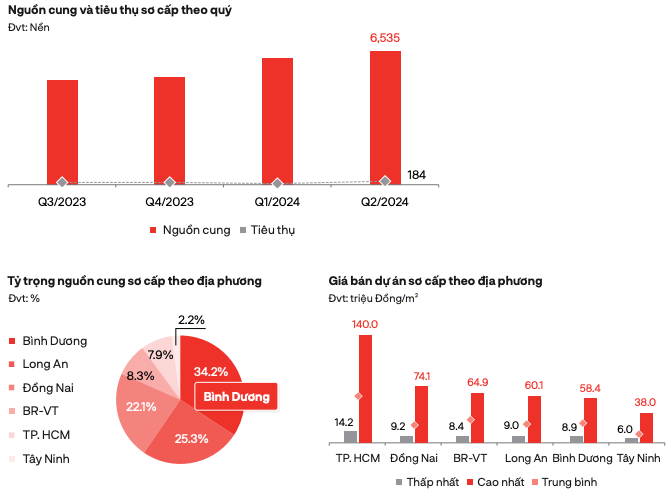

The latest report on the real estate market for Q2 2024 by DKRA provides interesting insights into the land segment. The primary supply reached 6,535 plots, a slight increase of 5% from the previous quarter. Notably, Binh Duong, Long An, and Dong Nai accounted for over 81% of the primary supply in Q2 2024.

While overall market demand showed significant improvement from the previous quarter, it remains relatively low compared to the pre-2019 period. However, there was a notable spike in consumption during the quarter, with 184 plots sold, a 2.6-fold increase from the previous quarter. These transactions were concentrated in products with completed infrastructure and legal documentation, with average prices below VND 30 million per square meter.

Source: DKRA

Ho Chi Minh City recorded the highest land prices, reaching VND 140 million per square meter, while Dong Nai’s peak land price was VND 74.1 million per square meter.

DKRA’s report also indicates that there weren’t significant changes in primary land prices compared to previous launches. To stimulate the market, investors offered various discounts for quick payments and incentives for those using their own capital.

In the secondary market, prices witnessed a slight increase of 1% from the previous quarter. Market liquidity showed positive developments compared to the same period last year, with transactions focused on projects with completed infrastructure and legal documentation, conveniently located for connections to central areas.

The land segment in Ho Chi Minh City has been showing signs of recovery. The upcoming enforcement of the Land Law, Real Estate Business Law, and Housing Law is expected to accelerate the market’s revival. Additionally, the restriction on subdivision in 105 areas is anticipated to drive up land prices.

Mr. Le Bao Long, Director of Strategy at Batdongsan.com.vn, predicts a high probability of real estate price increases following the implementation of the new Land Law, Housing Law, and Real Estate Business Law. The provisions in these three laws are expected to enhance the accuracy of land price updates.

Mr. Long forecasts a rise in real estate prices after 2025, with land plots being the most affected due to the ban on subdivision sales in 105 cities and towns. Sharing this view, Mr. Vo Hong Thang, Director of Consulting Services and Project Development at DKRA Group, notes that land plots with completed legal documentation, well-developed transport infrastructure, adjacent to residential and industrial areas, and offering convenient connections to city centers, have been attracting investors’ preferences.

In the long run, the appeal of land plots is unlikely to wane. This segment remains a favorite among investors due to various factors, including the cultural preference for owning land and the desire for secure wealth accumulation. The potential for higher profits from land plots is still significant. Based on extended cycle research, another land fever could occur in the 2025-2026 period.

“The present can be considered the beginning of a new cycle of recovery and growth for the real estate market,” shared Mr. Thang.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.

Removing Land Policy Bottlenecks, Creating New Resources for Development

The passing of the Land Law by the National Assembly has been well-received by society, with expectations that policy barriers and bottlenecks will be quickly dismantled and eliminated. This will effectively utilize land resources, contributing to the creation of new resources that will promote socio-economic development…

Real Estate Expert Forecasts Booming Market for Land in 2024

Currently, land plots are still highly valued by experts as they bring high profits and minimize risks, even in a slow-paced and low liquidity market.