Mr. Tran Le Minh, CEO of VIS Rating, shared his insights on the matter. Special Purpose Entities, or SPEs, are companies established with a specific purpose, often capital raising, and typically have insignificant cash flow from business operations and weak repayment capabilities. They are essentially shell companies.

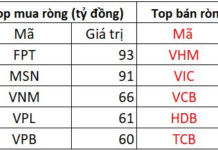

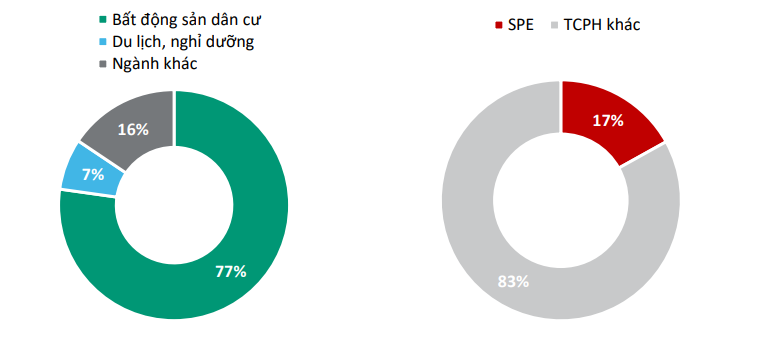

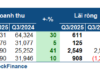

According to VIS Rating data, June 2024 witnessed the maturity of 41 bond codes from 34 issuers worth over VND 23,000 billion. Of this, about VND 6,900 billion (30%) is considered high-risk, corresponding to a potential delay in principal and interest repayment. Analyzing by industry, the residential real estate sector accounted for 77% of the high-risk bond value, followed by tourism and hospitality at 7%, and other industries at 16%.

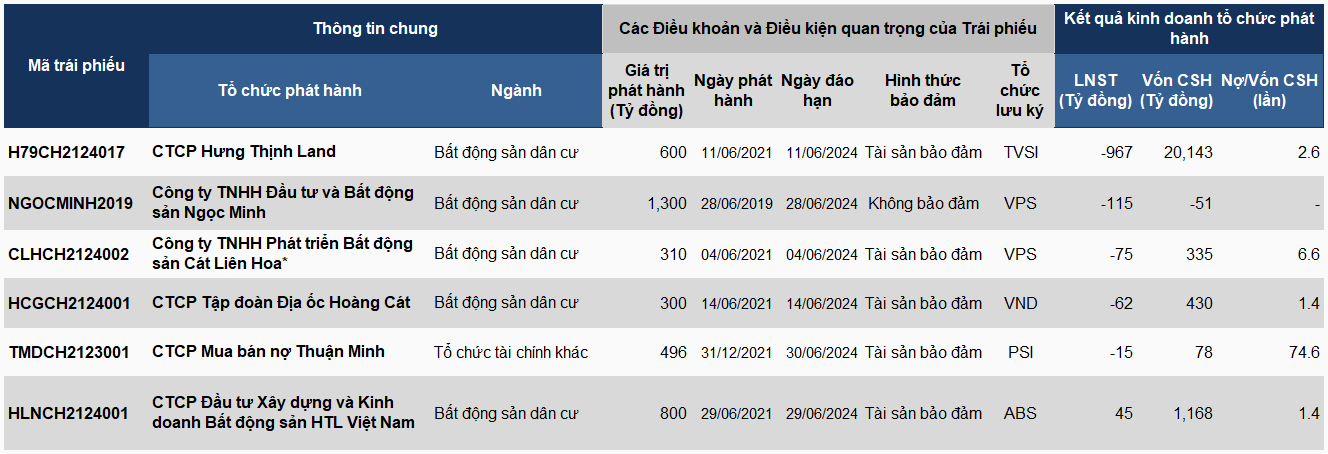

Notably, six companies, including Cat Lien Hoa Real Estate Development Co., Ltd., Hung Thinh Land JSC, Hoang Cat Real Estate Group JSC, Ngoc Minh Investment and Real Estate JSC, HTL Vietnam Construction and Real Estate Investment JSC, and Thuan Minh Debt Trading JSC, were identified as SPEs by VIS Rating. These companies experienced delays in principal and interest payments in 2023, except for HTL Vietnam.

|

High-risk bonds in June 2024 by industry and business type

Source: VIS Rating

|

|

List of bonds from SPEs maturing in June 2024

* Updated to the semi-annual 2023 financial statements

Source: VIS Rating, author’s summary

|

Among these, Hoang Cat Real Estate Group JSC failed to repay VND 300 billion in principal and over VND 33 billion in interest for the HCGCH2124001 bond code on its due date of June 14, 2024. On the maturity date, the company announced a delay in payment and is currently in negotiations with bondholders, with no new updates yet.

It is worth noting that the funds raised from the bond issuance were used by Hoang Cat to buy back capital contributions from members of Hoang Gia Phu Real Estate Investment and Trading Co., Ltd. (with a charter capital of VND 410 billion). VND acted as the issuance advisory organization, while VPBank (VPB) managed the secured assets, which included land-use rights in An Long, Phu Giao District, Binh Duong Province, and financial assets related to exploitation and management between individuals. The sole investor for this bond issue was a credit institution.

Hoang Cat’s business performance has been lackluster, with a post-tax loss of over VND 62 billion in 2023, higher than the nearly VND 48 billion loss in 2022. As a result of these losses, the company’s owner’s equity decreased to VND 430 billion at the end of 2023, pushing the debt-to-equity ratio to over 1.4 times.

Hoang Cat Real Estate Group continues to lose VND 48 billion

Cat Lien Hoa Real Estate Development Co., Ltd. also experienced a delay in repaying the CLHCH2124002 bond, with VND 310 billion in principal and nearly VND 9 billion in interest. In a notice sent to HNX on June 5, the company stated that it was negotiating with bondholders to extend the payment of the principal, while the interest would be paid on July 1 due to a lack of timely funding.

The purpose of the bond issuance was to acquire 99.99% of the capital of Phuoc Thien Urban Area Co., Ltd., land-use rights, and financial assets related to a residential project in Phuoc Thien, along with some other assets. In the same notice, Cat Lien Hoa also mentioned its inability to pay interest on two other bonds, CLHCH2126001 and CLHCH2125003, due to a lack of timely funding.

Cat Lien Hoa still has four bonds to be paid in the future, totaling VND 951 billion. In 2023, the company had previously delayed principal and interest payments for multiple bonds.

Cat Lien Hoa has only published semi-annual financial data for 2023, reporting a loss of over VND 75 billion, compared to a loss of over VND 61 billion in the first six months of 2022. The company’s debt-to-equity ratio is extremely high at 6.6 times, with a bond debt-to-equity ratio of 5.6 times.

Cat Lien Hoa is known to be affiliated with Novaland and was established on January 8, 2020, initially named Nova Real Estate Co., Ltd., with a charter capital of VND 100 million. In March 2021, the company changed its name to the current one and increased its charter capital to VND 359 billion, with Ms. Vo Thi Kim Khoa owning 99.99% and serving as the Chairman of the Members’ Council and Director of the company. By the end of 2021, the company had raised its capital to VND 500 billion. In June 2022, Nova SQN Investment JSC replaced Ms. Khoa, with Ms. Cao Ngoc Kieu Trinh taking over as Chairman of the Members’ Council and Director.

Ms. Khoa currently owns and holds 99.98% of the capital of Ngoc Minh Investment and Real Estate JSC (with a charter capital of VND 350 billion) – another SPE with bonds maturing in June as mentioned above.

Ngoc Minh currently has only one outstanding bond, NGOCMINH2019, issued in June 2019, with an initial value of VND 1,300 billion. The bond’s maturity was originally set for December 31, 2024, but due to a lack of timely repayment, Ngoc Minh extended it to June 28, 2024. Recently, on June 26, 2024, the bondholder, VPS Securities JSC, passed a resolution agreeing to Ngoc Minh’s request for another one-year extension, until June 28, 2025, bringing the total maturity period to six years. After multiple buybacks, the outstanding debt for this bond is now nearly VND 381 billion.

Ngoc Minh’s business performance in 2023 resulted in a loss of nearly VND 115 billion, with a loss of nearly VND 82 billion in the previous year. Consequently, the company’s owner’s equity became negative, with a deficit of over VND 51 billion as of December 31, 2023.

Thuan Minh Debt Trading JSC currently has only one outstanding lot, TMDCH2123001, with an initial issuance volume of 4,959 tp and a remaining volume of 2,199 tp, equivalent to a value of nearly VND 220 billion due in June 2024. According to HNX updates, Thuan Minh has canceled this entire bond issue. However, on June 26, the company sent a written request to the bondholder, Vietnam Public Commercial Joint Stock Bank (PVcomBank), proposing to pay the overdue bond interest.

Specifically, Thuan Minh proposed to pay the full interest of VND 15 billion on 2,199 tp for the period from October 18, 2023, to April 19, 2024; pay the full penalty interest of over VND 323 million for the period from April 19 to June 26, 2024; and buy back 10 tp with a total par value of VND 1 billion. The company stated that these payments would be made on June 26, 2024.

Thuan Minh has drawn attention due to its high debt-to-equity ratio, with payables at the end of 2023 amounting to over VND 5,834 billion, while owner’s equity stood at only VND 100 billion, resulting in a debt-to-equity ratio of nearly 75 times. The company’s business performance has been consistently unprofitable, with a loss of over VND 15 billion in 2023 and nearly VND 7 billion in 2022.

Given the company’s lackluster business performance, it is evident that Thuan Minh’s ability to repay the bonds on time is challenging. In March 2023, the company had previously failed to repay nearly VND 263 billion in principal and over VND 10 billion in interest on time.

Thuan Minh was established on July 16, 2018, with Mr. Tran Khac Truong as its legal representative. The company primarily operates in the fields of investment consulting and debt trading services.

The remaining company, HTL Vietnam Construction and Real Estate Investment JSC, issued VND 800 billion in HLNCH2124001 bonds in June 2021, with a maturity date of June 29, 2024. According to HNX data, HTL has repurchased and canceled this entire bond issue.

The funds raised from the bond issuance were used to pay for the land-use rights won at an auction and to invest in the development of a residential project in two plots of land east of Hung Vuong Street, Tuy Hoa City, Phu Yen Province. On the bond issuance date, HTL Vietnam also mortgaged the two plots of land at An Binh Commercial Joint Stock Bank (ABBank).

HTL Vietnam’s business performance in 2023 showed a post-tax profit of over VND 45 billion, nearly 16 times higher than in 2022.

Appearance in new issuances

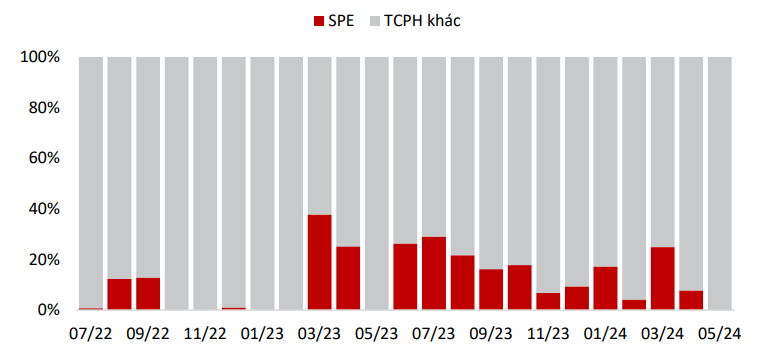

While SPEs were not involved in new bond issuances in May, they had a significant presence in previous months, with the highest proportion of 30% in March 2024, coming from two bond codes of Hai Dang Real Estate Investment and Development JSC.

|

Monthly new issuances by business type

Source: VIS Rating

|

Specifically, on March 12, 2024, Hai Dang issued two lots: HDRCB2425001 with a value of VND 1,300 billion, an interest rate of 9.8%/year, and a maturity date of September 12, 2025; and HDRCB2425002 with a value of VND 1,200 billion, an interest rate of 10%/year, and a maturity date of March 12, 2027.

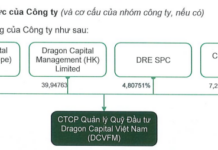

Hai Dang was established on August 30, 2022, and operates primarily in the real estate and housing management fields, with its headquarters located in Dream City Urban Area, Nghia Tru, Van Giang, Hung Yen. Its charter capital has remained unchanged at nearly VND 5,260 billion since its establishment. However, the ownership structure has undergone multiple changes. Initially, VHM held 99.9%, while Ms. Nguyen Thuy Ha held 0.1%. Ms. Vu Thai Ninh served as the General Director and legal representative. Following several changes, in April 2023, VHM reduced its ownership to 0.5%, Ms. Phuong held 1.5%, and Dream City Villas Hung Yen Real Estate Investment Co., Ltd. owned 98%. In the latest business registration change on February 28, 2024, Mr. Dinh Hao Hiep was authorized for the entire capital of Dream City Villas Hung Yen, and Ms. Vu Thai Ninh was authorized for the entire capital of VHM. Mr. Nguyen Xuan Phuoc took on the role of General Director and legal representative.

Numerous risks

At a workshop on Developing the Corporate Bond Market towards 2030: A Perspective from Credit Ratings, Mr. Nguyen Dinh Duy, Director and Senior Analyst at VIS Rating’s Rating and Research Division, shared his insights: “SPEs tend to have lower transparency and weaker repayment capabilities compared to other companies.”

According to data presented by Mr. Duy, 20% of the value of corporate bonds in circulation came from SPEs, which had a delay rate of up to 38%, while the remaining 80% of the value from other companies had a delay rate of only 10%.

Previously, Mr. Tran Le Minh, CEO of VIS Rating, mentioned that SPEs are particularly common in the real estate sector and are typically established without genuine business operations to repay bond debts. One of the most noticeable signs is that one-third of these companies do not have a website, indicating a lack of transparency. Additionally, individual investors are usually the buyers of these bonds.

The proportion of SPEs in total bond issuances is currently at its highest level in the last five years, reaching 35% at the end of 2023. Furthermore, 54% of SPEs have faced issues with debt repayment.

|

The proportion of SPEs in total bond issuances is at its highest level in the last five years

* Scale of corporate bonds issued by non-bank organizations

Source: HNX, VIS Rating

|

Mr. Minh provided an example of a typical SPE, Vinam Land JSC, which was established on May 25, 2018, with a charter capital of VND 3.6 billion. On April 9, 2023, the company changed its name to Vinam Land JSC, increased its capital to VND 490 billion, and then to VND 520 billion in May of the same year. On June 23, 2023, VinamLand issued VND 1,500 billion in bonds, three times its charter capital. The interest rate was a mix, with the first year at 14%/year, significantly higher than the market average.

Vinam Land’s updated financial statements for 2023 showed a turnaround from a profit of over VND 108 million to a loss of nearly VND 119 billion. The debt-to-equity ratio also increased from 0.007 times to 4.01 times, with the bond debt-to-equity ratio at 3.73 times.

According to Mr. Minh, while the corporate bond market may be nearing the end of its adjustment phase and transitioning to a new cycle, the risks associated with SPEs should not be overlooked. The new cycle he