Hanoi-Kinh Bac Agriculture and Food Joint Stock Company (HKB stock code) has just announced its Q2 2024 consolidated financial statements with a net loss of nearly VND 15 billion in Q2. This is also the 18th consecutive quarter that the company has reported a loss.

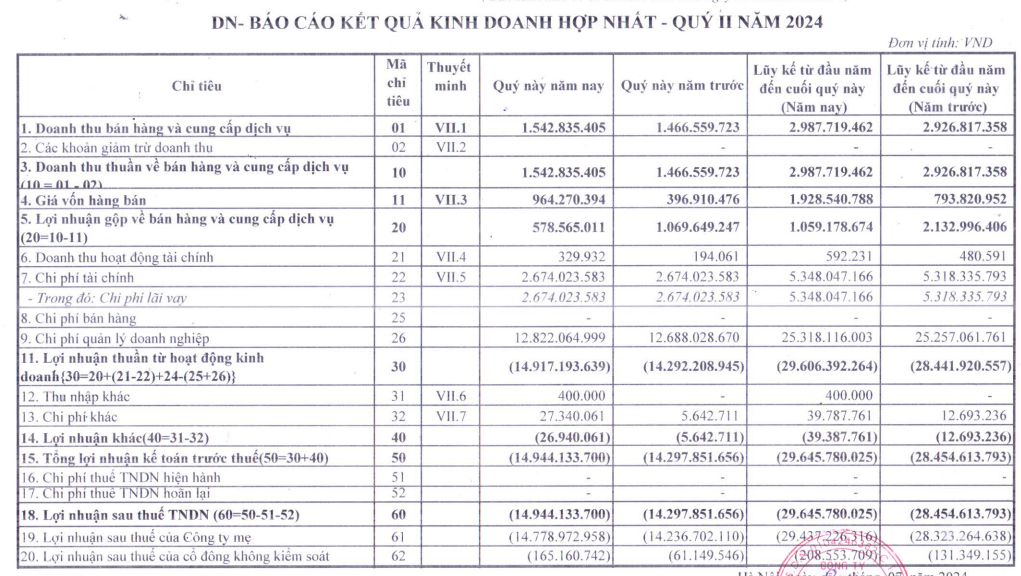

In Q2, the company’s net revenue reached over VND 1.54 billion, up nearly 5% year-on-year. Gross profit was VND 579 million, down 46% year-on-year.

Financial income was only a few hundred thousand dong, while interest expense was VND 2.7 billion and selling expenses were VND 12.8 billion, resulting in a loss of nearly VND 15 billion. In the same period last year, the loss was VND 14.3 billion.

For the first six months of the year, HKB recorded net revenue of nearly VND 3 billion and a loss of nearly VND 30 billion. The accumulated loss has amounted to VND 415.5 billion.

HKB stated that the company is in the process of restructuring and rearranging its credit sources with banks and has not yet met the short-term capital requirements for production and business activities.

As of June 30, 2024, HKB’s total assets were VND 295.5 billion, a decrease of VND 25 billion from the beginning of the year. Of this, cash and cash equivalents were over VND 1.4 billion. Commercial advantage contributed the most to HKB’s total assets, with over VND 109 billion. The company is provisioning for doubtful short-term receivables of over VND 80 billion.

On the capital side, HKB’s payables as of the end of Q2 were VND 178.6 billion, of which short-term debt was VND 164 billion, nearly three times the short-term assets. Total debt exceeded VND 100 billion.

HKB’s share price is currently VND 700 per share. At the time of its IPO, HKB was considered a bright spot in the agriculture sector with an offering price of VND 15,000 per share. The company’s core business is agriculture, with products including pepper, corn, cassava, rice, etc.