The recently released Q2 economic data from SGI Capital’s June report continues to showcase a recovering economy, with improvements in various production and consumption sectors compared to the same period last year. However, the main growth drivers remain weak, including slow public investment growth, a stagnant real estate market, and challenging bank credit conditions.

“From an optimistic perspective, there’s room for improvement, which is a silver lining for patient investors to hold onto their stocks, especially with deposit interest rates remaining low,” states the SGI Capital report.

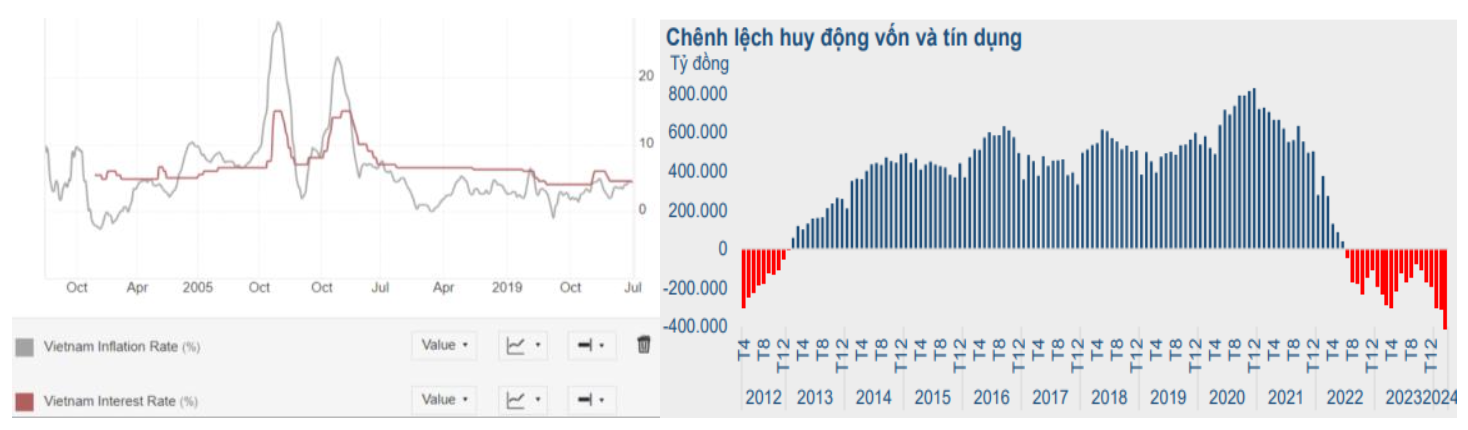

By the end of the first half, the State Bank (SBV) had sold over $6 billion to stabilize exchange rates and maintain low-interest rate management. However, interest rates are also under pressure from inflation, which remains high and close to the full-year target. Other countries in the region, such as Indonesia, the Philippines, Malaysia, and China, have much lower inflation rates than their policy rates, allowing for rate cuts if needed to stimulate their economies.

Source: SGI Capital

Additionally, the widening gap between deposits and credit across the system is causing stress on the credit-to-deposit ratio (LDR) in the banking sector. There could be pressure to increase deposit rates as credit growth accelerates, coupled with the rising trend of non-performing loans, which may result in tighter liquidity for the banking system towards the year-end.

According to a recent FiinRatings report on the bond market, financial pressures continue for various business groups with high non-performing loan ratios in 2024 and 2025, including real estate (42.5%) and energy (42.7%). Thus, the low-interest rate foundation has only stimulated investment money, while struggling businesses in need of restructuring have not benefited significantly and still face localized liquidity risks.

Regarding the stock market, SGI Capital believes that liquidity has passed its peak as low-interest rates attracted a large number of new investors. The recent sharp decline in liquidity indicates weakening market participation. Another risk to note is the significant increase in margin loans at securities companies, including loans from major shareholders and owners of businesses facing cash flow difficulties and losing access to bank credit.

Source: SGI Capital

Looking at the broader picture, SGI Capital assesses that, except for the Banking sector, which is undervalued, most other sectors’ stock prices have entered a high valuation zone, reflecting optimistic expectations and only suitable for a sudden recovery in the latter half and 2025.

“With existing domestic constraints and a rising likelihood of a global recession, attractive investment opportunities are becoming scarce, while risks are increasing. Patience and caution are advised for the market going forward,” SGI Capital comments.

Adopting a cautious stance, the Ballad Fund, managed by SGI Capital, maintains a high cash balance of nearly 80%. Correspondingly, the equity ratio remains at its lowest since the fund’s inception in November 2021, at approximately 21%. The fund’s portfolio at the end of June included seven stocks: BWE, DHG, FMC, PNJ, SGN, TLG, and VNM. These stocks are relatively insensitive to market fluctuations.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.