|

CEO Lê Chí Phúc

|

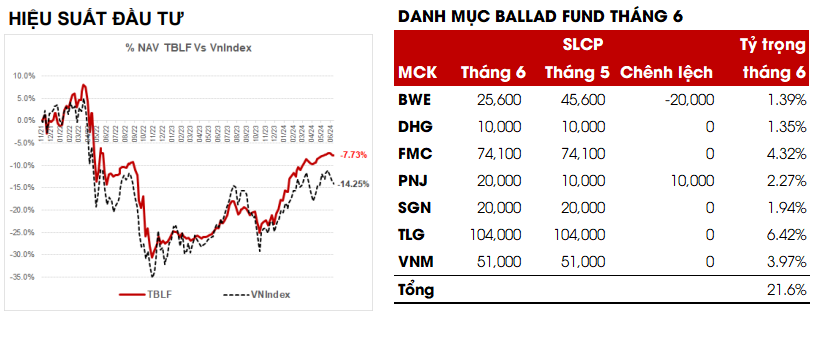

In June, the investment fund led by CEO Le Chi Phuc recorded a negative performance of 0.03% while the VN-Index fell by 1.3%. By adopting a “wait-and-see” approach, the fund managed to avoid significant losses during the recent adjustment phase. Since the beginning of 2024, Ballad Fund has achieved a performance of 15.09%, outperforming the VN-Index’s gain of 10.21%.

In terms of stock portfolio, Ballad Fund reduced its position in BWE but added a small amount of PNJ. By the end of June, the fund held only 7 stocks with a total weight of nearly 22%. Most of these are companies with solid business foundations, consistent cash flow, and less volatility compared to the market. As of June 2024, more than 78% of the fund’s assets were in cash.

CEO Le Chi Phuc’s allocation strategy reflects the pessimistic view expressed in April 2024, indicating that the market is facing various pressures, including exchange rate and inflation pressures, as well as selling pressure from foreign and insider investors. Additionally, the slower-than-expected recovery of businesses is also a concern for the head of Ballad Fund.

Be Cautious of a US Recession

In this update, Mr. Phuc, CEO of Ballad Fund, points out that there are warning signs of an impending US recession and advises investors not to be too optimistic about the scenario of the Fed cutting interest rates.

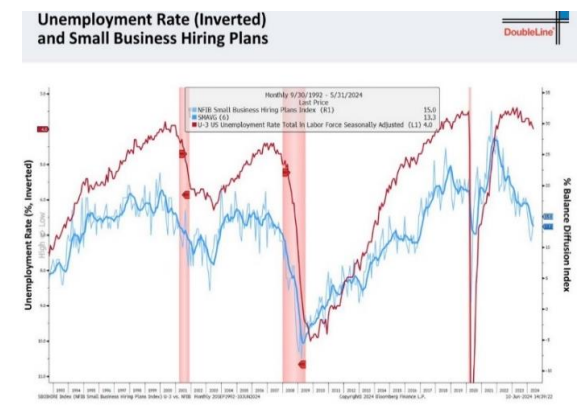

Recent reports indicate that the US unemployment rate rose to 4.1% in June, up from a low of 3.4% in April 2023. “When the unemployment rate increases rapidly and surpasses 1% from its low, the US economy tends to enter a recession,” he states.

He also notes that several important economic indicators are deteriorating, including the ISM services and manufacturing indices falling below 50, depletion of personal reserves from COVID, declining consumer demand, and a rapid increase in personal bad debts. “The possibility of a weakening US and global economy in the second half of this year and a recession in 2025 is increasing,” he says.

According to Mr. Phuc, investors should not pin too much hope on the scenario of the Fed cutting interest rates. Even if the Fed lowers rates, financing costs will not decrease immediately, and the positive impact usually has a time lag.

Over the past year, the US government has focused on issuing short-term debt instruments in anticipation of the Fed lowering interest rates. “This puts refinancing pressure on previously raised low-cost funds, resulting in actual financial costs for the US government and businesses remaining high even if the Fed and central banks start cutting rates,” he explains.

He believes that as the risk of a recession increases, capital will shift from risky assets like stocks to safe-haven assets like gold and bonds, withdrawing from high-risk markets such as emerging and frontier markets and returning to their home countries. “This is the time when the stock market shifts from expecting rate cuts to being cautious about the unemployment rate,” CEO Phuc states.

Regarding Vietnam, Mr. Phuc assesses that the economy continues to recover broadly, but the main growth drivers remain weak, including slow public investment, low real estate market liquidity, and challenging bank credit growth. He emphasizes: “There is still room for improvement, and this is a support for investors who patiently hold stocks, especially when deposit interest rates remain low.”

However, he also cautions that interest rates are under pressure from the inflation rate, which remains high, close to the full-year inflation target. The widening gap between deposit and credit rates across the banking system is straining the industry’s LDR ratio, and there may be pressure to increase deposit rates when credit growth accelerates. The trajectory of non-performing loans and overall liquidity in the banking system may not be as robust towards the end of the year.

Investment Opportunities Are Scarce

Turning to the Vietnamese stock market, Mr. Phuc believes that the recent sharp decline in liquidity indicates a weakening of the participating cash flow in the market. This is coupled with familiar issues such as high margin trading and the wave of foreign investor divestment, as well as insider and long-term investor selling.

Looking at the bigger picture, Mr. Phuc assesses that except for the banking sector, which is trading below average valuations, most other sectors’ stock prices have been pushed into high valuation territories, reflecting optimistic expectations. These valuations are only justified if there is a dramatic recovery in the latter half of this year and in 2025.

“With the existing domestic constraints and the increasing possibility of a global recession, good investment opportunities are becoming scarce, while risks are escalating. Patience and caution are advised for the market in the coming period,” shares the head of Ballad Fund.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.