Afternoon liquidity on the two matching floors soared 32% over the morning session, with a significant market downturn. The VN-Index closed at the lowest price of the day, with the number of falling stocks doubling the number of rising ones. Foreign investors net sold more than VND 1,037 billion on HoSE, with the total selling value accounting for 22.7% of the floor’s trading value.

The VN-Index closed down 0.6%, equivalent to a loss of 7.77 points, which is not too strong but is the deepest decline and ends the unexpected short-term rising streak. The market reversed and adjusted widely after the index tried to “stretch” one more beat in the morning, getting closer to the 1,300-point mark when it touched 1,297.96 points.

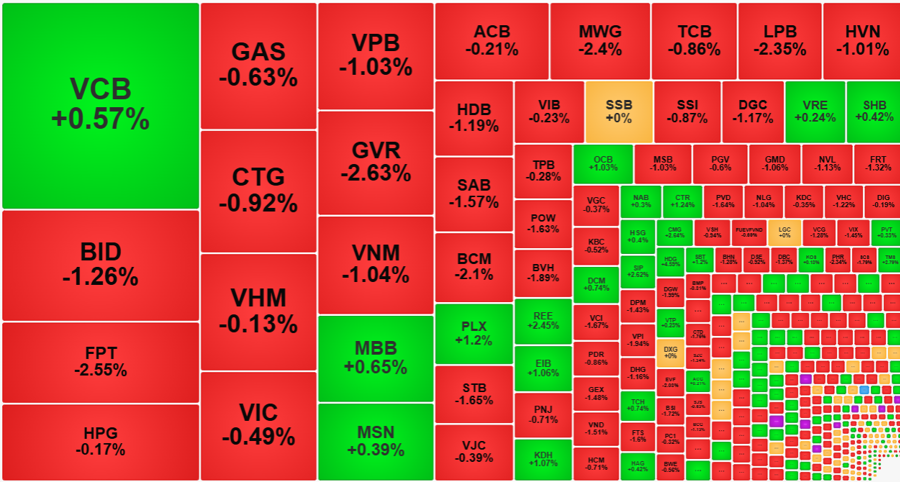

The weakness of large-cap stocks has taken away the opportunity for the index to hit the peak. This afternoon, blue-chip stocks turned down in unison. The VN30-Index also closed at its lowest price, down 0.82% with 6 gainers and 23 losers. Statistics show that this afternoon, up to 28/30 codes fell compared to the morning session. The two stocks that are not among them stood still: TPB fell 0.28% against the reference price, and VCB rose 0.57%. In the top 10 stocks by market capitalization of the VN-Index, only VCB is still in the green.

The pillar stocks weakened significantly this afternoon when they turned down in unison. BID – the second largest stock in the market after VCB – fell as much as 1.68% against the morning closing price and closed below the reference price by 1.26%. FPT, which has been weak since morning, fell another 1.62% in the afternoon, closing down 2.55%. GVR fell an additional 1.73%, expanding the range to -2.63%. HPG, GAS, CTG, VHM, and VIC all weakened further this afternoon and closed below the reference price.

Statistics also show that the VN30 basket had up to 18/30 stocks closing at the lowest price of the session, and the vast majority of the rest were only 1-2 steps higher than the bottom price. This reflects the fairly strong pressure in this group of stocks, especially when the liquidity of the VN30 basket also increased by nearly 26% compared to the morning session.

Expanding to the entire HoSE floor, the closing breadth was much worse than in the morning session, with 151 gainers and 299 losers. Not only that, but the number of stocks falling by more than 1% also reached 114, while in the morning it was 47. The liquidity of this group of stocks, which fell the most, accounted for 43.4% of the floor’s total matching value, with 27 stocks trading at VND 100 billion or more. This is the clearest manifestation of decisive selling action, accepting a sharp drop in prices.

The most vulnerable group this afternoon was small-cap stocks, speculative stocks that had previously risen sharply. Investors took short-term profits and sold strongly in the context of weak cash flow, causing prices to fall deeply. ITA, MIG, TV2, ITD, VOS, TNH, TVS, and LPB all fell sharply. However, there are still stocks that can regulate liquidity and go against the flow. Although all HoSE indices are in the red, 11 stocks still hit the ceiling, and liquidity is not bad, such as HAX, VTO, CKG, VIP, NTL, and HHP. Even at the close, the floor still had 59 stocks rising by more than 1%. Of course, this group of counter-flowing stocks is mostly traded less, so liquidity accounts for only about 13.4% of the whole floor. EIB, HDG, REE, CMG, KDH, PLX, and AGG are the most notable representatives, all matching in the hundreds of billions of VND.

Foreign investors maintained a large selling intensity in the afternoon session, net selling an additional VND 513.5 billion on the HoSE exchange. For the whole day, foreign investors net sold VND 1,037.4 billion on this exchange. The selling value reached VND 4,960.5 billion, accounting for about 22.7% of the floor’s trading value. Thus, since the beginning of the week, foreign investors have net sold nearly VND 3,700 billion on HoSE, and although it is not halfway through the first half of July 2024, the total net selling value has reached nearly VND 6,059 billion, of which stocks were withdrawn by VND 5,831 billion net.