The southern land market has seen a positive shift in liquidity recently. A group of financially capable investors continue their proactive approach in acquiring land ahead of the new laws coming into effect on August 1, 2024. Despite predictions of challenges, many investors foresee opportunities in the future and have decided to invest.

While land purchases in the first quarter of 2024 were mainly concentrated in the outskirts of Ho Chi Minh City (District 9, District 12, Nha Be, and Hoc Mon), transactions have now expanded to neighboring provinces such as Dong Nai, Binh Duong, and Long An since the second quarter. Although demand is not yet prominent, investors’ interest is gradually returning.

Areas with potential for infrastructure development, high urbanization rates, and room for price appreciation remain attractive to investors. They anticipate a new growth cycle that will drive both demand and selling prices. In addition, the tightening regulations on land subdivision in urban and town areas have influenced investors’ strategies. Well-capitalized investors are taking advantage of the situation before the new laws come into effect by acquiring land plots. Secondary land plots with available pink books and prices reduced by 10-20% compared to the beginning of 2022 have been trading steadily since the second quarter of 2024.

Real estate brokers in the south are more active during this period. Photo: HV

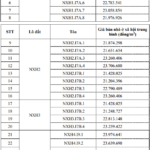

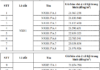

However, both supply and demand for land in the south remain generally low. According to DKRA Group’s report for the second quarter of 2024, only 184 out of 6,535 land plots released in the southern market were consumed. Although consumption volume increased by 2.6 times compared to the same period last year, it is still a very modest number compared to the period before 2019. Transactions are localized to products with completed infrastructure and legal status, with average prices below VND 30 million per square meter, mainly in Binh Duong, Long An, and Dong Nai provinces.

Overall, the southern land market shows signs of recovery in liquidity, but it is not yet clear. Land prices are either stagnant or slightly decreased by about 15% compared to the beginning of 2022. Investors’ aggressive land acquisition strategies continue, but the trend is not consistent across all areas. It is predicted that the demand for land plots will become more apparent from the end of 2024 onwards. However, the market is not expected to experience a rapid increase in prices or a feverish atmosphere like the previous period.

“Potential Lawsuits Threaten 14 Ho Chi Minh City Condo Developers over ‘Om’ Maintenance Fees”

For condominium investors experiencing delays or incomplete handovers of maintenance funds, local authorities are recommending that management boards take legal action through the people’s courts.