The Vietnamese stock market shines bright, weathering “headwinds” and continuing its upward trajectory from November 2023. Despite short-term adjustments, the indices maintained their growth trend since the beginning of the year.

Short-term Risks on the Rise

According to a recent report by SSI Research, in the short term, the technical indicators RSI remain neutral, while ADX mid-term returns to a weak position. This suggests that the VN-Index trend in the July 2024 cycle will experience fluctuations that may not meet expectations. However, the mid-term uptrend of the VN-Index remains intact, as it has not breached the support level of 1,195-1,205. The VN-Index is expected to trade within the range of 1,220-1,295 points in July 2024.

Given the mixed factors at play, the analysts believe that a cautious approach is warranted as the overall market risk is increasing. Investors are advised to patiently await truly attractive price regions, focusing on the individual stories of each stock for new investments, while continuing to hold stocks expected to experience strong growth.

From a cash flow perspective, there is also the possibility of a continued rotation towards groups that directly benefit from policies, including Real Estate, Retail, and Exports. Some groups that underperformed in the first half of 2024, such as Financial Services, may also garner attention.

Strong Potential for Growth in the Second Half

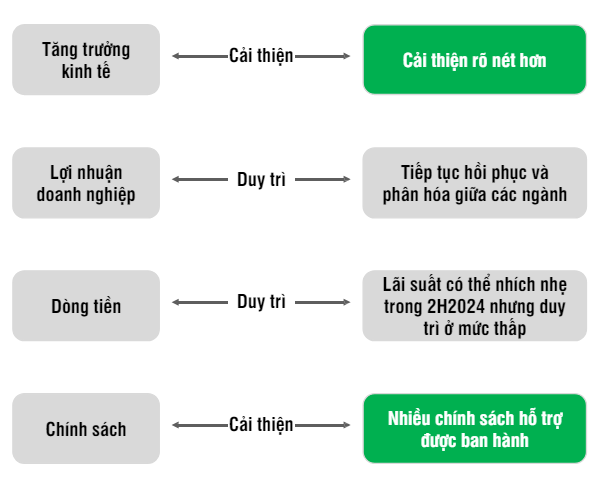

In the mid to long term, the analysts argue that the two main pillars for the market in 2024 – fundamentals and cash flow – are evolving more positively than expected. Economic recovery will become more apparent in the second half of the year. With GDP growth for the first half exceeding expectations, policy management may focus more on macroeconomic stability factors like inflation and exchange rates, while interest rates could continue to rise slightly. This may have contributed to the recent decline in stock market liquidity. Conversely, regarding foreign capital flows, the pressure to withdraw foreign capital may ease towards the end of the year if US interest rates decrease, creating a new positive dynamic for the market.

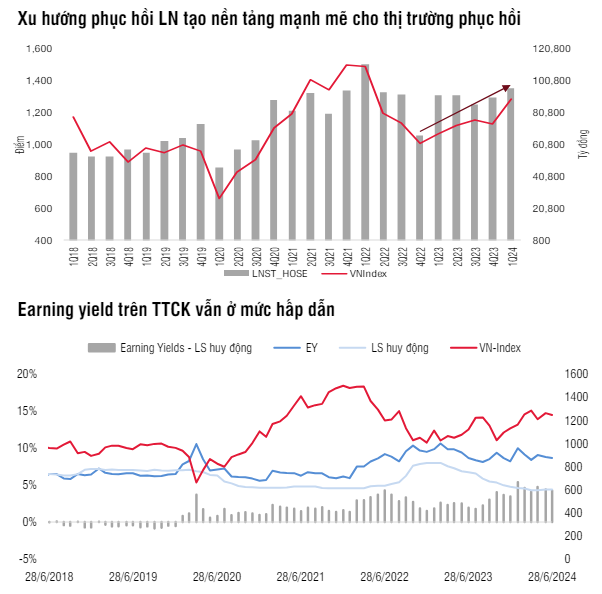

For the second half of 2024, SSI Research maintains a positive outlook for the market’s continued growth trend, despite the presence of risk factors that could cause fluctuations. The estimated P/E for 2024 of the VN-Index is currently at 11.5 times, lower than the 5-year average of 13.4 times.

“With this valuation, the VN-Index still has room to grow in the second half of the year and into 2025, especially as the economy continues its recovery. The increase in the basic salary for the public sector starting July 1st; the extension of the consumption stimulus policy of reducing VAT by 2% until the end of the year; Exports will be facilitated if the US recognizes Vietnam as a market economy by the end of July; Obstacles in the process of upgrading are gradually being removed. We continue to maintain our target of 1,300-1,350 for the VN-Index by the end of 2024,” SSI Research forecasts.

Regarding the Q2/2024 earnings outlook, in SSI Research’s watchlist, positive growth prospects are noted in many large bank codes, steel groups, essential and non-essential consumer groups, and port and shipping groups. Although some stock groups that have risen strongly in the past may have already reflected much of their profit growth prospects, alternating positive earnings growth between industries and stocks will continue to be the market’s driving force.