In late March 2024, the Ministry of Industry and Trade released a draft decree on gasoline and oil business, replacing Decree 83/2014/ND-CP and its amendments. It didn’t take long for investors to assess the impact of the draft on gasoline and oil businesses.

Capital quickly flowed into Petrolimex (PLX) and PV Oil (OIL) from mid-April, pushing the shares of the two largest gasoline and oil retailers in Vietnam to rise continuously. After less than 2 months, PLX’s market price had increased by about 30%, while OIL had surged by more than 50% to the highest price in more than 2 years.

According to a recent report by Maybank Investment Bank, the new draft decree on the gasoline and oil business is expected to positively impact large enterprises in the industry. This decree will consolidate the advantages of trading agents, bringing the most benefits to enterprises that dominate this group (Petrolimex, PV Oil) in terms of potential market share and profit margin .

Specifically, the decree still maintains the regulation that only trading agents are allowed to purchase gasoline and oil directly from domestic refineries or import from abroad. Meanwhile, the selling price from these trading agents to distribution/retail agents is not legalized and is entirely based on agreements between the participating parties. In other words, the trading agents still maintain the right to determine the profit distribution within the value chain.

Distribution agents will have to purchase gasoline and oil directly from the trading agents and will no longer be allowed to cross-purchase from other distribution agents. In addition, the decree requires stricter conditions for retail agents, weakening their position in the value chain compared to distribution and trading agents.

The new decree also aims to increase the number of days of gasoline and oil reserves from 20 to 30 days, which will increase business costs but will not affect the competitive advantage of trading agents throughout the value chain.

“If there are no significant changes from the initial draft, the spirit of the new decree will improve the operation of retail prices, reduce fragmentation, and be more favorable for large-scale trading enterprises“, Maybank Investment Bank report emphasized.

Sharing the same view, a recent report by ACBS stated that the recent draft amendment to Decree 80/2023 also has many supportive points for gasoline and oil trading enterprises such as Petrolimex in the long term. These include:

(1) Distribution traders are not allowed to buy from each other and can only import from trading agents to reduce costs in the intermediary stage;

(2) More stringent conditions are required to become a trading agent;

(3) Trading agents and distribution agents of gasoline and oil are allowed to decide the selling price, provided that it does not exceed the price specified by the pricing formula. This move aims to create a competitive environment and reduce state intervention;

(4) The total business expenses and maximum regulated profit in the draft are higher than the current level.

ACBS believes that with advantages such as the largest gasoline and oil storage, favorable gas station locations, and a strong brand, Petrolimex will compete better than its rivals.

Basically, enterprises participating in the gasoline and oil business (excluding refineries) are classified into 3 groups: (1) trading agents, (2) distribution agents, and (3) retail agents. In addition, trading agents can have their own distribution and retail channels. The two trading agents with the largest distribution and retail networks in Vietnam are Petrolimex and PV Oil.

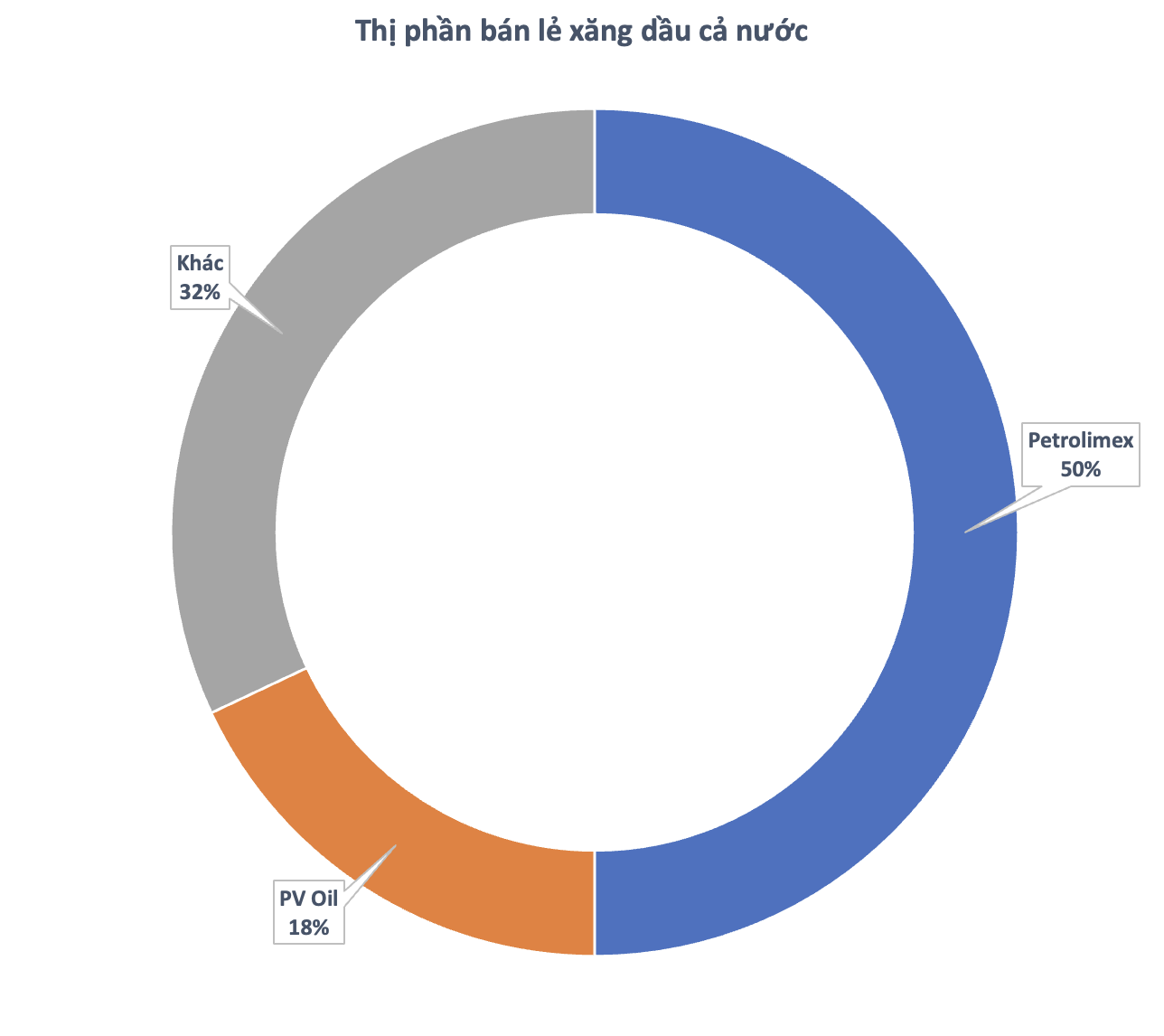

It is estimated that Vietnam currently has more than 17,000 gasoline and oil retail stores, supplying tens of millions of tons of products to consumers every year. Nearly 70% of the domestic market share in terms of revenue is held by the duo of Petrolimex and PV Oil.

Among them, Petrolimex leads with a 50% market share and 5,500 stores nationwide. PV Oil ranks second with an 18% market share and 700 directly-owned stores. In the first quarter of 2024, the total revenue of Petrolimex and PV Oil reached nearly VND 105,000 billion, the highest since the second quarter of 2022. On average, these two gasoline and oil retailers earn VND 1,150 billion per day.

Decree No. 80/2023/ND-CP of the Government took effect from November 17, 2023. It amends and supplements a number of articles of Decree No. 95/2021/ND-CP dated November 1, 2021, and Decree No. 83/2014/ND-CP dated September 3, 2014, of the Government on the gasoline and oil business.

PV OIL reports Q4/2023 loss, doubled debt financing

Due to the decrease in world oil prices, PV OIL incurred a net loss of over 36 billion VND in Q4 2023. What’s more, the company’s total debt at the end of the year increased 2.6 times compared to the beginning of the year, reaching 7,055 billion VND, mainly in the form of short-term loans.