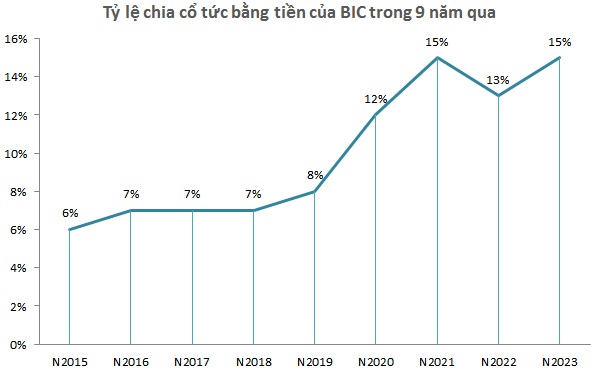

With an implementation rate of 15% (1 share receives VND 1,500) and nearly 117.3 million shares in circulation, BIC is estimated to spend nearly VND 176 billion on dividend payments for 2023 to its shareholders. The expected payment date is October 4, 2024.

Source: VietstockFinance

|

BIC has consistently paid cash dividends to its shareholders from 2015 to 2023, with rates increasing from 6% to 15%. However, in 2024, the company plans to switch to stock dividends with a proposed rate of 15%.

Source: VietstockFinance

|

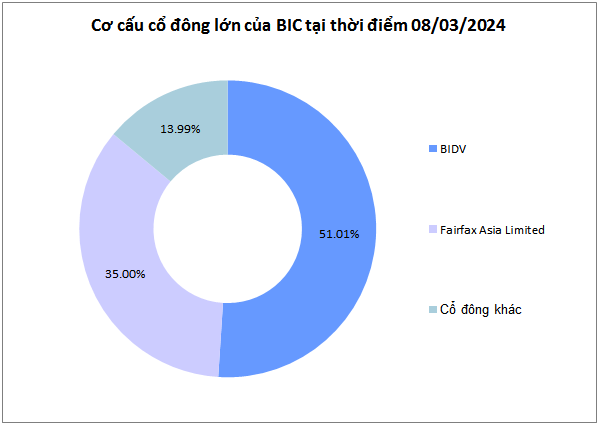

As of March 8, 2024, the Bank for Investment and Development of Vietnam (BIDV) is the largest shareholder of BIC, owning 51.01% of the shares. They are estimated to receive nearly VND 90 billion in dividends. Following closely is Fairfax Asia Limited, with a 35% stake, potentially earning them nearly VND 62 billion in dividends.

BIC concluded the year 2023 with original insurance revenue of VND 4,602 billion, marking a 28% increase from the previous year. This growth was driven by the notable performance of several insurance lines: Technical Group (up 27%) due to the success of their construction all-risk insurance and installation all-risk insurance products; Motor Vehicle Insurance rose 6%, mainly attributed to automobile physical damage insurance; Personal Insurance witnessed a remarkable 64% increase, driven by products such as borrower insurance, personal accident insurance, and student insurance; and Marine Insurance grew by 11%, with contributions from civil liability insurance for ocean-going shipowners and river/fishing vessel hull insurance.

Additionally, the company’s retention ratio for compensation in 2023 decreased by 8% compared to the previous year. This was due to lower compensation ratios in personal insurance, cargo insurance, motor vehicle insurance, and technical insurance. As a result, BIC’s insurance business recorded a gross profit of over VND 884 billion, reflecting a significant 53% increase.

According to BIC, the growth in insurance lines somewhat mirrors the overall economic landscape. In 2023, personal insurance products like health insurance and motor vehicle insurance experienced slow growth or even declines. Meanwhile, cargo insurance witnessed a sharp drop amid decreasing import and export activities. The primary growth driver in the non-life insurance market last year was property damage insurance, benefiting from accelerated public investment disbursements.

Fueled by robust insurance underwriting profits and an 11% increase in financial investment income, amounting to over VND 393 billion, BIC realized a net profit of nearly VND 450 billion, representing an impressive 43% surge compared to the previous year.

For the year 2023, BIC targeted a consolidated pre-tax profit of VND 480 billion, indicating a 22% increase from the actual performance in 2022. The company successfully surpassed this goal by achieving a 20% higher profit than planned.

Prior to this, the 2023 Annual General Meeting of Shareholders (AGM) proposed a minimum dividend payout of 13.5% for 2023. Given the company’s exceptional performance, which exceeded expectations, the Board of Directors (BOD) of BIC presented a proposal to the 2024 AGM to increase the dividend payout for 2023 to 15%, surpassing the initial projection.

|

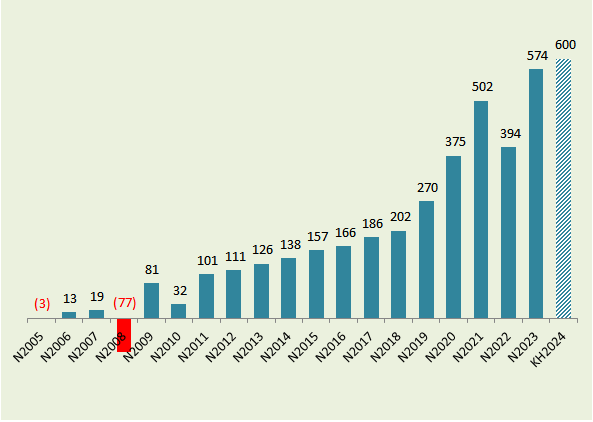

BIC’s Consolidated Pre-tax Profit Plan for 2024. Unit: Billion VND

Source: VietstockFinance

|

Considering the actual business results in 2023 and the strategic direction for 2024 in both insurance operations and financial investments, BIC has set ambitious goals for the upcoming year. They aim to attain VND 5,570 billion in total insurance premium revenue (according to the separate financial statements of the parent company) and achieve a consolidated pre-tax profit of VND 600 billion. These targets represent a 14% and 5% increase, respectively, compared to the actual performance in 2023.

In the first quarter of 2024, BIC reported a 23% year-over-year increase in net insurance revenue, reaching VND 984 billion. Meanwhile, insurance business expenses grew at a slower pace, increasing by only 13%. This favorable development led to a 62% surge in gross profit, amounting to VND 282 billion.

Furthermore, financial income rose by 51% compared to the same period last year, totaling VND 128 billion. As a result, BIC recorded a net profit of nearly VND 105 billion in the first quarter, reflecting a notable 35% increase. When compared to the annual plan, the company has successfully accomplished 25% of its profit target in just the first quarter.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.