Global commodity price movements over the past two years have been volatile due to geopolitical uncertainties and tight supply in some countries. With a large import-export ratio, the business performance of many domestic enterprises has been and is being affected by commodity price fluctuations, especially in industries with a large proportion of raw material input costs.

In its newly published research report on commodity trends in the second half of the year, Agriseco Research provides insights into the groups of enterprises that are expected to benefit or be impacted by these changes.

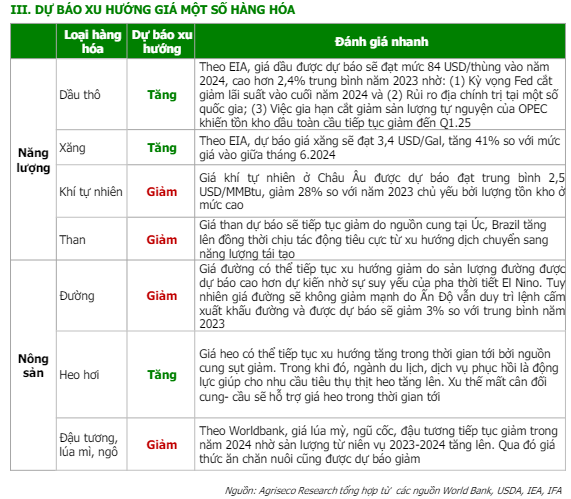

Capture1.PNG

Regarding energy prices, the analytical team forecasts an increase in gasoline and crude oil prices, while natural gas and coal prices are expected to decline.

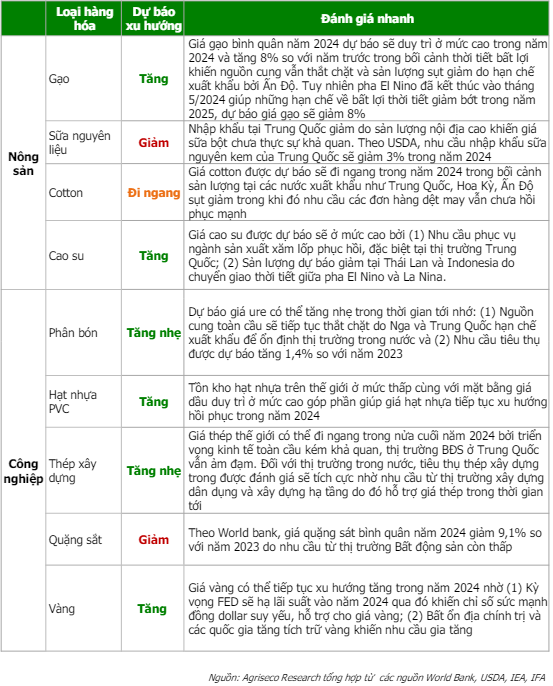

Crude oil prices are projected to reach 84 USD/barrel in 2024, a 2.4% increase compared to the 2023 average. This is attributed to expectations of a Fed rate cut by the end of 2024, geopolitical risks in certain countries, and the extension of OPEC’s voluntary production cuts, which will further reduce global oil inventories through the first quarter of 2025.

On the other hand, coal and natural gas prices may continue to decrease due to increased supply from Australia and Brazil, along with currently high inventory levels.

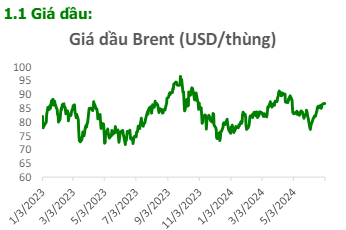

For agricultural commodities, Agriseco forecasts increases in hog, rice, and rubber prices, while sugar, soybean, wheat, and milk prices are expected to decline. The analytical team attributes this to a potential reduction in supply, which is likely to push up hog and rice prices further. Sugar prices may continue their downward trend as sugar production is forecast to be higher than expected due to the weakening of the El Nino weather pattern, resulting in a 3% decrease compared to 2023.

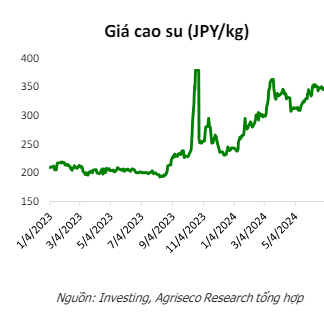

Rubber prices are also predicted to remain high by the analytical team due to: (1) Increasing demand from China’s electric vehicle industry; and (2) Prolonged heavy rainfall impacting supply in Thailand and Indonesia.

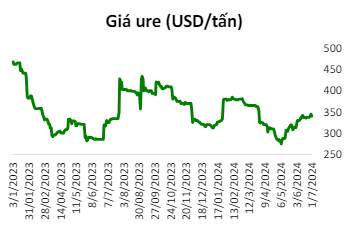

For industrial commodities, the analytical team expects an upward trend for fertilizer, PVC resin, construction steel, and gold prices, with only iron ore prices projected to decrease due to the still-low demand from the real estate market.

Fertilizer prices, specifically urea, are anticipated to rise slightly due to: (1) Continued tight global supply as Russia and China restrict exports to stabilize their domestic markets; and (2) A forecasted increase in consumption of 1.4% compared to 2023.

The prices of caustic soda and yellow phosphorus are also expected to rebound and rise in the second half of 2024 as the textile and chemical industries recover, and central banks around the world begin to cut interest rates.

Agriseco forecasts an improvement in construction steel prices in Q2 2024, with a more noticeable recovery from the end of Q4 2024 onwards. This is attributed to government policies addressing legal and capital obstacles in the real estate market. As 2024 is a pivotal year for the disbursement of large infrastructure projects, particularly in transportation, steel demand is expected to increase. Consequently, steel prices are likely to rise slightly towards the end of the year due to a slow recovery in demand, while supportive policies will require more time to take effect in the economy.

In conclusion, Agriseco believes that PVD, PVS, HPG, DBC, DCM, and GVR will be the enterprises that positively benefit from these commodity price fluctuations.

PV OIL reports Q4/2023 loss, doubled debt financing

Due to the decrease in world oil prices, PV OIL incurred a net loss of over 36 billion VND in Q4 2023. What’s more, the company’s total debt at the end of the year increased 2.6 times compared to the beginning of the year, reaching 7,055 billion VND, mainly in the form of short-term loans.