Vietnam’s Law on Credit Institutions: Understanding the Key Changes

|

The new Law on Credit Institutions addresses limitations of the previous law from 2010 and its amendments in 2017, aligning with international standards. This updated law introduces four significant changes, presenting opportunities and challenges for involved parties, including credit institutions, businesses, investors, and customers.

Reducing Credit Limits

The amended law stipulates a five-year roadmap for commercial banks and foreign bank branches to gradually decrease credit limits for a single customer (from 15% to 10% of their capital) and for a customer and related parties (from 25% to 15%) to mitigate concentrated credit risk.

From July 1st, the law also mandates non-bank credit institutions to limit credit exposure to a single customer to no more than 15% of their capital and 25% for a customer and related parties.

Total credit exposure to a single customer must not exceed 15% of the non-bank credit institution’s capital, and the limit is 25% when including related parties.

|

The specific roadmap for credit limit restrictions as per Clause 1, Article 136 is as follows: – From July 1st, 2024, to December 31st, 2025: 14% of capital for a single customer; 23% of capital for a customer and their related parties. – From January 1st, 2026, to December 31st, 2026: 13% of capital for a single customer; 21% of capital for a customer and their related parties. – From January 1st, 2027, to December 31st, 2027: 12% of capital for a single customer; 19% of capital for a customer and their related parties. – From January 1st, 2028, to December 31st, 2028: 11% of capital for a single customer; 17% of capital for a customer and their related parties. – From January 1st, 2029, onwards: 10% of capital for a single customer; 15% of capital for a customer and their related parties. |

Tightening Bancassurance

A novel aspect of the 2024 Law on Credit Institutions is the formal prohibition of credit institutions, their managers, and employees from selling non-mandatory insurance products alongside banking services. This measure enhances customer protection and boosts the credibility of credit institutions.

However, this may lead to short-term revenue losses for credit institutions, requiring adjustments to existing agreements with insurance company partners. Customers might also incur additional costs due to the separation of banking and insurance services.

Lowering Maximum Ownership and Enhancing Information Disclosure

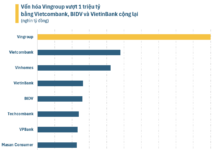

The amended law introduces measures to mitigate risks associated with cross-ownership and manipulation, fostering a more stable and trustworthy financial environment. It reduces the maximum ownership ratio for institutional shareholders (including indirect shareholders) from 15% to 10% of the credit institution’s chartered capital and for individuals and related parties from 20% to 15%.

This regulation will impact individuals, related parties, and institutional shareholders who currently hold shares exceeding the new limits in banks.

Meanwhile, foreign investor ownership ratios remain unchanged, as stipulated in Decree No. 01/2014, until the government issues new regulations. The law also introduces comprehensive information disclosure requirements for shareholders holding over 1% of the credit institution’s capital, encompassing shareholder details, related parties, and ownership specifics.

These provisions on ownership ratios and information disclosure will have ramifications for involved parties.

Early Intervention by the State Bank of Vietnam

The amended law expands the cases in which the State Bank of Vietnam can intervene early with credit institutions that violate existing regulations, such as experiencing mass withdrawals or failing to meet the required liquidity ratio. This empowers the State Bank to identify and address potential issues, making credit institutions more attractive for long-term investments.

Investors will have increased confidence in the stability of the banking system, leading to higher investment demand. Notably, this regulation strengthens the protection of customers’ interests.

Announcement of Credit Organizations Law 2024: Addition of Regulations on Bulk Withdrawals

According to Deputy Governor of the State Bank of Vietnam, Doan Thai Son, the Credit Institution Law 2024 has many new provisions, including clear regulations on measures to be applied when a credit institution experiences mass withdrawals and measures to support liquidity, ensure the safety of the system, and protect the rights of depositors.