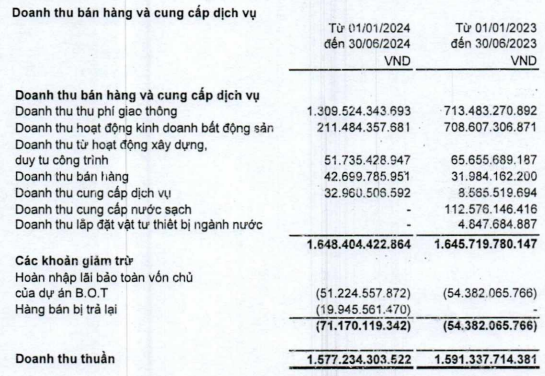

In the first half of 2024, CII recorded a modest increase in revenue, reaching nearly VND 1.6 trillion, with the majority stemming from toll road operations. The company experienced a significant boost in gross profit thanks to reduced production costs. Moreover, financial activities proved to be a bright spot, with a 13% increase in revenue, largely due to gains from the revaluation of investments in associated companies.

|

Revenue structure for the first half of 2024 CII

Source: CII

|

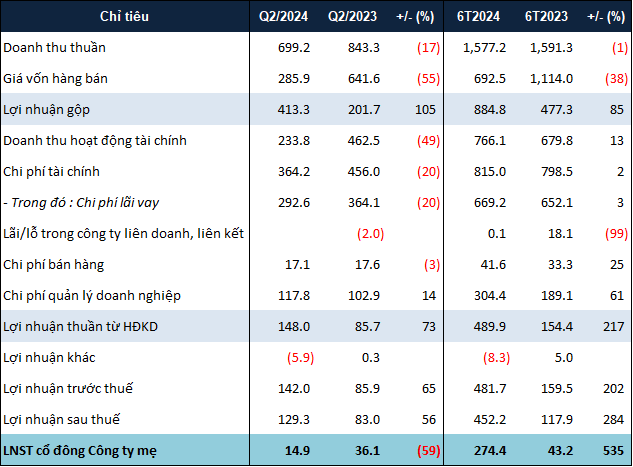

At the annual general meeting, the CEO of CII attributed the lack of revenue from real estate in 2023 to legal hurdles, expecting near-zero revenue from this sector in the 2023-2025 period. Despite flat revenue, CII managed to reduce production costs, resulting in a gross profit of nearly VND 885 billion, an impressive 85% increase year-on-year.

The company’s financial performance was further bolstered by a 13% rise in revenue from financial activities, totaling over VND 766 billion. This was largely due to gains of more than VND 430 billion from the revaluation of investments in associated companies upon obtaining control of HOSE: NBB, along with nearly VND 150 billion in other financial receivables from BOT contracts.

CII‘s consolidated financial statements led to adjustments in the allocation of commercial advantages, depreciation expenses, and the fair value increment of intangible fixed assets. Consequently, management expenses rose by 61%, totaling over VND 304 billion.

Despite these challenges, CII reported a net profit of over VND 274 billion in the first half of the year, surpassing the target by nearly 64%. This remarkable result was largely driven by the performance in the first quarter, which contributed over 95% of the half-year profit. In the second quarter, CII achieved a post-tax profit of more than VND 129 billion, a 56% increase, thanks to the BOT Trung Lương Mỹ Thuận project, but the net profit for this quarter decreased by 59%.

|

Financial results for the second quarter and first half of 2024 for CII. Unit: Billion VND

Source: VietstockFinance

|

As of June 30, 2024, CII‘s total assets stood at nearly VND 35.7 trillion, an increase of 8% since the beginning of the year. Cash holdings rose by 7% to nearly VND 1.3 trillion. The consolidation of financial statements with NBB resulted in a significant impact on CII‘s inventory and construction in progress, with values of nearly VND 2.3 trillion and over VND 2.2 trillion, respectively, as of the end of June 2024.

Meanwhile, the company’s liabilities increased by 7%, totaling over VND 26.3 trillion, mainly due to the issuance of convertible bonds worth more than VND 2.8 trillion in January 2024. Borrowings also witnessed a slight increase of 4%, reaching nearly VND 19.6 trillion.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.