Quarterly Business Results for Q2 2024 Show Continued Recovery

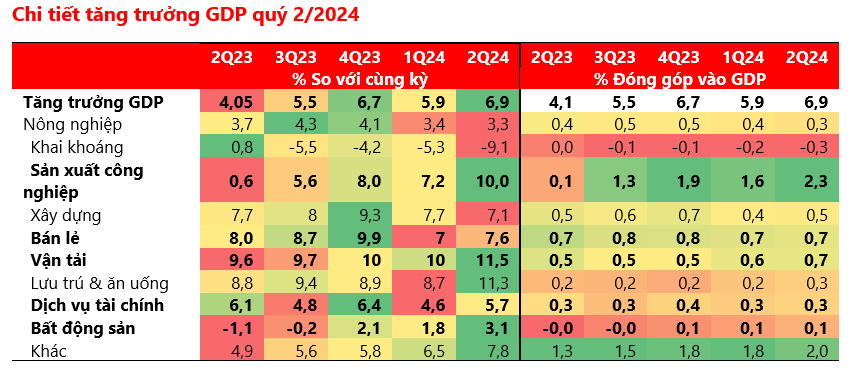

The Vietnamese economy achieved a growth rate of 6.93% in Q2 2024, surpassing the highest scenario set at 6.32%. With these figures, there is a solid basis for investors to expect a brighter picture for the Q2 financial results of listed companies.

Among them, industries with a high contribution to the revenue and profit structure of the VN-Index, such as industrial production, retail, and transportation, maintained their growth momentum.

The financial services component, as well as the capital mobilization of credit institutions, increased by 1.5%, and credit growth for the economy reached 4.45% compared to the end of 2023, indicating a positive outlook for the profits of banks and financial services groups.

Additionally, although the increase is not significant, the real estate sector is showing a resilient recovery, and VDSC expects a business performance recovery starting in Q2.

Source: VDSC’s July 2024 Investment Strategy Report

|

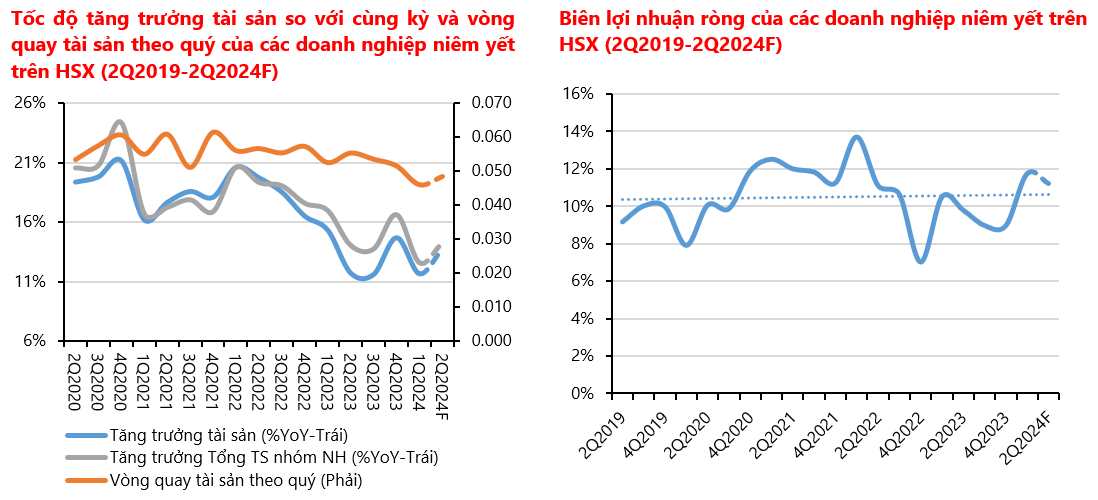

In Q2, the growth rate of total assets of listed companies on HOSE will reverse. VDSC expects asset turnover to have bottomed out in Q1/2024 and will tend to recover to a normal state in the coming quarters.

For net profit margins, there will be a slight adjustment compared to Q1 due to seasonal factors, and bank profit margins may not improve due to the potential risk of bad debts remaining.

Source: VDSC’s July 2024 Investment Strategy Report

|

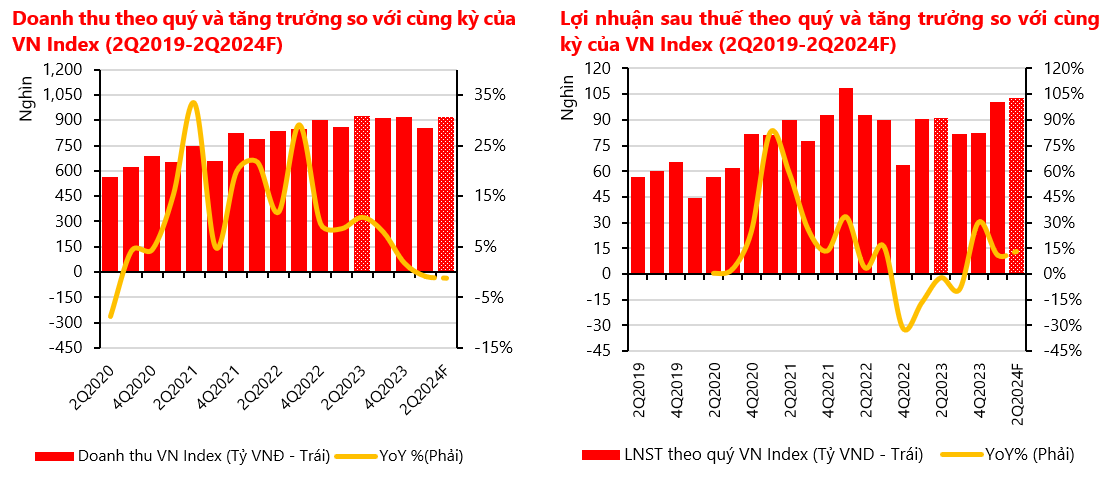

VDSC projects that market revenue in Q2 will start to recover compared to Q1, but growth will still be lower than the same period last year, while after-tax profit is estimated to increase by 13% over the same period.

Source: VDSC’s July 2024 Investment Strategy Report

|

Interest rates are likely to rise reasonably in the second half of the year

Looking back at the first half of 2024, deposit rates have gone through a recovery period from their lows but are still 15-45 points lower than last year. VDSC expects a rise in deposit rates to be a suitable scenario based on the expected movement of exchange rates and interest rate policies.

VDSC believes that pressure on exchange rates will persist due to the strength of the US dollar, which is forecast to continue. Additionally, due to seasonal factors, foreign currency demand (for importing goods) may surge again in Q3 before the Fed officially reverses its interest rate policy, prolonging exchange rate pressure during this period.

Meanwhile, after ten consecutive weeks of selling foreign currency to stabilize the exchange rate (from April 22), the SBV is estimated to have sold over $5.8 billion in intervention, equivalent to about 30% of the depletion in 2022.

For the upcoming period, in a scenario where the SBV aims to protect foreign exchange reserves while stabilizing the exchange rate, VDSC does not rule out the possibility of a hike in the operating interest rate (25-50 basis points) in Q3.

The recovery of credit growth in the second half of this year is also noteworthy. Credit will recover strongly towards the end of the year, and this, together with the net inflow of money through foreign currency sales, could create liquidity pressure for the banking system and the interest rate environment in the latter half of 2024. However, the increase will not be as abrupt as in 2022 due to different macroeconomic contexts.

July Investment Strategy – Riding the Wave of Q2 Financial Results

VDSC states that the current economic context is intertwined with two colors: the bright color of the positive recovery trend in economic growth and the dull color of the monetary market.

With the mixed impact of these two factors, the market has generally maintained the same level of volatility as in the past two months. With the season for announcing Q2 financial results in July, the VN-Index still has the opportunity to return to the 1,300-point threshold, while exchange rate issues and the risk of the SBV raising the operating interest rate may cause the index to fall back to the 1,240-point threshold or even the 1,180-1,220-point range in Q3.

Groups of stocks will take turns to increase, offering short-term investment opportunities, and investors can proactively allocate portfolios for short- and long-term targets and reasonable stock/cash ratios.

Huy Khai

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.