In their latest report, An Binh Securities (ABS) presents a positive outlook for Vietnam’s economy, with impressive Q2 GDP figures of nearly 7%, outperforming its regional peers and historical data. The manufacturing sector has seen its highest production expansion in over two years, while the services sector has witnessed a significant surge, attributed to improved household income and rising demand for logistics services.

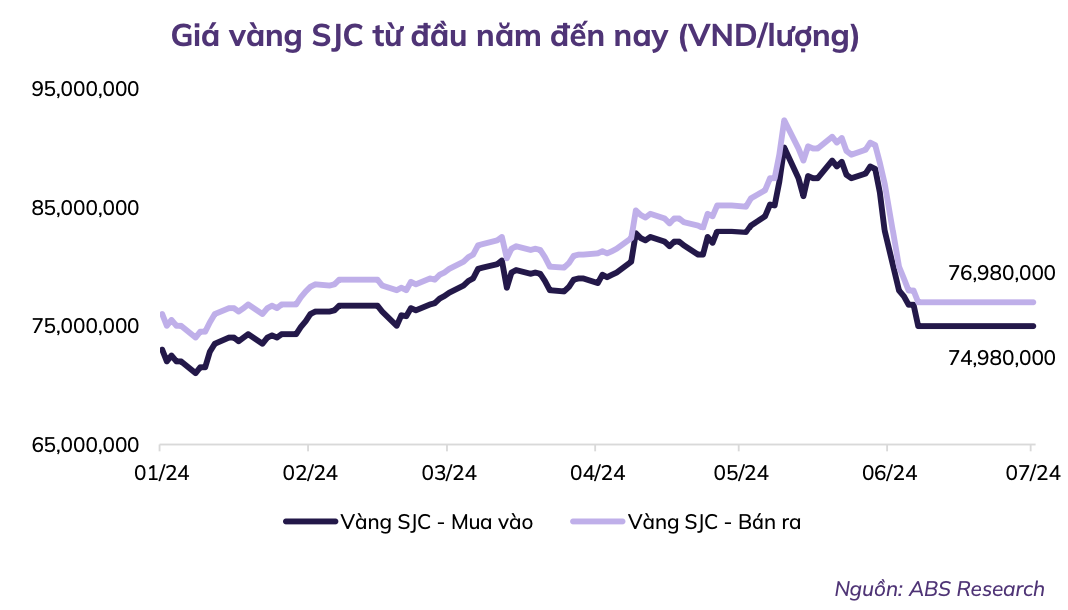

Several export commodities have experienced robust growth, including wood and wood products, furniture made from non-wood materials, plastics, textile auxiliaries, leather, and footwear. The State Bank of Vietnam has successfully stabilized the gold market, with SJC gold bar prices remaining steady throughout June, and this trend is expected to continue in July. This bodes well for the economy as it encourages money flow and contributes to overall growth.

Institutional improvements have been made with the passage of the amended Social Insurance Law and the enactment of the 2024 Land Law, Housing Law, Real Estate Business Law, and two articles of the Credit Institution Law. Additionally, a 2% VAT reduction has been extended until the end of 2024, along with the extension of Circular 02 on debt restructuring, providing further support to the economy and the people.

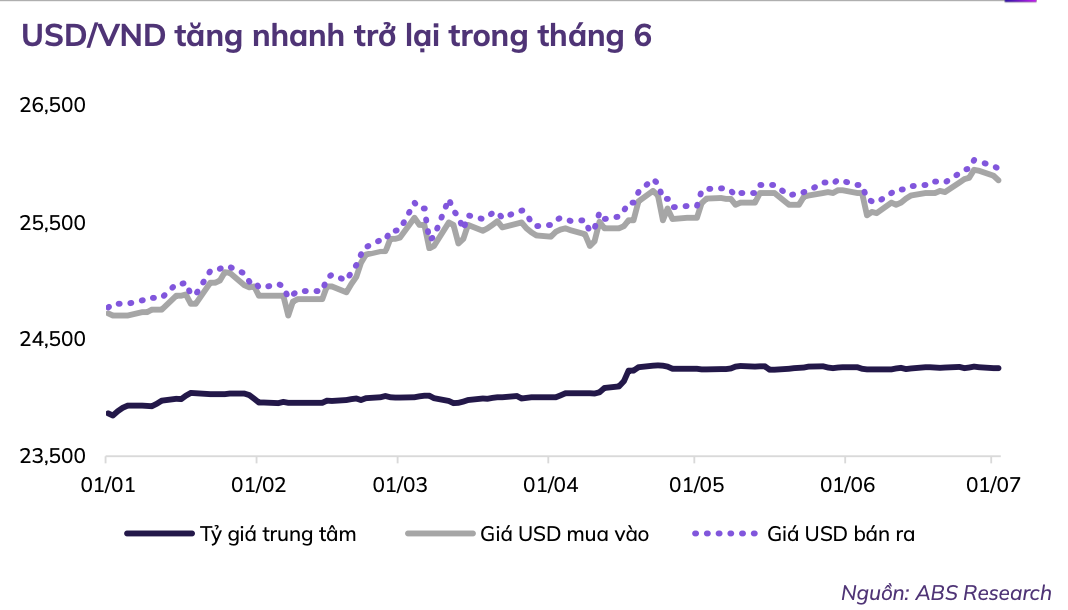

While exchange rate pressures persist, with the rate climbing steadily in June, ABS predicts a slower increase or even a reversal in July. This is due to rising policy and market interest rates, a return to trade surplus in June with a nearly $3 billion surplus, continued strong FDI inflows, and increasing expectations of the Fed beginning to cut rates in September.

Stock market to enter a new phase of price increases in the second half

The stock market is witnessing a weakening trend in terms of trading volume and value as it approaches the 1,300-point threshold. Continuous net selling by foreign investors, exchange rate pressures, and tightened liquidity in the monetary market have prevented the market from achieving a strong breakthrough.

In terms of valuation, after the mid-June correction, the VN-Index’s P/E ratio decreased from 14.3x at the end of May to 14.1x at the end of June, remaining below the +1 Std threshold for the past year. Large-cap stocks in the VN30 have a P/E ratio of 12.62x, significantly lower than mid-cap stocks in the VNMID (16.72x) and small-cap stocks in the VNSML (18.66x)

With positive developments in domestic production, consumption, and exports, along with supportive policies and legal frameworks, ABS anticipates continued economic growth, improved market liquidity, and a reduction in net foreign selling.

“We forecast that July will be a month of consolidation for the market, with prices ranging between 1,300 and 1,180 points, setting the stage for a bullish wave in the second half of 2024,” the ABS report stated. “Our mid-term outlook remains positive, with expectations for the VN-Index to reach the 1,350-1,370-1,395 range as mentioned in our earlier report. The confirmation of the market’s new uptrend will be marked by weekly closing prices surpassing the Resistance 1 level of 1,315 points.”

Preferred sectors for July include insurance, energy, industrial real estate, residential real estate, fertilizers, textiles, aviation, and banking. Stocks within these sectors should demonstrate positive earnings prospects, benefit from macroeconomic factors, and exhibit appropriate accumulation patterns in terms of volume and time, with room for further price appreciation.

Vietnam’s Economic Landscape in the First Month of 2024

In January 2024, the country witnessed the reactivation of nearly 13.8 thousand businesses, which is 2.2 times higher than December 2023 and represents an 8.4% decrease compared to the same period in 2023. This resulted in a total of over 27.3 thousand newly established and reactivated businesses in January 2024, marking a 5.5% increase from the previous year.

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

Looking back at meaningful credit policies

Results in overcoming obstacles, recovery, and business growth, as well as macroeconomic stability, are greatly influenced by credit and policy credit.