The latest report on Ho Chi Minh City’s real estate market by Savills, focusing on the villa/townhouse segment, reveals that new supply remained limited in Q2 2024 due to scarce land resources, complex legal procedures, and cautious investor sentiment. The only new supply came from the release of 10 commercial townhouses in a project in Binh Tan district, a 75% decrease quarterly and a 97% decline year-on-year.

Primary supply decreased by 12% quarterly and 33% year-on-year to 668 units due to limited new supply and inventory absorption. High-end products priced above VND 30 billion dominated, accounting for over 77% of the primary supply. Most of these premium offerings are located in urban areas, primarily in Thu Duc City.

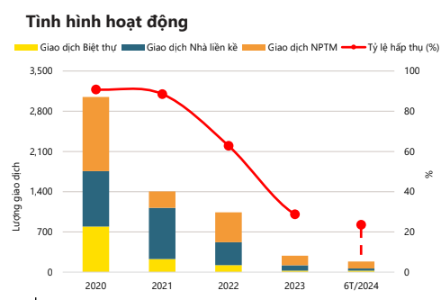

According to Savills, Q2 performance slowed down with only 72 transactions, a 36% drop both quarterly and annually. The high prices of primary inventory, competition from the secondary market, and affordable alternatives in neighboring provinces challenged the Ho Chi Minh City market. Properties valued at over VND 30 billion struggled, with only 6% absorption. Terraced houses had the highest absorption rate at 31%, driven by genuine housing needs and competitive pricing.

In Q2 2024, the expensive commercial townhouses of a project in District 2 were sold, causing primary prices to dip by 2% quarterly and 4% annually, settling at VND 320 million per square meter of land.

With scarce land resources and infrastructure support, Ho Chi Minh City’s house prices have tripled in the primary market and doubled in the secondary market over the past five years.

The rising prices have pushed practical homebuyers to neighboring provinces for more suitable options.

Savills experts predict that by 2026, Ho Chi Minh City will no longer have low-rise products priced below VND 5 billion, and only 10% of the primary supply will be under VND 10 billion. In contrast, offerings within this price range account for 85% of the supply in Binh Duong and 55% in Dong Nai.

Mr. Troy Griffiths, Deputy Managing Director of Savills Vietnam, commented on the limited supply and the diversion of demand to neighboring provinces.

In the second half of 2024, an estimated 883 low-rise units are expected to enter the market, mainly from subsequent phases of existing projects. Properties priced above VND 20 billion will make up 80% of future supply.

By 2026, the projected future supply is anticipated to reach 4,663 units, concentrated in District 2, Binh Chanh, and Nha Be areas.

Savills, CBRE, and JLL Generate Impressive Revenue in Vietnam’s Market but Fall Behind Local Enterprises in Net Profit.

In the Vietnamese market, global leading names in the real estate service and building management sector such as Savills, CBRE, JLL,… have the highest market revenue, but after-tax profit is relatively modest compared to a Vietnamese enterprise, PSA.