The VN-Index maintained its upward trajectory throughout the trading session, supported by gains in several large-cap stocks. The index closed 10.15 points higher at 1,293 on July 9, with improved liquidity compared to the previous session. Total trading value on the HOSE exceeded 21.8 trillion VND.

However, foreign investors’ trading activities were a downside, as they net sold up to VND 462 billion on the entire market. This marked the 23rd consecutive session of foreign net selling in Vietnam.

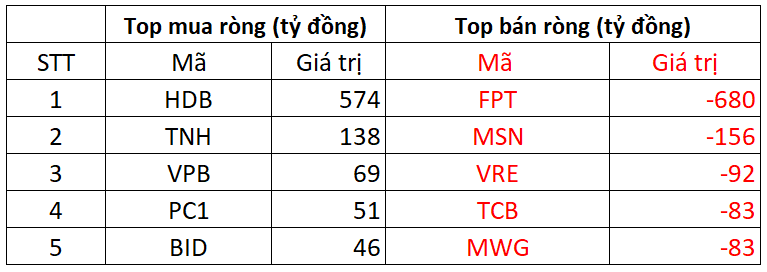

On the HOSE, foreign investors net sold VND 464 billion.

In terms of buying, HDB stock witnessed strong foreign buying with a net value of VND 574 billion. TNH and VPB followed suit, with net purchases of VND 138 billion and VND 69 billion, respectively. PC1 and BID also saw net buying of VND 51 billion and VND 46 billion, respectively.

On the other hand, FPT faced the strongest foreign selling pressure, with nearly 5 million shares sold, equivalent to a value of VND 680 billion. MSN and VRE also witnessed net selling of VND 156 billion and VND 92 billion, respectively.

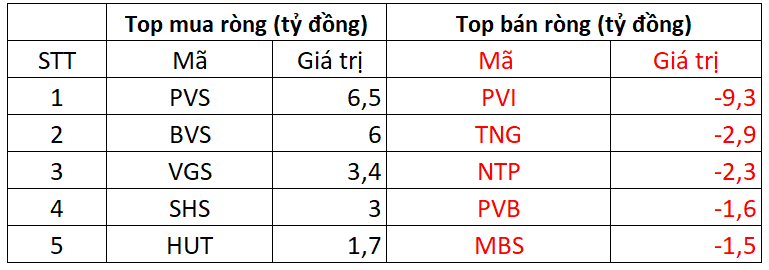

On the HNX, foreign investors net bought VND 6 billion.

PVS was the most bought stock by foreign investors, with a net value of VND 6.5 billion. BVS followed closely, with net purchases of VND 6 billion. Additionally, foreign investors also net bought a few billion dong worth of VGS, SHS, and HUT shares.

On the selling side, PVI faced the highest net selling pressure from foreign investors, with a value of nearly VND 10 billion. TNG, NTP, and PVB also witnessed net selling of a few billion dong.

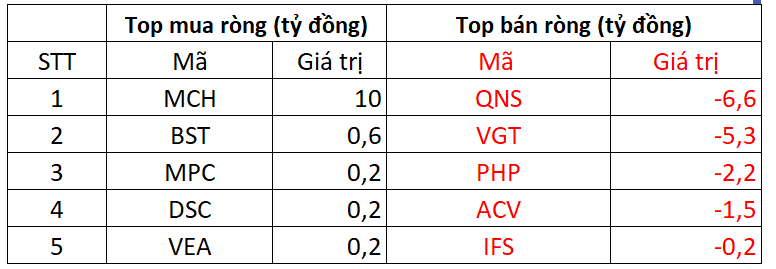

On the UPCOM, foreign investors net sold VND 4.4 billion

Conversely, QNS faced net selling pressure from foreign investors, with a value of nearly VND 6.6 billion. Additionally, foreign investors also net sold VGT, PHP, and a few other stocks…

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”