The Law on Real Estate Business 2023 introduces updated regulations regarding down payments and installment payments for real estate purchases, aiming to protect buyers and promote transparency in the real estate industry.

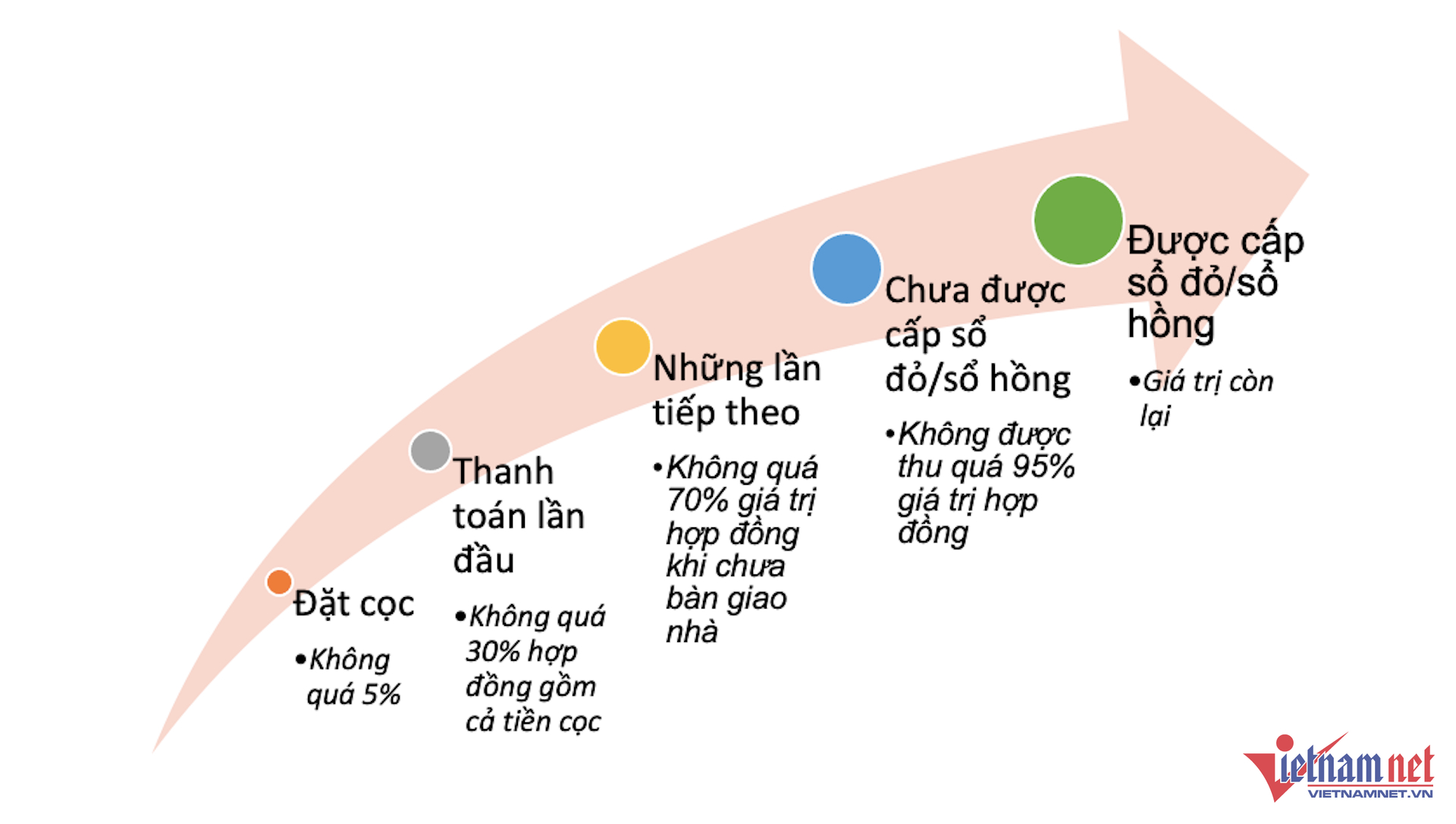

According to Clause 5, Article 23 of the Law on Real Estate Business 2023, real estate project investors are permitted to collect a down payment of up to 5% of the selling price for off-plan properties. This includes the sale or lease-purchase of houses, construction works, or floor space in a building under construction. However, investors must first fulfill specific conditions before accepting any down payments. These conditions include obtaining a construction permit, submitting a construction commencement notice, and possessing land use rights and ownership papers for the property in question.

The down payment agreement must clearly state the selling price or lease-purchase price of the house, construction work, or floor space being purchased. This transparency ensures that buyers are fully aware of the financial commitments involved in the transaction.

Illustration of the payment process for purchasing off-plan properties according to the Law on Real Estate Business 2023. Graphic: Hong Khanh |

Article 25 of the Law on Real Estate Business 2023 stipulates that buyers and sellers must make multiple installment payments. The initial payment cannot exceed 30% of the contract value, including the down payment. Subsequent payments must align with the construction progress but must not exceed 70% of the contract value before the handover of the property. This regulation provides a more detailed framework compared to previous legislation, offering better protection for buyers.

In cases where the seller is a foreign-invested organization, the total payment before handover cannot exceed 50% of the contract value. Additionally, if the buyer has not yet been granted a red book (land use right certificate and home ownership certificate), the total payment collected must not exceed 95% of the contract value. The remaining balance will be settled once the buyer receives their red book.

The new law also introduces provisions for lease-purchase agreements, which were not covered in the Law on Real Estate Business 2014. For these arrangements, multiple installment payments are also required, with the initial payment not exceeding 30% of the contract value, including the down payment. Subsequent payments are made according to the construction progress, but the total pre-handover payments must not exceed 50% of the contract value. The remaining amount is then calculated as rent and paid to the lessor within an agreed-upon timeframe.

Hong Khanh

The Ministry of Finance to implement new regulations to upgrade the stock market

Deputy Minister Nguyen Duc Chi stated that in order to achieve the goal of upgrading the stock market as soon as possible by 2025, the Ministry of Finance and relevant ministries need to actively implement preparatory tasks in 2024.

Legal framework for condotel transactions

The condominium hotel (condotel) market, as well as the tourism real estate market in general, has not been regulated under the 2014 Real Estate Business Law. As a result, the ongoing obstacles of this type of real estate are expected to be resolved after the passing of the 2023 Real Estate Business Law. From a legal perspective, what are the positive aspects of the new law that investors need to be aware of in order to protect their rights and interests in transactions?

Minister of Finance Hồ Đức Phớc: Aiming to upgrade the stock market

In the exchange in the early days of the Year of the Snake 2024 with the Financial Market and Monetary Journal on the orientation of the stock market’s development, especially upgrading the stock market in the near future, Minister of Finance Ho Duc Phoc emphasized that for the Vietnamese stock market to be upgraded, besides the efforts of the Ministry of Finance, strong direction from the Government, the Prime Minister and the cooperation of many ministries, sectors and businesses is crucial. As the leading agency, the Ministry of Finance is urgently and resolutely working towards this goal.