In response to VTC News, Mr. Ngo Thanh Huan, Director of Personal Finance at FIDT Joint Stock Company, shared his insights on investment allocation and personal financial planning.

Mr. Huan stated that the amount one should invest in the stock market depends on their personal financial goals and asset allocation. He provided an example, “If you currently have 200 million VND in disposable income and an additional 10 million VND each month, it would be challenging to invest in real estate. In this case, you could consider investing entirely in fund certificates. However, if you have savings of around 2 billion VND, you could allocate 1.5 billion VND, along with a 500 million VND bank loan, to purchase a plot of land worth 2 billion VND. You could then invest the remaining 500 million VND in stocks.” This illustrates the complexity of determining the initial investment amount for newcomers to the stock market, as it varies based on individual financial goals and circumstances.

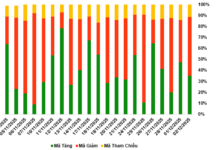

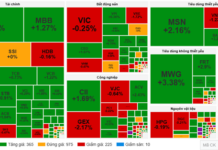

According to experts, investment amounts in the stock market depend on personal financial plans and asset allocation.

Mr. Huan also highlighted that selecting which stocks to invest in as a beginner is not an easy task. He suggested that for investors with limited capital, diversifying their portfolio might not be feasible. “In my opinion, fund certificates are the most suitable investment vehicle for newcomers to the stock market,” he added.

Another expert offered advice on the initial capital required for stock market investments. They cautioned that investing a substantial amount without a solid understanding of the basics carries risks. Conversely, investing a meager sum may result in lower profitability and longer wait times. Both novice and experienced investors are susceptible to losses if they fail to anticipate potential risks. Therefore, it is crucial to carefully consider expected returns and risk tolerance when determining the appropriate investment capital.

For instance, an investor may set a maximum loss threshold of 30 million VND and anticipate a market risk level of 20%. Using this information, the suitable investment capital can be calculated as 30 million VND divided by 20%, resulting in approximately 150 million VND.

The intended investment period also plays a role in shaping one’s trading strategy and capital allocation. For long-term investors, a buy-and-hold approach focused on solid, fundamentally strong stocks may be advisable. This allows for a higher allocation of capital towards purchases. On the other hand, short-term investors who require flexibility may opt for a market trend-following strategy, carefully balancing their cash holdings.

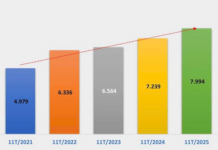

Some suggest that newcomers can start exploring the stock market with as little as 3 to 4 million VND in disposable income. They can then gradually increase their investments by allocating 10-20% of their monthly income as they become more familiar and confident in identifying lucrative opportunities.

In conclusion, the amount one should invest in the stock market depends on their disposable income, expected return on investment and risk tolerance, and investment time horizon. It is recommended to consult professional stockbrokers or financial advisors to determine the most suitable initial investment capital based on individual circumstances.