On July 3rd, the market witnessed a transaction of over 5.8 million TN1 shares at a value of approximately VND 73.7 billion (VND 12,700 per share, with little deviation from the closing price).

FPT Capital became a major shareholder of TN1 in 2020 following a share swap deal. Specifically, TN1 issued 3.85 million shares in a private placement to swap for shares held by shareholders of M-Talent JSC and TNTech JSC. Prior to this, FPT Capital owned 66.67% of TNTech and 60% of M-Talent.

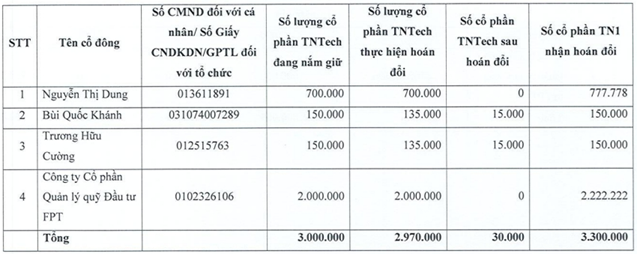

The swap ratio for M-Talent shares was 1:1.8, meaning 1.8 M-Talent shares were exchanged for 1 TN1 share. Similarly, the swap ratio for TNTech shares was 1:0.9. TN1 subsequently owned 99% of these two enterprises.

List of TNTech shareholders who swapped shares with TN1. Source: TN1

|

In 2021, TN1’s market price reached over VND 40,000 per share (after adjustment) but plummeted in the following three years to around VND 13,000 per share, a decline of nearly 70%. While TN1’s revenue grew during this period, its net profit declined, which may have contributed to the stock’s depreciation.

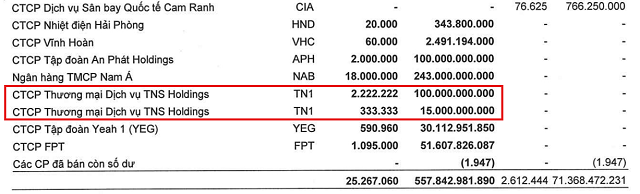

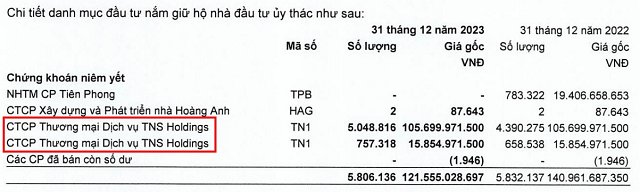

This is also reflected in the reports of the fund management company. At the end of 2020, FPT Capital recorded an initial investment amount of VND 115 billion in TN1 (then known as TNS Holdings JSC) on behalf of its investors. After the additional share offering in 2021, this amount increased to nearly VND 122 billion. However, FPT Capital only retrieved nearly VND 74 billion, incurring a loss of nearly VND 50 billion compared to the initial investment value.

FPT Capital’s investment in TN1 in 2020. Source: FPT Capital

|

FPT Capital’s investment in TN1 in 2023. Source: FPT Capital

|

As of the end of 2023, FPT Capital had a chartered capital of VND 110 billion, with SBI Ven Holdings Pte Ltd – established in Singapore – owning 49% and FPT Corporation (HOSE: FPT) holding 25%. Currently, FPT Capital manages several investment funds, including the FPT Capital Investment Fund (FIF) with a chartered capital of VND 50 billion, the A+ Investment Fund with a chartered capital of VND 150 billion, and the FPT Capital VNX50 ETF with a chartered capital of VND 60 billion.

In a reverse transaction, the sole member of Sao Hom Investment Company Limited acquired an additional 2.6 million TN1 shares from FPT Capital through a matched bargain, thereby increasing its holding ratio from 58.94% to 64.18%.

In another development, TN1’s Board of Directors has approved the implementation of a bonus share issue to pay dividends for 2023. In the third quarter, the Company is expected to issue nearly 5 million new shares at a ratio of 10% (shareholders owning 100 shares will receive 10 new shares) from the undistributed post-tax profit balance up to the end of 2023.

| TN1 Share Price Movement from 2021 to Present |

Tu Kinh

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.