Following the State Securities Commission’s directive to halt the distribution and fractionalization of real estate capital, previously offered in denominations of 10,000 VND, VPS Securities Company has proactively removed and disconnected new information related to FNEST on the VPS SmartOne application since June 7th, ahead of the guidance provided by the leadership of the State Securities Commission at the periodic meeting of the Ministry of Finance on June 18th.

“Moving forward, VPS will coordinate with FNEST to update information and request FNEST to ensure the rights and interests of customers. As a matter of principle, the rights and interests of customers are guaranteed and remain unaffected,” said a representative of the securities company.

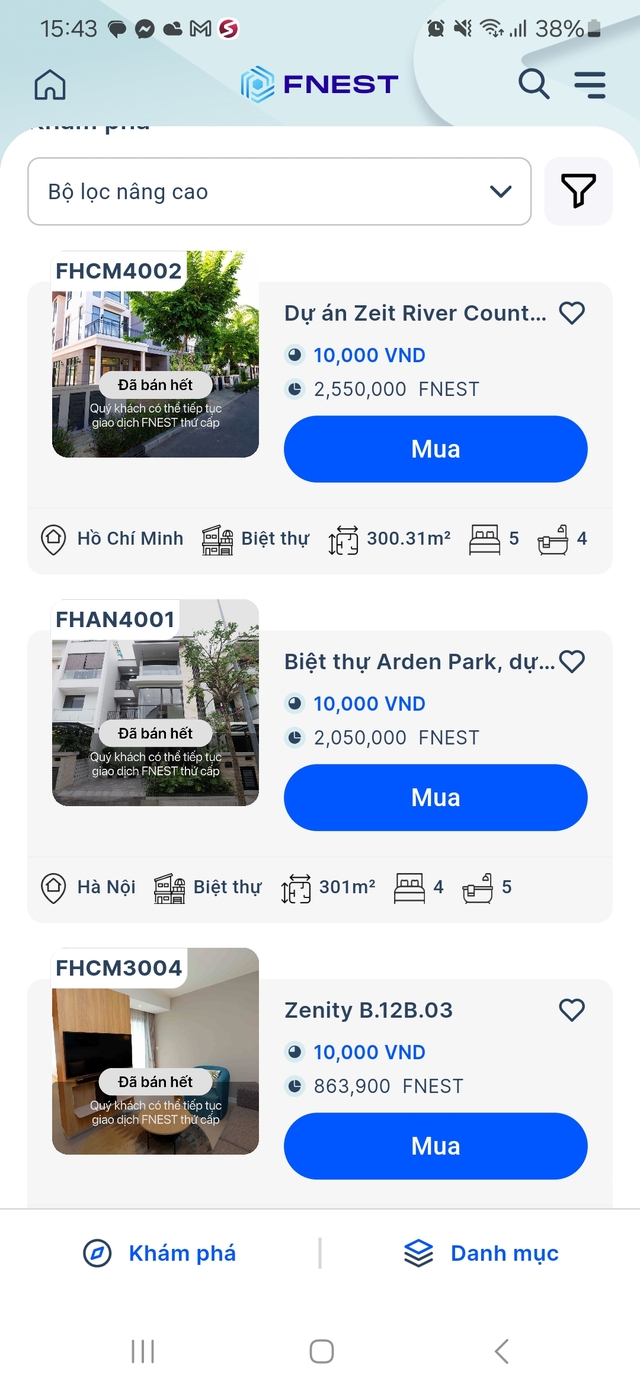

Previously, VPS Securities Company collaborated with FNEST Joint Stock Company to launch a real estate fractional investment model. Accordingly, the value of a real estate property was divided into investment shares, referred to as “FNEST.” During each offering, the primary face value of one FNEST was 10,000 VND.

With this approach, a 10 billion VND property would be divided into one million FNEST units, allowing investors to purchase small fractions and benefit from the appreciation of the real estate as well as its operational management.

However, the leadership of the State Securities Commission stated that the current securities laws do not specifically regulate this method of real estate investment and therefore requested VPS to temporarily suspend this offering.

According to our reporters, a few months ago, some investors who had opened accounts at VPS were approached by the company’s brokerage staff and invited to invest. A number of investors participated in purchasing these fractionalized real estate offerings through VPS’s SmartOne application.

However, as of now, a VPS brokerage employee has revealed that the company has stopped offering new real estate units. On the VPS SmartOne application, secondary real estate offerings also appear as “sold out.”

FNEST on VPS Securities Company’s SmartOne application. Screenshot taken on the afternoon of July 5th

According to VPS, real estate co-investment models are prevalent globally, such as the Arrived.com platform in the US, Indian applications like Strat and Propetyshare, and platforms in New Zealand like Miuwi and BrickX Hatch.

The implementation in each country depends on compliance with the respective country’s legal framework. This model has seen significant growth worldwide and offers several positive aspects: it provides customers with diverse investment opportunities, opens doors to investing, particularly in real estate, and creates opportunities for individual investors.

“If this co-investment model for real estate purchases can be developed, it will boost the economy, benefit the nation, and provide opportunities for investors. Therefore, regulatory agencies should consider promoting this model to create a dynamic and innovative environment for the economy in general and for businesses in particular, keeping up with global trends,” the VPS representative proposed.