Foreign investors recorded the strongest net-selling session since the beginning of the year, with a focus on large-cap stocks. However, domestic money flowed in to balance the market, keeping the index in the green, albeit slightly. The VN-Index temporarily stood at 1,283 points. The market breadth remained positive, with 243 advancing stocks against 214 declining ones.

There were signs of money outflow from large-cap stocks, shifting to mid and small-cap stocks, including penny stocks. The real estate sector declined by 1.15%, and the banking sector dropped by 0.45%, mainly due to foreign investors’ significant net-selling in banks like HDB and STB.

On the contrary, the retail sector surged by 1.69% despite foreign investors’ net-selling in MWG, which still gained 2.13%. Other sectors that attracted buying interest included information technology, up 0.39% despite FPT’s net-selling, and seafood, up 0.65%. Additionally, construction materials, chemicals, and oil and gas sectors also posted gains.

Top stocks contributing to the market’s positive performance were GVR, adding 1.36 points, and MWG, contributing 0.50 points, along with DCM and FPT. Market liquidity across three exchanges rose sharply to VND23,000 billion, indicating improved sentiment and the return of money flow after a week of stagnation.

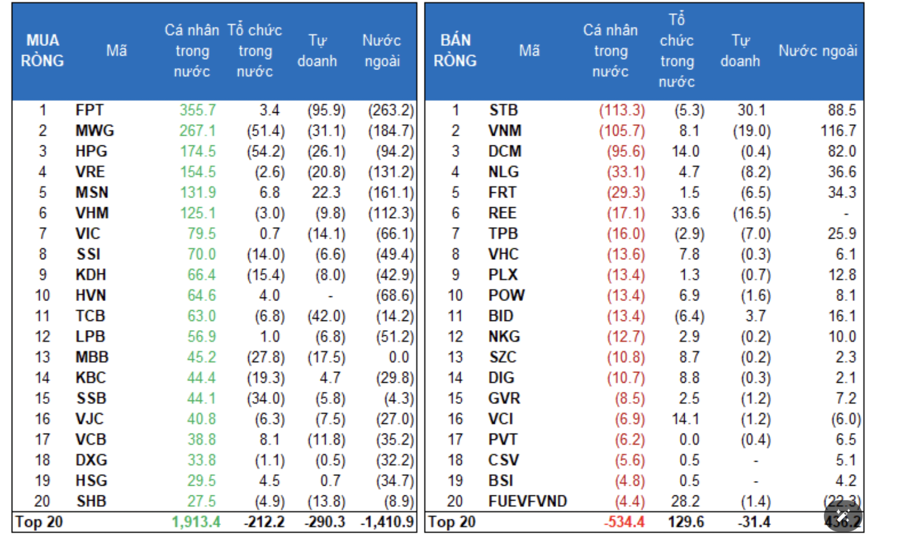

Foreign investors net-sold VND2,426.3 billion on the market, including VND1,239.0 billion in matched orders. Their net buying focused on the chemical and oil and gas sectors, with top stocks being VNM, STB, DCM, NLG, FRT, TPB, BID, GMD, PLX, and DGC.

On the selling side, foreign investors net-sold real estate stocks, including FPT, MWG, MSN, VRE, VHM, HVN, VIC, LPB, and SSI.

Individual investors net bought VND1,825.6 billion, including VND1,805.0 billion in matched orders. They net bought 15 out of 18 sectors, mainly focusing on the real estate sector, with top stocks being FPT, MWG, HPG, VRE, MSN, VHM, VIC, SSI, KDH, and HVN.

On the selling side, they net-sold 3 out of 18 sectors, mainly chemicals and media. Top stocks included STB, VNM, DCM, NLG, FRT, REE, VHC, PLX, and POW.

Proprietary trading accounted for a net buy of VND328.7 billion, while net selling VND501.7 billion in matched orders.

In terms of sector allocation, proprietary trading focused on buying stocks in the healthcare and media sectors, with top stocks being STB, MSN, GAS, KBC, BID, TNH, FUESSVFL, HSG, IJC, and HAG. On the selling side, they focused on the banking sector, including FPT, GMD, TCB, PNJ, MWG, ACB, HPG, VRE, and VNM.

Domestic institutions net bought VND110.5 billion, while net-selling VND64.4 billion in matched orders. They net sold 10 out of 18 sectors, mainly basic materials. Top stocks included HPG, MWG, SSB, MBB, KBC, PVD, VPB, KDH, SSI, and CTD. On the buying side, they focused on financial services, with top stocks being HDB, REE, FUEVFVND, ACB, GMD, DBC, VCI, DCM, PNJ, and DPM.

Block deals today reached VND2,755.5 billion, up 213.1% compared to the previous session, contributing 12.1% to the total trading value.

Notably, foreign institutions net sold HDB, STB, and SCS to proprietary trading. There was also a transaction of over 3.1 million units (valued at over VND172 billion) between foreign and domestic institutions in the SAB stock.

Individual investors continued to focus on trading bank stocks (ACB, SAB, MSB, EIB, MBB) and mid-cap stocks (KOS, KDC). In terms of money flow allocation, there was a decrease in banking, securities, software, warehousing, agriculture and seafood, textiles, water transport, and aviation sectors, while an increase was seen in real estate, chemicals, steel, food, retail, construction, oil and gas, and electricity production and distribution sectors.

Specifically, in terms of matched orders, the money flow allocation increased for mid-cap stocks (VNMID) and decreased for large-cap (VN30) and small-cap stocks (VNSML).

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.