The Board of Directors of Hodeco, a leading real estate development company in Ba Ria-Vung Tau, recently approved a resolution to amend the plan for utilizing proceeds from its recent rights offering to existing shareholders.

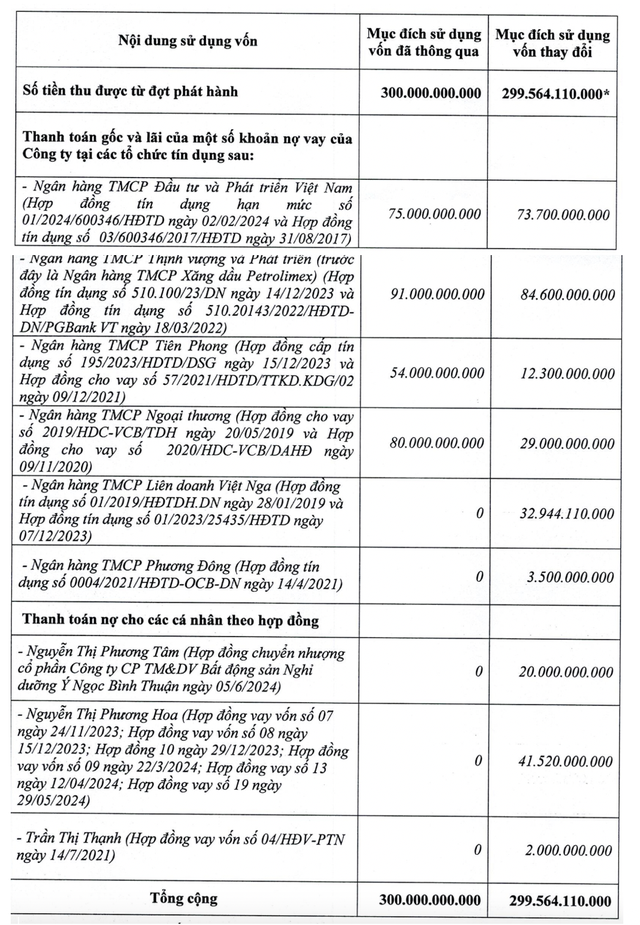

Specifically, Hodeco has reduced payments towards principal and interest on certain loans with financial institutions. This includes a decrease in repayments to VPBank from 91 billion VND to 84.6 billion VND, a reduction of 6.4 billion VND, and a significant adjustment to the amount owed to Tien Phong Bank, from 54 billion VND to 12.3 billion VND, saving the company almost 42 billion VND. Additionally, the company has also lowered repayments to Vietcombank and BIDV by 51 billion VND and 1.3 billion VND, respectively.

On the other hand, Hodeco has increased the amount payable to the Vietnam-Russia Joint Venture Bank from 0 VND to nearly 33 billion VND and will now repay 3.5 billion VND to Orient Commercial Joint Stock Bank, despite initially planning no repayments to this institution. Notably, the company will also settle debts with individuals, including Ms. Nguyen Thi Phuong Tam (20 billion VND), Ms. Nguyen Thi Phuong Hoa (over 41.5 billion VND), and Ms. Tran Thi Thanh (2 billion VND). This marks a shift from the initial plan, which did not include repayments to individuals, indicating a change in focus toward settling debts with individuals rather than primarily with banks.

Hodeco justified these adjustments as necessary to align with the actual amount of funds raised, the practical situation of production and business operations, the need to repay maturing debts, and to maximize capital efficiency while ensuring the company’s and shareholders’ best interests.

The rights offering, which concluded on June 19, saw Hodeco successfully issue 19.99 million shares out of the registered 20 million, resulting in a capital increase of nearly 300 billion VND. The company will cancel the issuance of approximately 10,000 unissued shares. Following this offering, Hodeco’s largest shareholder, Mr. Doan Huu Thuan, the Chairman of the Board of Directors, holds 9.85% of the charter capital, while the remaining 90.15% is owned by small shareholders with less than 5% stakes. The company’s charter capital has increased from 1,351 billion VND to 1,551 billion VND post-issuance.

Hodeco’s financial performance for the first quarter of 2024 revealed a 52% year-on-year decline in revenue, totaling over 85 billion VND, while net profit plummeted by 96.4% to approximately 1 billion VND. For the full year 2024, the real estate company has set ambitious targets, aiming for nearly 1,658 billion VND in revenue and 424 billion VND in net profit, representing increases of 2.5 times and 3.2 times, respectively, compared to the results of 2023.

With the first quarter’s results, Hodeco has achieved only 0.3% of its ambitious profit target of 424 billion VND for the year.

Sơn Hải: More Than Just Immaculate Roads – Unknown Ventures in Real Estate, 5-Star Hotels, and Hydroelectric Power

Son Hai is currently implementing various hydroelectric projects such as Dak Rong 3, Dak Rong 4, Khe Song, and investing in many other projects. In the real estate sector, the company has projects like Nam Cau Dai Urban Area, Truong Phuc Phan Urban Area, and is also investing in other high-end hotel and urban area projects.