How the New Base Salary Affects Wages and Social Insurance Benefits

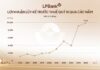

According to the Government’s Decree 73/2024/ND-CP, issued on June 30, 2024, the base salary for officials, public employees, and civil servants has increased from 1.8 million VND to 2.34 million VND per month.

The policy change regarding the base salary has brought about significant adjustments to the wage and social insurance system for workers nationwide.

The recent increase in the base salary has had a notable impact on the wage and social insurance system for workers across Vietnam. The following are the specific changes:

– Salary increase for officials, public employees, and civil servants, as well as those receiving allowances and working in agencies, organizations, and units of the Party, State, Vietnam Fatherland Front, socio-political organizations, and associations that are financially supported by the state budget.

As the base salary serves as the foundation for calculating the salary levels in the salary scales, allowances, and other benefits for the above-mentioned groups, an increase in the base salary results in a corresponding rise in their wages.

– Maximum contribution levels for social insurance, health insurance, and unemployment insurance have been raised.

While the contribution rates remain unchanged, the maximum monthly insurance contribution is determined by multiplying the base salary by 20. Therefore, an increase in the base salary leads to a higher mandatory monthly insurance contribution.

– Higher union fees for union members.

– Social insurance beneficiaries will receive increased allowances for ten different benefits, including post-illness recuperation, childbirth, post-natal recuperation, work-related accidents or occupational diseases, monthly allowances for work-related accidents or occupational diseases, caregiver allowances, one-time allowances for deaths due to work-related accidents or occupational diseases, post-treatment recuperation, funeral, and monthly survivor’s pension.

– Higher reimbursement rates for those with health insurance cards who seek medical examination and treatment outside of their designated network.

Base Salary Increase Leads to Higher One-Time Social Insurance Payout

The official base salary increase to 2.34 million VND per month, effective July 1, 2024, does not directly affect the one-time social insurance benefit for employees but rather has an indirect impact through the monthly salary used to calculate the benefit.

The one-time social insurance benefit is calculated based on the number of years of contribution and the average monthly salary used to pay social insurance contributions.

According to Article 60 of the 2014 Law on Social Insurance, the one-time social insurance benefit is calculated based on the number of years of contribution and the average monthly salary used to pay social insurance contributions.

Specifically, the formula is as follows:

|

One-Time Social Insurance Benefit |

= |

(1.5 x Average Monthly Salary Used for Social Insurance Contribution x Number of Years of Contribution before 2014) |

+ |

(2 x Average Monthly Salary Used for Social Insurance Contribution x Number of Years of Contribution from 2014) |

The increase in the base salary will lead to higher monthly social insurance contributions for the following groups:

– Officials, public employees, and civil servants, as well as those receiving allowances and working in public agencies, organizations, and units.

– Employees in non-state enterprises who are earning a salary equivalent to 20 times the base salary or more.

The higher contribution levels will result in a somewhat higher average monthly salary used for social insurance calculations, leading to a higher one-time social insurance benefit in the future. However, the increase is not significant as it is averaged over the entire insurance contribution period.

Note that employees who submit their one-time social insurance withdrawal applications on July 1, 2024, or in the first few days of July will not be eligible for the higher benefit amount as they have not yet contributed at the new salary level.

In conclusion, while the base salary increase will lead to a higher one-time social insurance benefit after July 1, 2024, it will not apply to all employees. Instead, it will only affect two specific groups:

(1) Officials, public employees, and civil servants, as well as those receiving allowances and working in public agencies, organizations, and units.

(2) Employees in non-state enterprises who are earning a salary equivalent to 20 times the base salary or more.

3 Types of Salary Increases Coming on July 1st

Starting from 01/07/2024, there will be an increase in three significant types of salaries, including civil servants’ salary, pension, and minimum wage, following the implementation of the salary reform.