Technical Signals for VN-Index

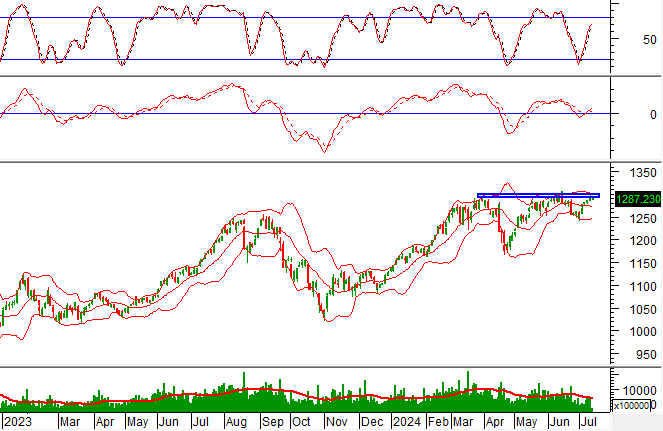

In the morning trading session of July 11, 2024, the VN-Index witnessed a rise in points, while trading volume slightly dipped, indicating investors’ cautious sentiment.

Currently, the VN-Index is witnessing a tug-of-war with alternating rises and falls after cutting above the Middle line of the Bollinger Bands. This occurs as the Bollinger Bands gradually narrow (Bollinger Squeeze), suggesting that the sideways trend may continue in upcoming sessions.

Technical Signals for HNX-Index

On July 11, 2024, the HNX-Index rose alongside an increase in trading volume during the morning session, reflecting investors’ optimistic sentiment.

Additionally, the HNX-Index continues to retest the old peak of May 2024 (equivalent to the 245-247 point region) as the MACD indicator consistently expands its gap with the Signal line after previously giving a buy signal. If this buy signal is maintained and successfully breaks through the resistance threshold, a short-term rise scenario may unfold in the upcoming sessions.

AAA – Green Plastic Joint Stock Company

During the morning session of July 11, 2024, AAA witnessed a price increase alongside trading volume that surpassed the 20-session average, indicating investors’ optimistic sentiment.

Additionally, the stock price rebounded after retesting the 61.8% Fibonacci Projection threshold (equivalent to the 11,400-11,700 region) as the Stochasic Oscillator indicator continued its upward trajectory, providing a previous buy signal. This suggests that short-term upward potential is present.

HDC – Ba Ria-Vung Tau Housing Development Joint Stock Company

On the morning of July 11, 2024, HDC witnessed a price increase alongside a significant rise in trading volume during the morning session, surpassing the 20-session average and indicating investors’ optimism.

Additionally, the stock price witnessed a Golden Cross between the SMA 50-day line and the group of SMA 100-day and SMA 200-day lines. This occurs as the MACD indicator gives a buy signal again, further reinforcing the strength of the stock’s current trend.

Technical Analysis Department, Vietstock Consulting