The stock market on Monday witnessed a tug-of-war between bulls and bears. A clear divergence among stock groups caused the VN-Index to fluctuate throughout the session. Large-cap stocks were divided, with GVR, PLX, and MWG gaining ground while VCB, VIC, and SAB underwent adjustments. The bright spot was the electricity and fertilizer sectors, although their impact on the index was limited.

The VN-Index closed Monday’s session slightly higher, up 0.52 points (+0.04%) to 1,283.5. Trading liquidity improved slightly, with the value of transactions on the HoSE reaching nearly VND 20,000 billion. Foreign investors net sold sharply, with a net sell value of VND 2,507 billion in the market. This was the 22nd consecutive session of net selling by foreign investors in the Vietnamese market.

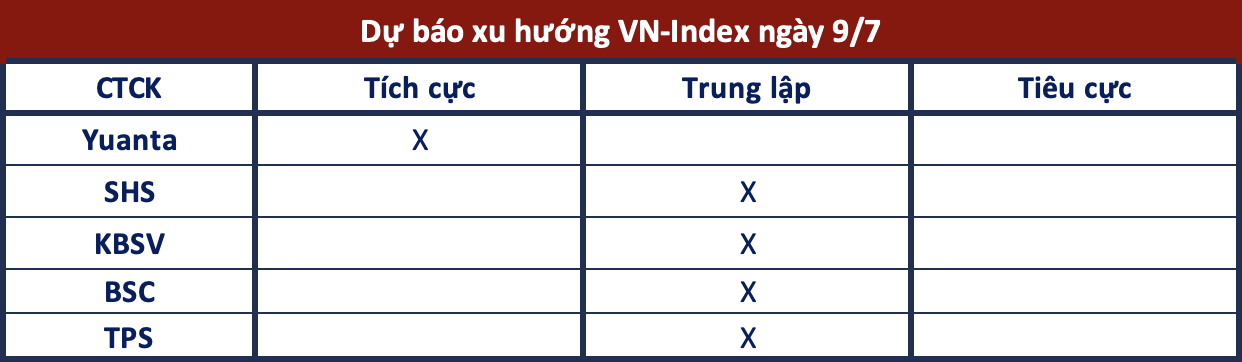

Regarding the market outlook for the upcoming sessions, securities companies have provided mixed assessments:

Upholding the Uptrend

Yuanta Securities: The market is likely to maintain its upward trajectory in the next session. If the VN-Index surpasses the 1,290-point level, trading volume is expected to increase significantly and spread evenly across stock groups. Notably, Yuanta observes that the majority of trading volume is concentrated in the Midcaps group, particularly in transportation and chemicals. Simultaneously, we anticipate an early return of trading volume to the securities group in the next few sessions.

Potential for Volatility

SHS Securities: In the short term, the VN-Index continues to accumulate positively after breaking above the 20-session average price of around 1,275 points, maintaining accumulation in the 1,250-1,300-point range. Market liquidity has improved but remains below average, so the index may experience volatility when encountering strong resistance at 1,285 points, the highest price level during the sharp declines in April, May, and June 2024.

The positive sign is the increase in buying demand for many stocks/stock groups, while the VN30 undergoes slight adjustments. Numerous stocks/stock groups have recovered well after corrections, with many surpassing their recent peaks and experiencing sudden increases in liquidity, such as stocks in the oil and gas, chemicals, fertilizers, industrial parks, and marine transportation sectors… offering attractive short-term opportunities.

Risk of Reversal Remains

KBSV Securities: The VN-Index formed a candlestick pattern with a rising volume, indicating that buyers were more proactive in bottom-fishing as the index faced pressure during the session. While large-cap stocks are still dictating the market’s pace, trading volume has not yet spread widely, and the risk of reversal persists as the index approaches the nearby resistance level.

Trade with Caution

BSC Securities: The VN-Index continued to fluctuate around the 1,280-point level before closing at 1,283.56, almost unchanged from the previous session. The index is exhibiting a tug-of-war at the 1,285-point resistance level. Investors should trade with caution, as a failure to hold this level could lead to a retreat to 1,260 points.

Sector Rotation in Play