The market remained subdued ahead of the release of Q2 earnings reports, with many enterprises expected to show strong growth. With money on the sidelines, the VN-Index hovered around the reference price and ended slightly up by 3.04 points to 1,279 points, with a negative breadth of 207 declining stocks versus 179 gainers.

Banking stocks weakened towards the end of the session, closing down 0.03% with VCB falling 0.56% and CTG down 0.15%; while BID edged up 0.21% and VPB rose 0.26%. Retail also declined by 0.39%, followed by Construction Materials and Seafood.

On the flip side, Securities and Real Estate sectors witnessed minor gains of 0.21% and 0.11%, respectively; while Oil & Gas climbed 0.48%. Information Technology stood out with a 3.33% surge, led by FPT’s impressive 3.66% jump, making it the most significant contributor to the overall market with 1.70 points. Conversely, VCB was the biggest detractor.

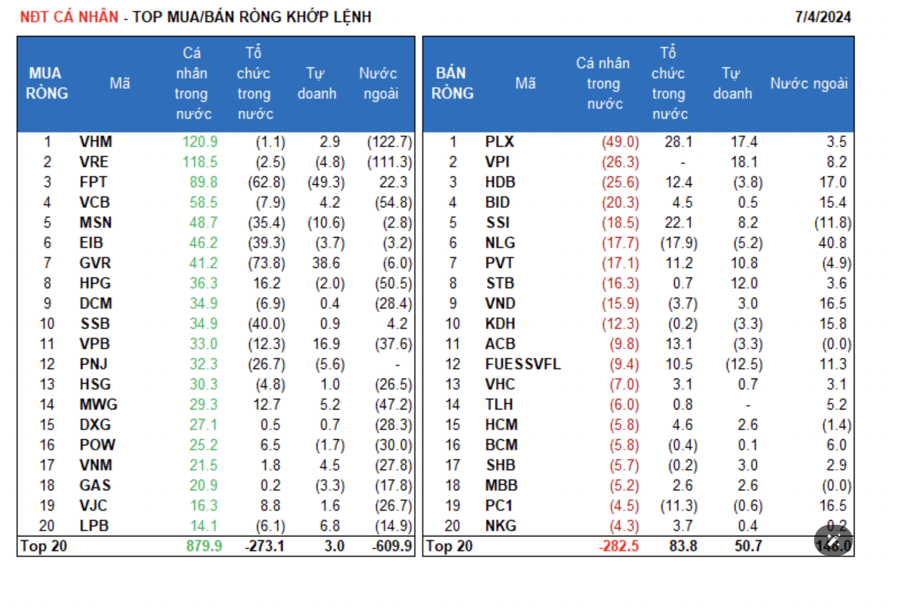

Market liquidity across all exchanges dropped significantly to VND16.4 trillion, including a net sell of VND534.3 billion by foreign investors. Specifically, in matched transactions, they were net sellers to the tune of VND576.1 billion. Foreign investors’ main net buys in matched transactions were in the Financial Services and Information Technology sectors, with top stocks including NLG, FPT, HDB, VND, PC1, KDH, BID, FUESSVFL, FUEVFVND, and VPI.

On the sell side, their main net sells in matched transactions were in the Real Estate sector, with top stocks being VHM, VRE, VCB, HPG, MWG, POW, DCM, DXG, and VNM.

Individual investors were net buyers to the tune of VND734.1 billion, of which VND709.9 billion was in matched transactions. In matched transactions, they were net buyers in 16 out of 18 sectors, mainly in Real Estate. Their top net buys included VHM, VRE, FPT, VCB, MSN, EIB, GVR, HPG, DCM, and SSB.

On the sell side, they net sold in 2 out of 18 sectors, mainly in Financial Services and Oil & Gas. Top net sells included PLX, VPI, HDB, BID, SSI, NLG, STB, VND, and KDH.

Proprietary trading accounted for a net sell of VND52.3 billion, while in matched transactions, they were net buyers to the tune of VND37.7 billion.

In matched transactions, proprietary trading was net buyers in 8 out of 18 sectors, with the strongest purchases in Chemicals and Banking. Top net buys included GVR, VPI, PLX, VPB, STB, PVT, SSI, LPB, MWG, and VNM. On the sell side, they focused on Information Technology, with top net sells including FPT, FUESSVFL, FUEVFVND, MSN, GMD, REE, PNJ, NLG, VRE, and PVP.

Domestic institutional investors were net sellers to the tune of VND105.6 billion, while in matched transactions, they net sold VND171.6 billion.

In matched transactions, domestic institutions net sold in 10 out of 18 sectors, with the largest value in Chemicals. Top net sells included GVR, FPT, SSB, EIB, MSN, PNJ, NLG, VPB, KBC, and PC1. On the buy side, their largest net purchases were in Financial Services. Top net buys included PLX, SSI, HPG, ACB, MWG, HDB, REE, PVT, FUESSVFL, and VJC.

Block trades today amounted to VND1,515.5 billion, down 48.5% from the previous session, contributing 9.2% of the total trading value.

Notably, EIB witnessed substantial block trades today, with over 27.2 million units (equivalent to VND491.0 billion) changing hands between domestic institutions (sellers) and individual investors (buyers).

Additionally, there were block trades between individual investors in HDB and KOS stocks.

The money flow allocation decreased in Banking, Real Estate, Steel, Chemicals, Retail, Textiles, Warehousing & Logistics, and Power Production & Distribution, while it increased in Securities, Software, Food, Oil & Gas, Construction, Agriculture & Seafood, and Plastics, Rubber & Fibers.

In matched transactions, the money flow allocation rebounded in the mid-cap VNMID group, while it decreased in the large-cap VN30 and small-cap VNSML groups.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.