The fertilizer sector witnessed a positive trend on the stock market during the first trading session of the week on July 8, with most stocks in this group witnessing a surge in buying interest, even hitting the ceiling price. Notably, LAS, issued by the Chemical Fertilizer and Chemical Joint Stock Company, stood out with a remarkable 9.8% increase to reach a new all-time high of VND 25,800 per share.

This positive momentum resulted in heightened trading activities, with over 2.7 million shares changing hands. Despite reaching the maximum daily limit, buyers were still queuing, with nearly 900,000 buy orders at the ceiling price.

In fact, LAS has been on an upward trajectory for the past few months. Compared to the beginning of 2024, LAS’s market price has surged by 84%. This stellar performance is further bolstered by its impressive business results. During the company’s second-quarter conference to review performance for the first half of 2024 and deploy tasks for the third quarter, the management highlighted that despite challenges, all production and business targets witnessed positive growth, and the material and spiritual lives of employees were enhanced, with significant contributions to the state budget.

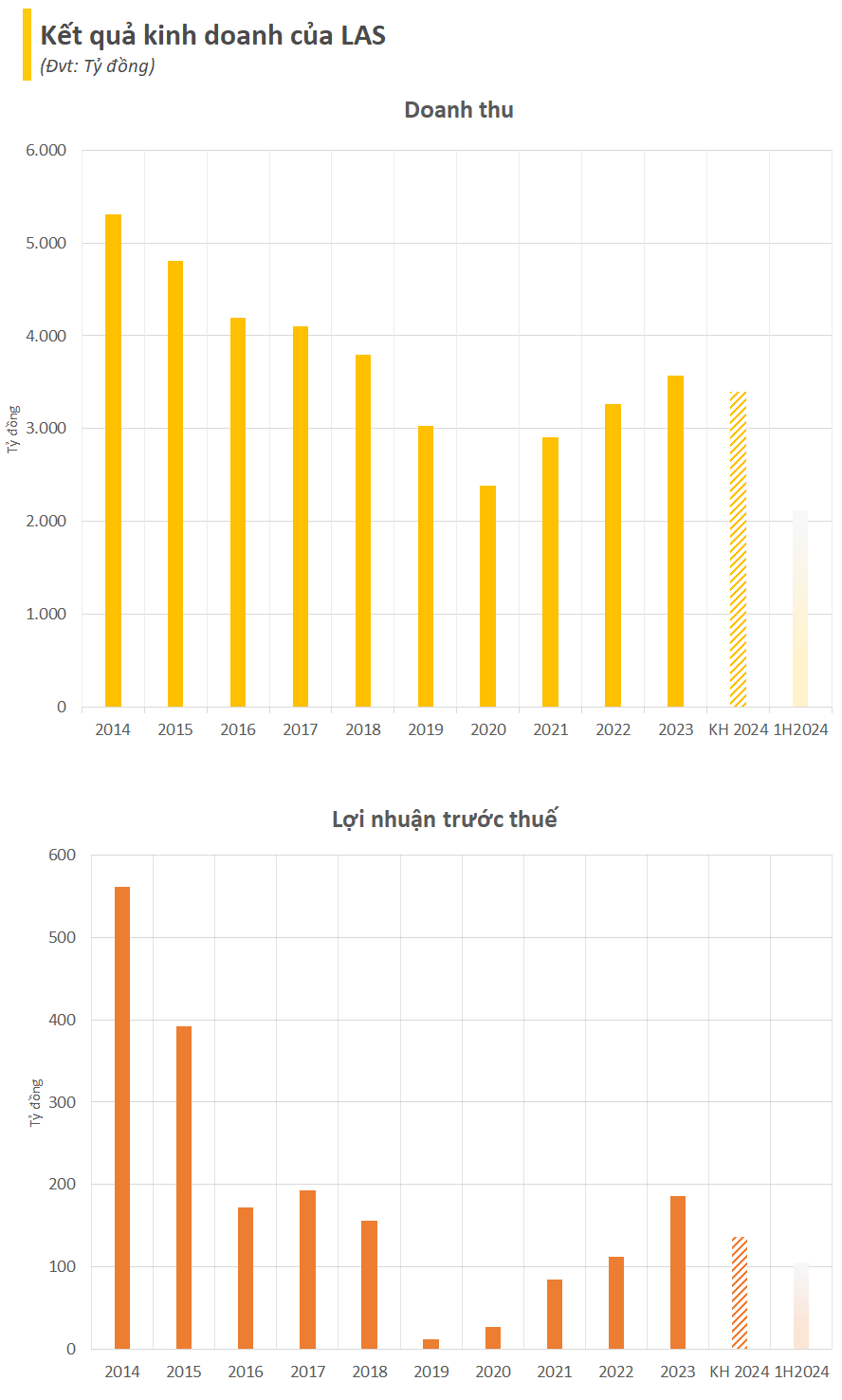

Estimates for the first half of 2024 indicate that LAS’s industrial production value reached VND 1,831 billion at current prices, equivalent to 55% of the annual plan. Revenue from sales of goods and services reached VND 2,124 billion, accounting for 63% of the annual plan, while profits were estimated at VND 105 billion, equivalent to 77% of the annual plan. Consequently, LAS is expected to have recorded a net profit of over VND 39 billion in the second quarter of 2024.

Stable Prospects in 2024: A Positive Outlook from the Proposed VAT Law Amendments

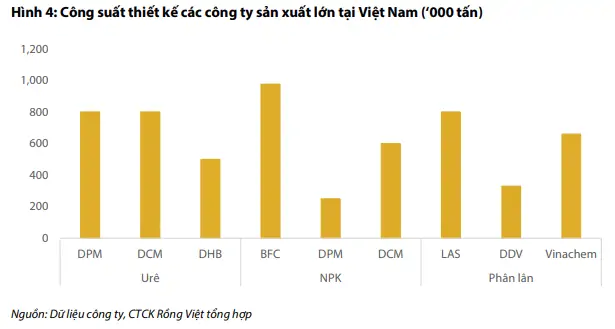

Regarding the fertilizer industry in Vietnam, the country has achieved self-sufficiency in producing urea, phosphate, and NPK fertilizers. Currently, the total domestic production capacity for various fertilizers exceeds annual consumption needs. NPK fertilizers lead the way, accounting for 35% of total demand, followed by urea at 28%, and then phosphate at 17%, with the remaining portion comprising other fertilizer types.

The NPK segment is relatively fragmented due to the participation of numerous enterprises, given the low barrier to entry. In contrast, the urea market share is dominated by two giants: PVN (65%) and Vinachem (nearly 30%). As for phosphate fertilizers, while Vietnam can produce phosphate fertilizers thanks to its apatite ore reserves, the production technology is relatively simple, mainly relying on machinery and equipment imported from China, resulting in lower quality compared to imported fertilizers. Notable large-capacity phosphate fertilizer producers include LAS.

In a recently updated industry outlook report, Rong Viet Securities (VDSC) opined that the domestic fertilizer industry has entered a saturation phase, with agricultural land area shrinking and excess production capacity. 2024 is expected to be a stable year for the fertilizer industry, as there is limited room for growth in sales volume and selling prices.

VDSC forecasts that the global urea supply in 2024 will be primarily secured by major exporting countries such as China and Russia. On the demand side, India and Brazil, the world’s largest urea importers, are estimated to import a combined total of 13-14 million tons of urea per year. However, following the fertilizer crisis during 2021-2022, which saw fertilizer prices soar and negatively impact the agricultural sector and food security, these governments plan to increase urea production capacity to reduce dependence on imports and protect domestic agriculture.

With reduced import demand from these major countries in 2024, coupled with sustained supply from China and Russia, the International Fertilizer Association (IFA) predicts that urea prices could range between USD 320-350 per ton in 2024, not deviating significantly from the 2023 average of USD 358 per ton. VDSC anticipates a potential decline of 3-5% in domestic urea prices in 2024, relative to the same period last year, mirroring the global urea price movement.

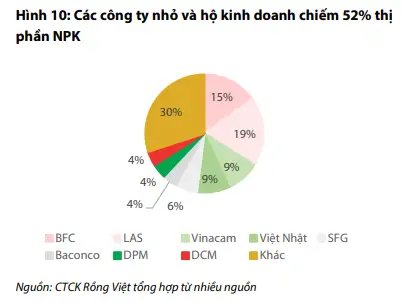

Regarding the NPK segment, the domestic NPK market is dispersed, with small businesses and households accounting for 52% of the market share, while the two largest producers, BFC and LAS, hold 15% and 19% of the market, respectively. According to VDSC, NPK prices have been declining at a slower pace compared to other single fertilizers, and they have maintained stable selling prices. This stability is attributed to the economic benefits that this type of fertilizer offers. VDSC expresses optimism about enterprises that entered the market later with more advanced technology and proactive business strategies.

Notably, the proposed amendments to the VAT Law (expected to take effect in 2025) present a positive development for the fertilizer industry this year. One of the key changes is the inclusion of fertilizers in the 5% VAT bracket (up from the previous non-taxable status). Currently, domestic fertilizer prices are higher than imported fertilizers due to higher production costs, as domestic producers incur an additional 10% VAT expense (without deduction). If the proposed VAT Law amendments are approved, domestic fertilizer production costs could decrease, while imported fertilizer prices would increase by 5% due to VAT. According to VDSC, this development would enhance the competitiveness of domestic fertilizer producers.