The latest report from Dat Xanh Services-FERI reveals that in the first half of 2024, the industrial real estate market witnessed stable supply, steadily increasing demand, and rising rental rates.

Specifically, the total supply of industrial real estate in the North and South remained stable compared to the previous quarter, reaching approximately 14,500 ha and 27,700 ha, respectively. Despite the lack of significant changes since the end of 2023, the market saw the development of new projects in multiple locations, indicating growing interest and investment in this sector.

Demand for industrial real estate continued to grow steadily due to the shift in manufacturing structures. The recovery of manufacturing activities in the second quarter of 2024 also contributed to improved occupancy rates in industrial parks.

Rental rates experienced a slight increase due to high demand and limited supply improvements. Specifically, rents in the North rose by 2%, reaching an average of $130 per sq m for the remaining lease term. In the South, rents increased by 7%, averaging $190 per sq m for the remaining lease term.

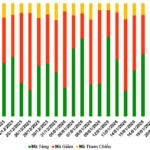

Occupancy rates in both the North and South remained high. In the North, the occupancy rate reached 83%, a 3% increase compared to the same period last year. Meanwhile, the South achieved a 92% occupancy rate, a 1% increase.

In terms of investment trends, in addition to traditional industrial parks, the market has seen the entry of new investors into ready-built factories (RBF) and ready-built warehouses (RBW), catering to diverse business needs. Domestic and foreign enterprises continue to show interest in Vietnam’s industrial real estate market. For instance, Taseco Land (TAL) aims to develop five new industrial parks totaling over 1,000 ha in the next five years. Foreign investors also hold a significant 75% market share in ready-built warehouses in Vietnam.

The industrial real estate market is expected to continue its growth trajectory in the coming period, especially with the enforcement of free trade agreements (FTAs) and Vietnam’s increasing attractiveness for foreign investment in manufacturing. Additionally, supply is anticipated to grow slightly in the short term and significantly in the long term as more industrial land is planned. The continuous rise in FDI inflows into the manufacturing sector is driving increased demand for industrial land and parks.

Given the positive supply and demand dynamics, industrial land rental rates are projected to remain stable or experience a slight increase in the second half of 2024. Occupancy rates are forecast to improve marginally in both the Southern and Northern regions.

Examining the “health” of real estate segments in 2024

Experts predict that the real estate market will experience a significant recovery in 2024, but in order to make profitable investments, it is crucial to choose the right segment.