Correction on the 10,000 billion VND credit facility

On July 5, DGW issued a correction regarding a resolution passed by its Board of Directors on a loan facility with the Vietnam Foreign Trade Joint Stock Bank (Vietcombank, HOSE: VCB) – Tan Binh Branch, due to an error in the date. Specifically, DGW stated that the correct date on the resolution was June 24, 2024, instead of April 26, 2024.

This loan facility has a total limit of up to 10,000 billion VND, including short-term loans, short-term guaranteed issuance, and short-term LC issuance. Accordingly, the total short-term loan balance, guarantee balance, and LC balance must not exceed 10,000 billion VND at any time. Other conditions will be agreed upon with VCB.

DGW stated that the purpose of this loan is to supplement working capital for production and business activities.

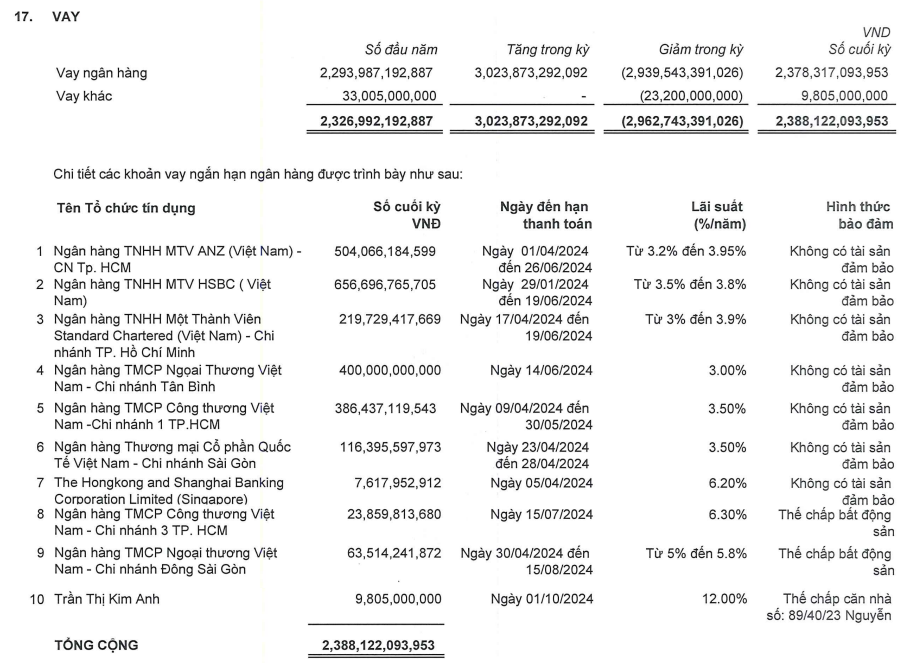

As of March 31, 2024, DGW‘s loan balance was over 2,388 billion VND, unchanged from the beginning of 2024, accounting for approximately 35% of total assets. Most of these are short-term loans from banks such as Vietcombank, VietinBank, HSBC Vietnam, Standard Chartered Vietnam, and ANZ Vietnam, mostly unsecured and due in the second quarter of 2024.

| DGW’s loan-to-total asset ratio in recent quarters |

|

Details of DGW‘s loan balances as of March 31, 2024

Source: DGW‘s Consolidated Financial Statements for Q1 2024

|

Finalizing the issuance of 2 million ESOP shares

Earlier, on July 3, the DGW Board of Directors also announced a resolution approving the plan to issue 2 million shares under the Employee Stock Ownership Plan (ESOP), with a sale price of 10,000 VND/share, corresponding to a total issuance value of 20 billion VND.

DGW plans to implement the issuance in the third and fourth quarters of 2024, and all ESOP shares will be subject to a one-year lock-up period from the end of the issuance. At the same time, DGW stated that it would still meet the foreign ownership ratio after implementing this plan, as no shares would be issued to foreign employees.

The ESOP plan is part of the company’s 2024 plan, which was approved at the 2024 Annual General Meeting of Shareholders. In addition to the ESOP issuance, there is also a plan to pay a 2023 dividend of 30% in shares (for every 100 shares held, shareholders will receive 30 new shares).

Thus, through the above two share issuances, DGW expects to increase its number of shares to 219.2 million, equivalent to a charter capital of nearly 2,192 billion VND.

At the 2024 Annual General Meeting of Shareholders, the DGW leadership was asked about the company’s decision to issue ESOP shares despite not meeting its 2023 business plan. In response, Chairman of the Board of Directors, Doan Hong Viet, stated: “The ESOP program was interrupted last year, and we are resuming it this year. It is a great source of encouragement for our employees. DGW is not afraid to set ambitious goals, and we are actually performing better than our listed peers in the same industry. Therefore, DGW plans to issue ESOP shares at only 50% of the volume from our successful years.”

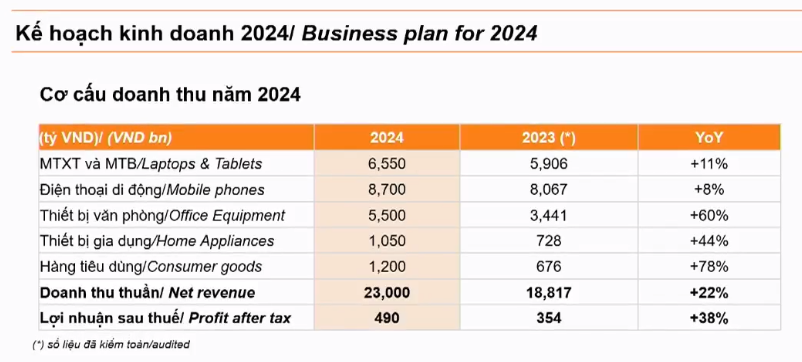

In 2024, DGW set ambitious business targets, with net revenue and net profit expected to reach 23 trillion VND and 490 billion VND, respectively, up 22% and 38% compared to 2023.

In terms of revenue structure, the focus will remain on the mobile phone segment, which is expected to contribute 8,700 billion VND (up 8%) and the laptop and tablet segment, which is expected to contribute 6,550 billion VND (up 11%). Other activities, including office equipment, household appliances, and consumer goods, are expected to increase by 60%, 44%, and 78%, respectively.

Source: DGW

|

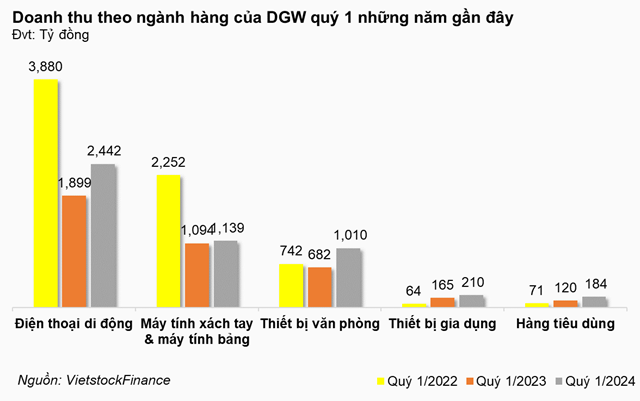

In the first quarter of 2024, DGW recorded net revenue of 4,985 billion VND, up 26% over the same period last year and achieving 22% of the year plan. All business segments showed growth, with consumer goods up 53%, office equipment up 48%, mobile phones up 29%, household appliances up 27%, and laptops and tablets up 4%.

In terms of proportion, mobile phones and laptops and tablets maintained their leading positions, contributing 49% and 23%, respectively, totaling 72% of revenue. However, DGW‘s management predicts that this proportion may decrease in the future.

Finally, DGW recorded a net profit of over 92 billion VND in the first quarter, up 16% year-on-year and achieving 19% of its annual plan.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.