Google Trends indicates a gradual increase in property searches over the months, especially in key markets such as Hanoi, Ho Chi Minh City, Danang, and surrounding provinces. However, buyers are exhibiting a more cautious approach, spending considerable time researching the market and projects before making a purchase decision. This is evident from the minor fluctuations in search interest, except for the period at the end of Q1 when the Northern market experienced a surge in demand, according to experts from the Institute of Economics, Finance, and Real Estate Research – Dat Xanh Services (FERI).

Hanoi and Ho Chi Minh City remain the most attractive markets, followed by provinces with new project launches such as Danang, Lao Cai, Hung Yen, Binh Duong, Vinh Phuc, Ha Nam, Can Tho, and Hai Phong.

Buyers are not only concerned about prices but also place significant emphasis on location, amenities, legal aspects, and the reputation of the developer. This is a positive sign for the real estate market, as buyers tend to make investment decisions based on thorough information and analysis.

Compared to other investment channels like gold, real estate continues to attract more investor interest, accounting for 33% compared to gold’s 30%. This can be attributed to the low mortgage interest rates maintained in the first half of 2024.

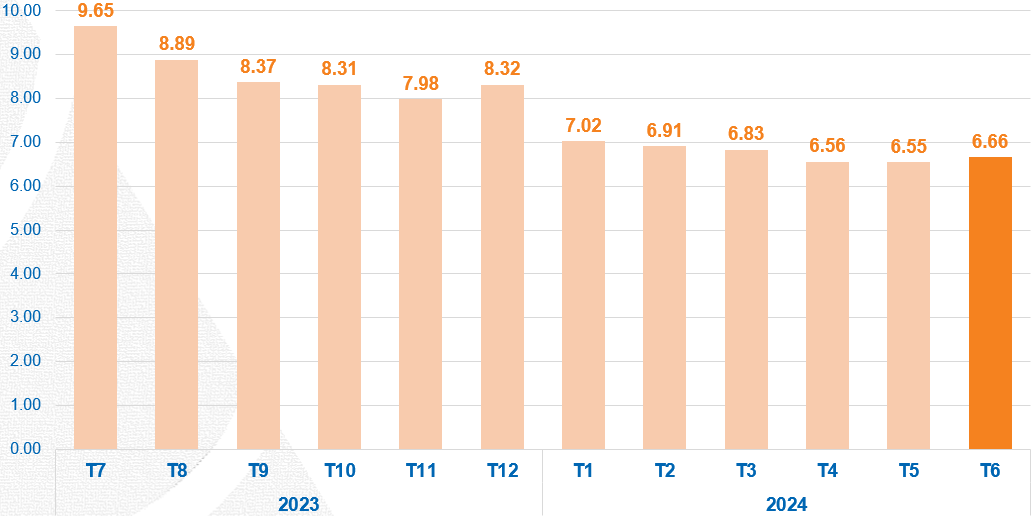

While there has been a slight increase in interest rates since May 2024, some investors are still seizing the opportunity to invest before rates climb higher. As of June, the average mortgage interest rate at commercial banks stood at 6.66%/year, a reduction of one-third compared to the rate in July last year.

|

Mortgage Interest Rate Trends of the Top 20 Domestic and International Commercial Banks (%/year)

|

|

Preferred Investment Channels

Source: FERI

|

Buyer psychology reveals that 79% of purchases are for owner-occupiers, while 21% are for investment purposes. New projects capture 84% of buyer interest, with existing projects accounting for only 16%. Buyers are increasingly focused on the intrinsic value of the property, including location, amenities, construction quality, and potential for price appreciation. Moreover, the reputation of the developer remains a key factor, prioritized by 75% of buyers, while only 25% are attracted by high discount policies. Project legalities are also gaining importance, with 17% of buyers considering it a deciding factor in their real estate purchases, reflecting their concerns amidst market fluctuations. Overall price is given more weightage than unit price, with 79% and 21% preference, respectively.

Additionally, FERI highlights that 67% of customers still prefer renting over buying, indicating a large housing demand but limited financial capacity.

Product value, location and infrastructure development potential, payment support policies and preferential interest rates, developer reputation, and project legalities are among the critical factors that facilitate easier access to real estate, according to FERI experts.

In terms of product mix consumed in the first half of the year (approximately 23,500 units), apartments remain the most popular, accounting for 74% of total consumption, a 10% increase compared to the same period last year. On the other hand, land plots have significantly dropped to only 1%, a 9% decrease year-on-year.

Purchase intentions show that 53% buy for owner-occupation, 20% for long-term investment, 16% for rental purposes, 5% for speculation, and the remaining 6% for other reasons.

Experts predict that in the second half of 2024, customer interest in real estate will gradually increase, with estimated growth of 50-70% in searches, project visits, and event participation. The enforcement of new laws will further enhance the legal framework, bolstering market confidence.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.

Removing Land Policy Bottlenecks, Creating New Resources for Development

The passing of the Land Law by the National Assembly has been well-received by society, with expectations that policy barriers and bottlenecks will be quickly dismantled and eliminated. This will effectively utilize land resources, contributing to the creation of new resources that will promote socio-economic development…

Real Estate Expert Forecasts Booming Market for Land in 2024

Currently, land plots are still highly valued by experts as they bring high profits and minimize risks, even in a slow-paced and low liquidity market.