Selling pressure became overwhelming as the VN-Index approached its previous peak, with the index falling further towards the end of the session to close at 1,285 points, a loss of 7.77 points. The market breadth was negative with 299 declining stocks versus 151 gainers, and most sectors suffered heavy corrections with very few maintaining their upward momentum.

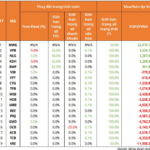

Among the losers, banks fell by 0.39%; Information Technology by 1.95%; Securities by 1.22%; Real Estate by 0.32%; Oil & Gas by 1.03%; and Retail by 1.67%. Other sectors declined by less than 1%. Meanwhile, stocks that dragged down the market included FPT, which erased 1.24 points; GVR, which wiped out 0.97 points; and BID, which took away 0.83 points. MWG, LPB, CTG, VPB, and VNM also contributed to the decline. On the other hand, VCB acted as the main pillar, supporting the market and adding back 0.68 points.

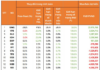

Aggressive selling in the afternoon session pushed the total trading value on the three exchanges to 25 trillion dong, with foreign investors net selling a significant 1,044.5 billion dong. Specifically, in matched orders, they net sold 970.0 billion dong.

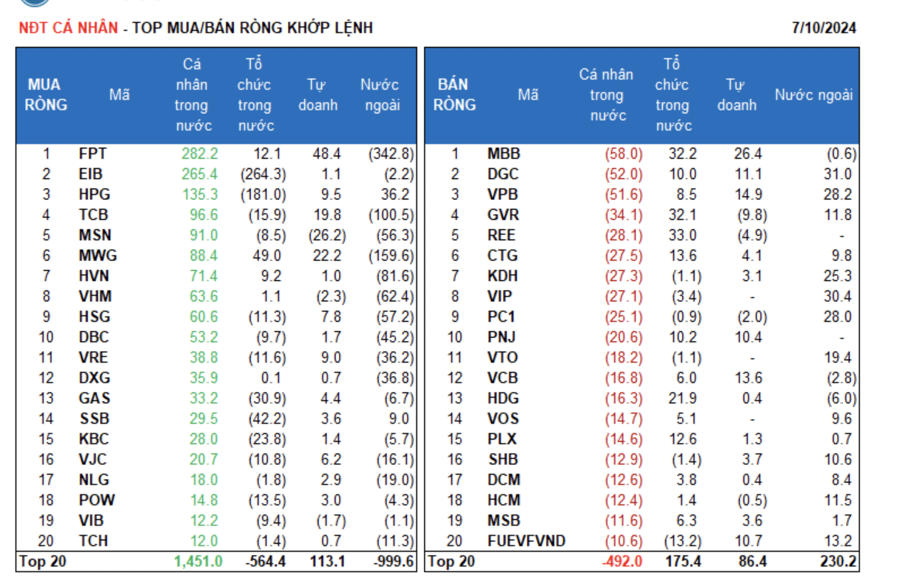

The sectors that foreign investors net bought in matched orders were Industrial Goods & Services and Chemicals. The top stocks they net bought were HPG, DGC, VIP, VPB, PC1, KDH, GMD, BID, and VTO. On the selling side, they net sold Information Technology stocks, with the top stocks being FPT, MWG, TCB, HVN, VHM, MSN, DBC, HDB, and DXG.

Individual investors net bought 970.7 billion dong, of which 1,029.6 billion dong was in matched orders. In terms of matched orders, they net bought 9 out of 18 sectors, mainly focusing on Information Technology. Their top buys included FPT, EIB, HPG, TCB, MSN, MWG, HVN, VHM, HSG, and DBC. On the selling side, they net sold 9 out of 18 sectors, mainly Chemicals and Industrial Goods & Services. Their top sells were MBB, DGC, VPB, GVR, REE, CTG, VIP, PC1, and PNJ.

Proprietary trading arms of securities firms net bought 325.4 billion dong, with a net purchase of 366.6 billion dong in matched orders.

In terms of matched orders, they net bought 15 out of 18 sectors, with the strongest purchases in Banks and Financial Services. The top buys for proprietary trading arms today were HDB, FPT, MBB, MWG, TCB, DPM, VNM, VPB, VCB, and DGC. On the selling side, they focused on Automobiles & Components. The top sells included MSN, VPI, GVR, CMG, REE, VHM, PC1, FUEVN100, HAX, and VIB.

Domestic institutional investors net sold 266.3 billion dong, with a net sell of 426.1 billion dong in matched orders.

In terms of matched orders, domestic institutions net sold 9 out of 18 sectors, with the largest value in Banks. Their top sells included EIB, HPG, SSB, GAS, KBC, GMD, DPM, TCB, POW, and BID. On the buying side, their largest net buys were in Retail, with top stocks being MWG, REE, MBB, GVR, HDG, CTG, PLX, FPT, VNM, and PNJ.

Today’s matched orders contributed 17.4% of the total trading value, with negotiated trades reaching 4,323.6 billion dong, up 137.3% from the previous session.

A large negotiated trade was observed in VCB, with foreign investors transacting nearly 28.23 million units worth 2,456 billion dong.

Additionally, several large-cap stocks witnessed negotiated trades involving all investor groups, including MBB, ACB, MSN, and MWG.

The money flow allocation decreased in Securities, Food & Beverage, Software, Construction, Agriculture & Seafood, Power Production & Distribution, Oil & Gas, Plastics & Rubber, while it increased in Banks, Real Estate, Steel, Chemicals, Retail, Water Transport, and Mobile Telecommunications.

In terms of matched orders, the money flow allocation increased in mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in large-cap (VN30) stocks.