In its explanation, Infrastructure Investment Corporation (HOSE: LGC) attributed its strong performance to the acquisition of the BOT Trung Luong – My Thuan Toll Road, which became a subsidiary in Q4 2023, with LGC holding an 89% stake. As a result, the company’s gross profit increased mainly due to toll revenue from the Trung Luong – My Thuan project.

Additionally, the company’s financial revenue increased significantly due to the recognition of accumulated financial interests up to the reporting date for the Ca Na Toll Station – Km 1584+100, National Highway 1 – Ninh Thuan project, owned by LGC‘s subsidiary, BOT Ninh Thuan Company LTD, in which LGC holds a 100% stake.

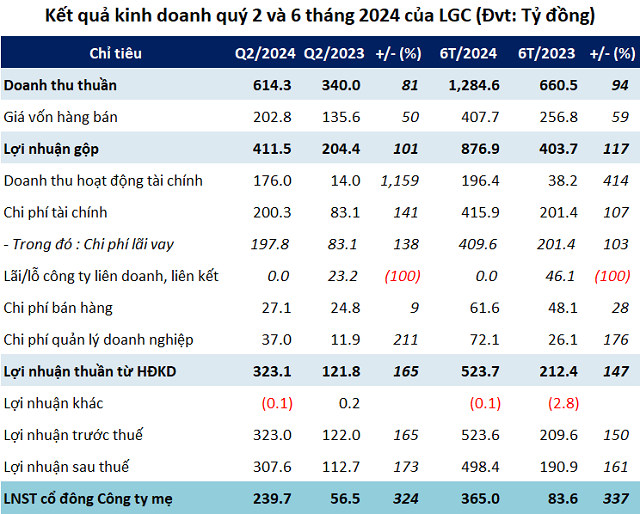

In Q2 2024, LGC achieved remarkable results with a gross revenue of over 614 billion VND, an increase of 81% compared to the same period last year. After deductions, the company’s gross profit reached nearly 412 billion VND, double that of the previous year. Consequently, the gross profit margin improved from 60% to 67%.

The most notable aspect of this quarter’s performance was the financial revenue, which amounted to 176 billion VND, a 12.6-fold increase compared to the same period last year. Financial expenses also increased by 141% to 200 billion VND, mainly due to interest expenses.

Ultimately, the company’s net profit for the quarter was nearly 240 billion VND, 4.2 times higher than the same period last year, significantly contributing to LGC‘s overall performance in the first half of 2024.

Source: VietstockFinance

|

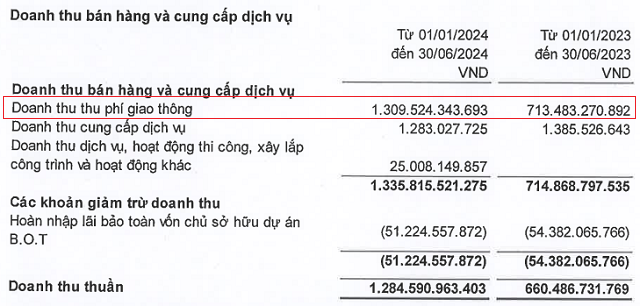

In the first half of 2024, LGC recorded impressive results with a gross revenue of nearly 1,285 billion VND, an increase of 94% year-on-year. Toll road revenue, the company’s primary business, reached nearly 1,310 billion VND, a rise of 84%. The company’s net profit increased by nearly 4.4 times compared to the previous year, amounting to 365 billion VND.

Source: LGC

|

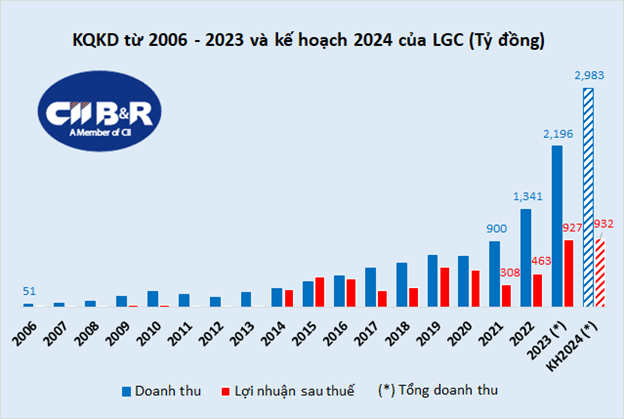

For the full year 2024, LGC has set ambitious targets, including a total revenue of over 2,983 billion VND, an increase of 36% compared to 2023, and a net profit of nearly 932 billion VND, a slight increase of 0.5%. Both of these targets are the highest in the company’s history since its listing on the HOSE in 2006.

With the impressive results achieved in Q2, LGC has already met 50% of its annual revenue target and 53% of its net profit target for the first half of the year.

Source: VietstockFinance

|

As of the end of June, LGC‘s total assets amounted to over 23,244 billion VND, a slight increase of 1% from the beginning of the year. The company’s capital is mainly invested in long-term assets, totaling 21,310 billion VND, which accounts for 92% of the total capital sources. Cash and cash equivalents stood at nearly 947 billion VND, a 34% increase.

The company’s liabilities remained almost unchanged from the beginning of the year at 17,729 billion VND. However, LGC‘s short-term financial debt decreased from over 1,000 billion VND at the beginning of the year to approximately 600 billion VND, while its long-term financial debt increased by 4% to over 12,622 billion VND.

LGC’s AGM: Preparing for Record-Breaking Performance and 5 Key PPP Projects in the Near Future

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Declining profits at Bank increase in 2023

Throughout the year 2023, this bank achieved a pre-tax profit of over 928 billion VND, a decrease of 16.2% compared to 2022 and only 73% of the set plan was accomplished.