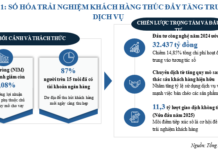

According to the latest figures from the Ministry of Information and Communications, as of the end of May 2024, the number of Mobile Money service users in Vietnam reached over 8.8 million, an increase of 3.3% compared to the previous month. Of this, the number of customers in rural, mountainous, and remote areas accounted for more than 6.3 million, or 72% of total Mobile Money users.

Mobile Money is a service that uses telecom accounts to pay for goods and services of small value. The State Bank of Vietnam has granted a license to pilot Mobile Money nationwide for a period of 2 years, from November 18, 2021, to November 18, 2023.

After the initial pilot phase, the government issued Resolution 192 to extend the pilot implementation of Mobile Money until December 31, 2024.

The Mobile Money pilot program is a major policy initiative of the information and communications industry to promote cashless payments, especially in rural, mountainous, and island areas where people do not have access to bank transaction points.

Unlike regular e-wallets, Mobile Money provides users with an account linked to their mobile subscription without the need for a bank account. This account functions similarly to a telecom account but can be used for money transfers, payments, and legal goods and services in Vietnam.

A Mobile Money user’s account. Source: Trong Dat |

As of now, there are 275,879 Mobile Money payment acceptance points across the country, an increase of 9.56% compared to April 2024. The total number of transactions (deposit, withdrawal, transfer, and payment) via Mobile Money exceeded 119 million, an increase of 8%. The total transaction value reached over VND 4,462 billion, an increase of 7%.

In fact, many countries around the world have successfully implemented Mobile Money. A notable example is the M-PESA model in Kenya, which has 30 million customers and a transaction value of USD 78.8 billion, increasing the financial inclusion rate to nearly 83%.

According to a study by the Consultative Group to Assist the Poor, Kenyan households’ incomes increased by 5-30% thanks to this service, lifting 194,000 families out of poverty. Additionally, approximately 185,000 Kenyans shifted from agricultural activities to business or retail.

Given the positive results of the pilot program, at a meeting in May 2024, Deputy Prime Minister Le Minh Khai instructed the State Bank of Vietnam to take the lead in coordinating with relevant ministries, agencies, and units to urgently research and finalize reports and proposals for the issuance of legal documents regulating Mobile Money services.

The government’s direction is to have a comprehensive evaluation with specific data that reflects the actual situation of the Mobile Money pilot program. In addition, it is necessary to thoroughly assess the impacts, benefits, risks, and influences on related entities, the payment system, banking activities, and the country’s financial and monetary security.

The proposed plan must ensure the security and safety of banking payment activities, the national financial and monetary system, effectiveness, compliance with laws, authority, procedures, and regulations. It should also be in line with the development of science and technology and international practices, ensuring management and protecting the rights and interests of related entities.

Trong Dat

The Timeless Value of Bold Decision-making by “Trailblazers” in the Digital Banking Space

As a leading bank in pioneering new technologies and innovations, Techcombank has achieved remarkable successes that have created a strong momentum for digitalization in the banking industry. We play a vital role in driving the digital transformation of the economy and improving the social life of the people.

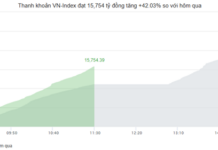

Surge in QR Payments Leads to Bank ATM Closures

By the end of January 2024, the market witnessed a decrease of 1.70% in the number of ATMs compared to the same period in 2023, with a total of 20,986 ATMs. On the other hand, there was a significant increase of 32.68% in the number of POS machines, reaching a total of 554,580 POS. The month of January 2024 also saw a remarkable surge in QR code transactions, with a staggering increase of 892.95% in terms of quantity and an impressive 1,062.01% in terms of value.