categories: Bank Loan Repayments for House, Utilities (electricity, water, wifi), Transportation (55%), Car Savings (10%), Entertainment (5 – 10%), Investments (10%), Education (10 – 15%), and Social Obligations (5%).

“In addition to the rule of six jars, I often use a budgeting app to keep track of my daily, weekly, and monthly expenses. I also optimize my spending by using a credit card for both online and supermarket purchases,” shared Hoa. As the family’s financial manager, she has diligently researched and acquired multiple credit card lines from VIB to maximize the benefits of her spending.

Among the cards she holds, she particularly favors those with cashback and reward point features for shopping, dining, and traveling, such as the VIB Family Link, VIB Rewards Unlimited, VIB Online Plus 2in1, and VIB Cashback. The Family Link card is her go-to choice for paying her children’s tuition fees, as it often comes with special offers and is accepted at many reputable educational institutions.

Family Link – A Favorite Among Vietnamese Mothers

As Vietnam’s first credit card designed exclusively for families, VIB Family Link offers innovative features that support parents in managing their household expenses and accompanying their children on their educational journey. The generous reward points earned on significant expenses for healthcare, education, and insurance have made this card a trusted companion for families with young children and young couples embarking on new life milestones.

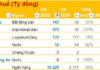

Cardholders can choose one of three spending categories—Education, Healthcare, or Insurance—and enjoy up to 10% cashback in reward points. Other spending categories offer 0.1% cashback, with a maximum of 1 million reward points per billing cycle.

One of the most appealing features of this card is the 0% installment plan (no fees, no interest) for all educational expenses at schools and training centers nationwide. Parents only need to select a suitable course for their child and contact the VIB hotline to enroll in the installment plan, choosing a period of 3 to 6 months to ease their financial burden while investing in their child’s future.

Additionally, cardholders can take advantage of exclusive benefits from VIB‘s partner ecosystem, including a 40% discount on travel with VIB Travel, 30% off on dining with VIB Dine, 20% off on shopping with VIB Shop, and a 10% discount on transportation with VIB Move.

Apply for the VIB Family Link card in just 5 minutes and enjoy instant access to its unique features, a waiver of the first-year annual fee when you spend 3 million VND, a lifetime waiver of the annual fee for spouse cards, and exclusive benefits for cardholders here.

BAC A BANK international credit cards charge a 1% foreign transaction fee

BAC A BANK MasterCard credit cardholders rejoice! Starting from April 22, 2024, enjoy an unbeatable foreign transaction fee of just 1% on all international spends. This exclusive privilege extends to both card variants throughout the year.

How VIB Family Link credit card reduces fees, increases rewards from April 27th?

Starting from April 27, VIB Family Link cardholders will enjoy remarkable changes, including a 50% reduction in annual fees, a shift from the Smile rewards feature to a cashback points system offering up to 10% cashback, complimentary insurance packages for cardholders, and support for children’s education expenses.