As of now, SCR holds 61% of TTC Land Hung Dien. In late 2018, SCR announced its capital contribution to establish TTC Land Hung Dien with a chartered capital of nearly VND 1,360 billion. The company is headquartered at 253 Hoang Van Thu, Ward 2, Tan Binh District, Ho Chi Minh City.

In early 2019, after careful review and consideration, SCR adjusted its approach. As a result, the chartered capital of TTC Land Hung Dien was reduced to VND 300 billion, with SCR holding a 62% stake, equivalent to a capital contribution of VND 186 billion. The company also appointed Mr. Bui Tien Thang, General Director, as the representative of SCR’s capital to exercise the rights and obligations of the contributing shareholder in accordance with the law. The term of authorization is three years.

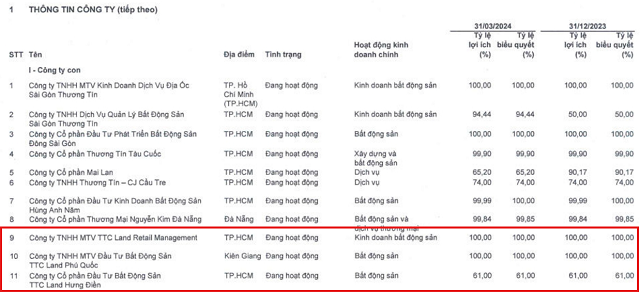

While the reason for this move is unclear, as of early July 2024, SCR announced the simultaneous dissolution of two wholly-owned subsidiaries, TTC Land Retail Management and TTC Land Phu Quoc, to restructure its group of subsidiaries and optimize operations. TTC Land Retail Management shares the same headquarters as TTC Land Hung Dien, while TTC Land Phu Quoc is located in Phu Quoc City, Kien Giang Province.

In addition to TTC Land Hung Dien, SCR also established several companies during 2018-2019, including TTC Land Retail Management and TTC Land Phu Quoc, with SCR contributing 100% of the chartered capital of VND 3 billion and VND 50 billion, respectively. SCR also holds a 98% stake in TTC Land Long An, with a chartered capital of VND 50 billion, and a 51% stake in Dau Tu Bat Dong San Thuong Tin 620, with a chartered capital of VND 20 billion.

In 2021, SCR dissolved Thuong Tin Energy Joint Stock Company due to its inefficient business operations and lack of future plans. This decision aligned with SCR’s strategy to cautiously manage its portfolio and focus on consolidating existing projects.

SCR’s subsidiary portfolio as of Q1 2024. Source: SCR

|

Mr. Dang Van Thanh, Chairman of TTC Group and representative of the major shareholder, emphasized a conservative strategy for SCR’s development during 2021-2025. He suggested refraining from expansion, focusing on project consolidation, and avoiding bond issuances. This period could be described as a form of hibernation.

Additionally, the Group suggested that SCR should operate as a comprehensive real estate company, offering a full range of services in the real estate sector. To support SCR’s liquidity, the Group proposed a debt-to-equity swap, providing nearly VND 400 billion in financial assistance.

Specifically, SCR plans to issue nearly 35 million shares to exchange existing debts of creditors at a swap ratio of 10,000:1 (VND 10,000 debt will be converted into one SCR share). The total debt value to be converted is nearly VND 350 billion. These shares will be restricted from transfer for one year.

If successful, the largest creditor, Thanh Thanh Cong Investment Joint Stock Company, will increase its ownership in SCR to 22.7%. Thanh Thanh Cong Industrial Zone Joint Stock Company will hold 1.26%, while Thanh Thanh Nam Joint Stock Company will own 0.13%.

Chinese citizens flock to buy 280 tons of gold, realizing real estate and stocks are no longer a good investment channel

Regardless of the global decline in demand for gold, the purchasing power of Chinese citizens has propelled the price of gold to surpass the $2,000 per ounce threshold in 2023.