The Vietnamese economy has maintained a strong growth trajectory in the first half of 2024, overcoming challenges arising from the international situation. Key indicators such as GDP and trade have shown remarkable growth, surpassing initial forecasts.

According to a report by the General Statistics Office, the country’s GDP in the second quarter of 2024 grew by an estimated 6.93% year-on-year, a strong performance second only to the 7.99% growth rate achieved in the same quarter of 2022 during the 2020-2024 period.

For the first six months of 2024, GDP expanded by 6.42%, slightly lower than the 6.58% growth rate recorded in the same period of 2022 but still impressive given the global economic headwinds.

Experts attribute this positive momentum to several supportive factors, and they remain optimistic about the economy’s prospects for the remainder of the year.

Prof. Dr. Nguyen Huu Huan, a lecturer at the University of Economics in Ho Chi Minh City, believes that the economy will sustain its high growth rate in the second half of the year, achieving the targeted growth rate of 6-6.5% by the end of 2024. He adds, however, that the focus for 2024 is not solely on economic growth but also on managing exchange rates and inflation.

Sharing a similar sentiment, Prof. Dr. Dinh Trong Thinh, an economic expert, highlights several opportunities that could propel the economy towards higher growth in the latter half of 2024. These include a robust recovery in business operations, with a 6-7% increase in the number of newly established and reactivated enterprises compared to the previous year.

The manufacturing sector is expected to witness a notable improvement in the third quarter, outperforming the second quarter. Moreover, an increased number of enterprises have secured export-import contracts, with many reporting better deals in the second quarter than in the first, and they anticipate further improvements in the third quarter.

Trade figures also paint a positive picture, with exports and imports surging by 14.5% and 17%, respectively.

Looking back at the first quarter of 2024, Vietnam achieved a remarkable GDP growth rate of 5.66%, the highest in the last five years. This strong performance continued into the second quarter, with a growth rate of 6.93%, just shy of the 2022 figure. The economy is on a solid growth trajectory, accompanied by stable prices and healthy macroeconomic balances. The State Bank of Vietnam (SBV) has been diligent in maintaining exchange rate stability.

Earlier projections for 2024 presented two growth scenarios. The first scenario anticipated a slow global economic growth and possible disruptions in commodity prices due to supply chain issues. In this case, Vietnam’s GDP was expected to grow by 5.5-6.5%, with inflation hovering around 3.2-3.5%.

The second scenario envisioned a more favorable global economic environment, with stable prices and Vietnamese enterprises capitalizing on export opportunities and boosting domestic consumption and production. In this optimistic scenario, GDP growth was projected to reach 6.3-7%, while inflation would be kept under control at 3.5-3.8%.

Given the positive performance in the first half of the year, Prof. Dr. Thinh believes that the second scenario is well within reach, and the economy could even surpass these expectations. He forecasts that Vietnam’s GDP for the entire year could reach 6.8-7.3%, with inflation remaining within the target range of 3.8-4.1% set by the National Assembly and the Government.

Ms. Bui Thi Thao Ly, Director of Analysis at Shinhan Securities Vietnam (SSV), offers a slightly different perspective. She acknowledges that the economy’s pillars are beginning to drive growth, albeit at a slower pace than expected. To sustain this upward trajectory, she emphasizes the need for additional catalysts.

Since the beginning of the year, the Purchasing Managers’ Index (PMI) has hovered around 50, indicating a lack of significant changes in the economy. However, industrial production has shown promising growth. A survey by S&P Global reveals that new orders have increased, leading to a rise in output. Nevertheless, high input costs have forced businesses to raise their selling prices, creating challenges for the second half of 2024.

Despite these challenges, businesses remain optimistic about their performance in the latter half of the year, as evidenced by the survey results. The majority of enterprises have successfully secured new orders and are committed to overcoming obstacles in their production and business operations.

Retail sales, however, have yet to witness a significant boost. The primary driver of growth in this sector is tourism.

Foreign direct investment (FDI) registrations have been robust, increasing by over 50%, indicating a strong recovery in FDI inflows and Vietnam’s continued appeal as an investment destination.

To achieve the targeted growth rate of 6-6.5% for 2024, Ms. Ly underscores the need for additional catalysts to bolster the economy’s pillars. She outlines three key areas of focus:

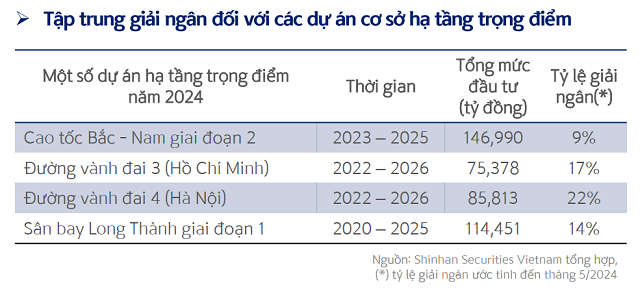

First, there is a need for aggressive public investment disbursement, particularly in critical infrastructure projects such as the North-South Expressway, the Ring Road 3 and 4, and the Long Thanh International Airport Phase 1. Accelerating public investment will not only provide an immediate boost to GDP but also contribute to the economy’s long-term sustainable development. In the short and long term, enhancing public investment in infrastructure is a prudent strategy.

Second, to stimulate domestic consumption, Ms. Ly suggests implementing measures such as tax breaks and reductions in fees and charges. The scale of budget savings in the last six months of the year is estimated at VND 98,000 billion. This includes a 2% reduction in VAT, amounting to VND 24,000 billion. Concurrently, the SBV should strengthen credit support packages, such as the VND 30,000 billion package for the agriculture, forestry, and fisheries sector and the upcoming package for the rice industry. It is also crucial to expedite the disbursement of the VND 120,000 billion program.

Regarding the VND 120,000 billion package for social housing, less than 1% has been disbursed so far, partly due to challenges in the real estate market and legal issues. According to the Ministry of Construction, over 1,200 projects are facing legal hurdles related to land pricing, approval authority, and inconsistent project planning. Expediting the resolution of these legal issues through amendments to the Land Law, the Law on Real Estate Business, and the Housing Law would send a positive signal for the recovery of the real estate market.

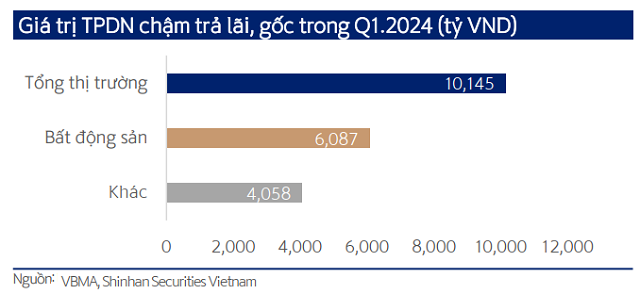

A revival in the real estate sector would also alleviate pressure on the banking system, even though there are no precise data on the proportion of bad debts attributed to this sector. Bond market statistics, however, paint a concerning picture, with 60% of bonds in default (both principal and interest) in the first quarter of 2024 originating from the real estate sector. The financial strain on this sector is expected to persist in the second half of 2024 and into 2025. Approximately 40% of corporate bonds will mature during this period, according to statistics.

Therefore, the third area of focus, according to Ms. Ly, is the resolution of legal issues related to the real estate sector. Addressing these challenges would alleviate concerns in the banking and financial markets.

As per the General Statistics Office, credit growth for the entire economy stood at 4.45% as of June 24, 2024. The SBV has issued a directive aiming to reduce lending rates by 1-2% and achieve the targeted credit growth rate of 15% for the year. To meet this target, credit growth will need to accelerate in the second half of the year. However, this task will be challenging amid the ongoing difficulties in the real estate sector.

If banks streamline their lending procedures and leverage digitalization to reduce costs, there is a possibility of lowering lending rates by 0.5-1% in the latter half of 2024. Such a reduction would provide a much-needed boost to credit growth in the face of economic and real estate sector headwinds.

In conclusion, Ms. Ly asserts that addressing the aforementioned issues, along with boosting fiscal spending, credit growth, FDI attraction, and exports, will be crucial to sustaining economic growth. She projects that Vietnam’s GDP for 2024 could reach 6%, with inflation remaining within the target range of 4-4.5%.

The Power of Lizen: Consistently Winning Massive Bids

Lizen has achieved a significant milestone by successfully deploying and implementing major high-speed construction projects in 2023. The company’s revenue has reached 2,030.5 billion VND, which is twice the amount compared to 2022. However, the post-tax profit has reached its lowest point in the past 6 years, dropping down to only 118.3 billion VND.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.