According to statistics from Drewry, an independent maritime research consultancy, there has been a significant increase in shipping rates for container transportation from Asia to Europe and the US. However, rates from the Americas and Europe to Asia, as well as intra-Asian trade lanes, have remained relatively stable. In light of this, Vietnamese businesses believe that there is a need to diversify their export markets and reduce dependence on certain markets.

EXPORT TENSIONS WITH MARITIME TRANSPORTATION

Mr. Dang Dinh Long, CEO of Mega A Logistics Company in Ho Chi Minh City, stated that the situation for sea transportation to Vietnam’s key export markets is highly tense. The most critical issue is the Europe-bound route, which is both expensive and difficult to secure space. Mr. Long also noted that Vietnamese businesses used to primarily focus on exporting on a Free on Board (FOB) basis and importing on a Cost, Insurance, and Freight (CIF) basis, hence paying less attention to shipping rates as their partners handled them. However, as Vietnamese businesses have now shifted to exporting on a CIF basis, recent developments in shipping rates have had a significant impact.

Concerned about the situation, Mr. Nguyen Minh Nhat, Director of Nhat Nam Woodworking and Construction Joint Stock Company in Ben Cat, Binh Duong, shared that the wood industry is on a good recovery path. However, since May 2024, shipping rates for ocean freight have been continuously adjusted upward by shipping lines, causing concerns for many businesses. For now, companies have not discussed increasing prices and have accepted reduced profits to maintain customers and increase supply. In the long term, businesses are also exploring closer markets, such as ASEAN countries, for export opportunities.

The textile and footwear industries, with a high degree of openness and 70-80% of their production volume being exported, are heavily dependent on ocean freight rates and vulnerable to global market fluctuations. Since the end of the first quarter of this year, Dony Garment Company in Ho Chi Minh City has shifted its focus to the Southeast Asian market, including Singapore, Indonesia, Malaysia, and Cambodia. “These markets have intense competition, but they offer logistics advantages,” said Mr. Pham Quang Anh, Director of Dony. “The cost and time for transportation are very favorable, and in some cases even cheaper than domestic transportation. This is a rational choice given the current context.”

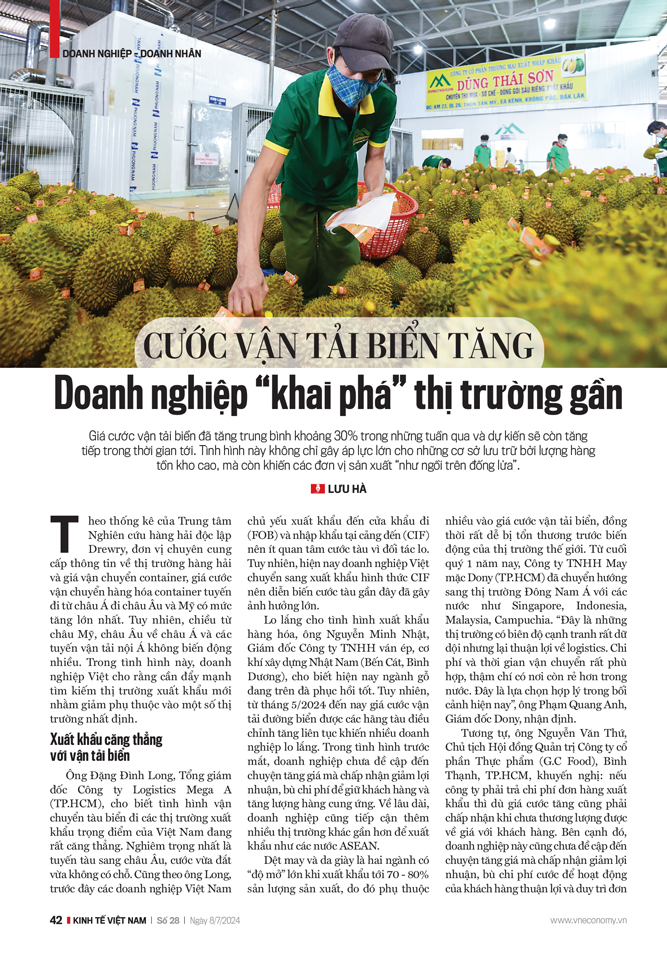

Similarly, Mr. Nguyen Van Thu, Chairman of the Board of Directors of G.C Food Joint Stock Company in Binh Thanh District, Ho Chi Minh City, recommended that if the company has to bear the cost of export orders, it must accept the increased freight rates until it can negotiate better prices with customers. Meanwhile, the company has not discussed raising prices and has accepted reduced profits to offset freight costs and maintain smooth operations for its customers. G.C Food is also exploring closer markets in the region to promote exports.

Agricultural products are often seasonal, and companies tend to sign short-term contracts, making them vulnerable to freight rate increases. “When freight rates rise too high, we have to opt for longer routes, which can be detrimental to perishable products like fruits and vegetables,” shared Ms. Vo Thanh Chau, Director of Thanh Tuoi Import-Export Company in Binh Chanh District, Ho Chi Minh City. To mitigate losses, Thanh Tuoi has temporarily halted exports to markets with extremely high freight rates.

In Ba Ria-Vung Tau province, businesses have proactively sought new markets, focusing on closer markets such as ASEAN, China, South Korea, and Japan, while orders from traditional markets have been declining and freight rates soaring. As a result, the province’s exports in the first half of the year are gradually recovering and showing positive growth. Ms. Mai Thi Nhan, Director of Ngoc Tung Company, acknowledged that these challenges have impacted their business, and they are shifting their focus to nearby retail markets to reduce pressure.

This article was published in the Vietnam Economic Magazine, Issue 28-2024, released on July 8, 2024. To read the full article, please visit: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam